Bitcoin: If and why users are losing interest in Ordinals

- Bitcoin Inscription transaction fees took a dip.

- Miner revenues started to decline while long-term holders continued to show support for BTC.

The introduction of Ordinals and Inscriptions took the Bitcoin[BTC] sector by storm as new use cases for the network emerged. This led to high activity on the Bitcoin network as well.

Is your portfolio green? Check out the Bitcoin Profit Calculator

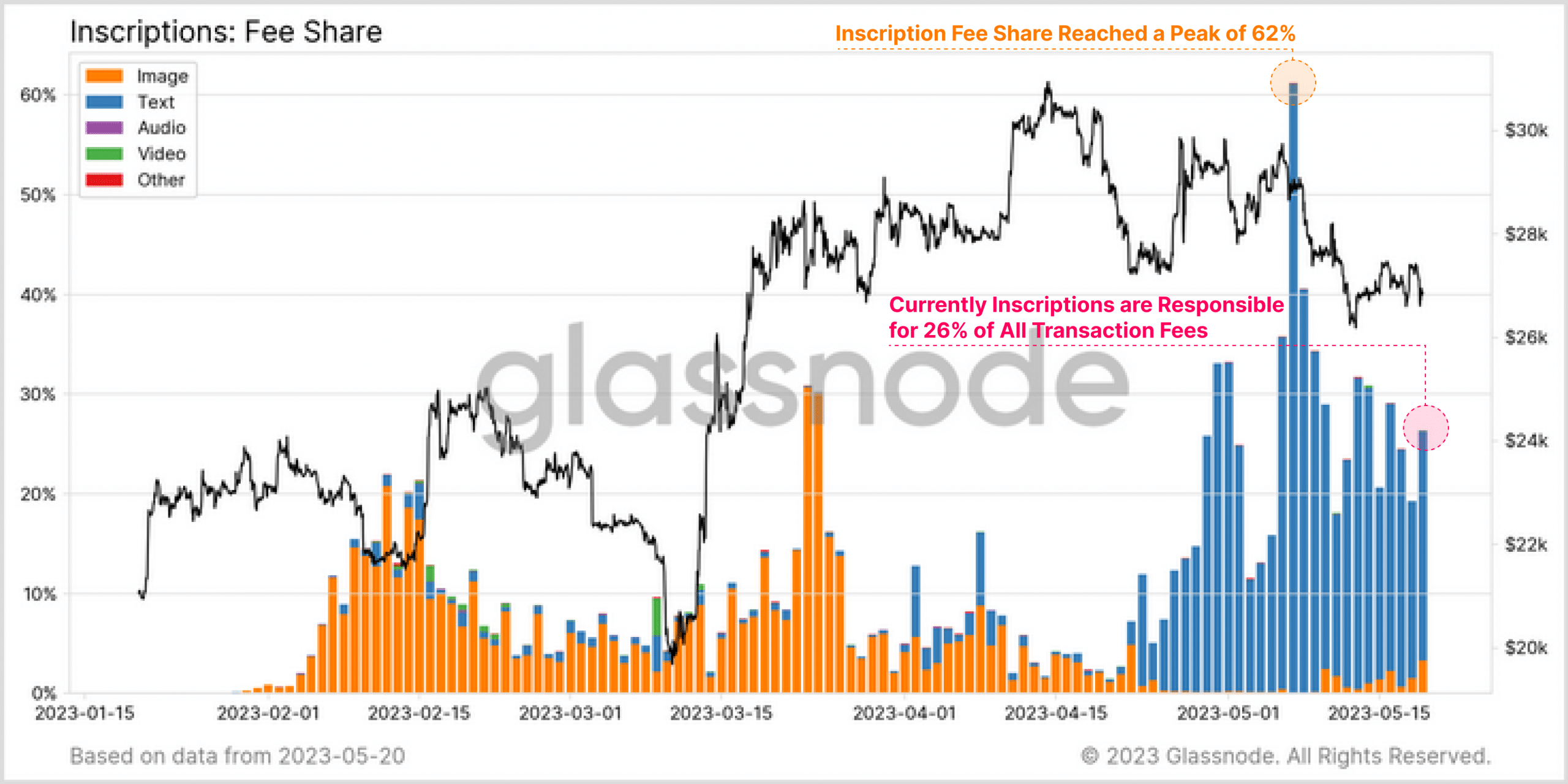

Based on Glassnode’s data, the proportion of Bitcoin transaction fees attributed to Inscriptions remained relatively high at 26%. Also, out of 111 trading days, only 12 of them (10.8%) recorded a larger relative share of fees.

However, it was worth noting that the current fee dominance of Inscription transactions fell from its peak, during which they accounted for an astonishing 62% of all transaction fees.

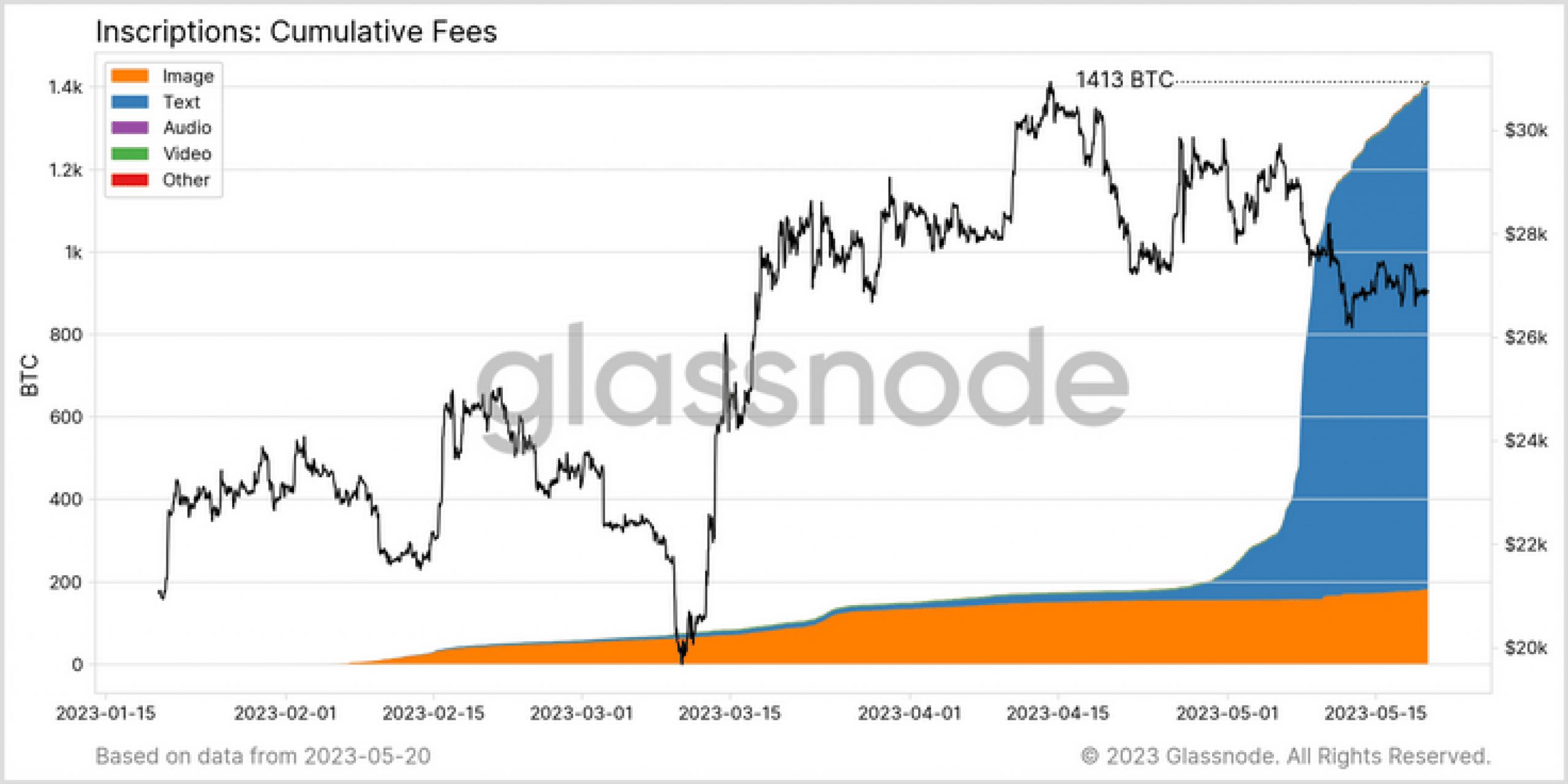

Currently, the cumulative fees generated from Inscription transactions amounted to 1413 BTC, which was equivalent to approximately $38 million in revenue.

While the current fee dominance of Inscription transactions was lower than its peak, it still represents a notable share of transaction fees.

This implies that the specific activities or addresses associated with Inscription transactions remain relevant and continue to generate revenue on the network.

The current state of miners

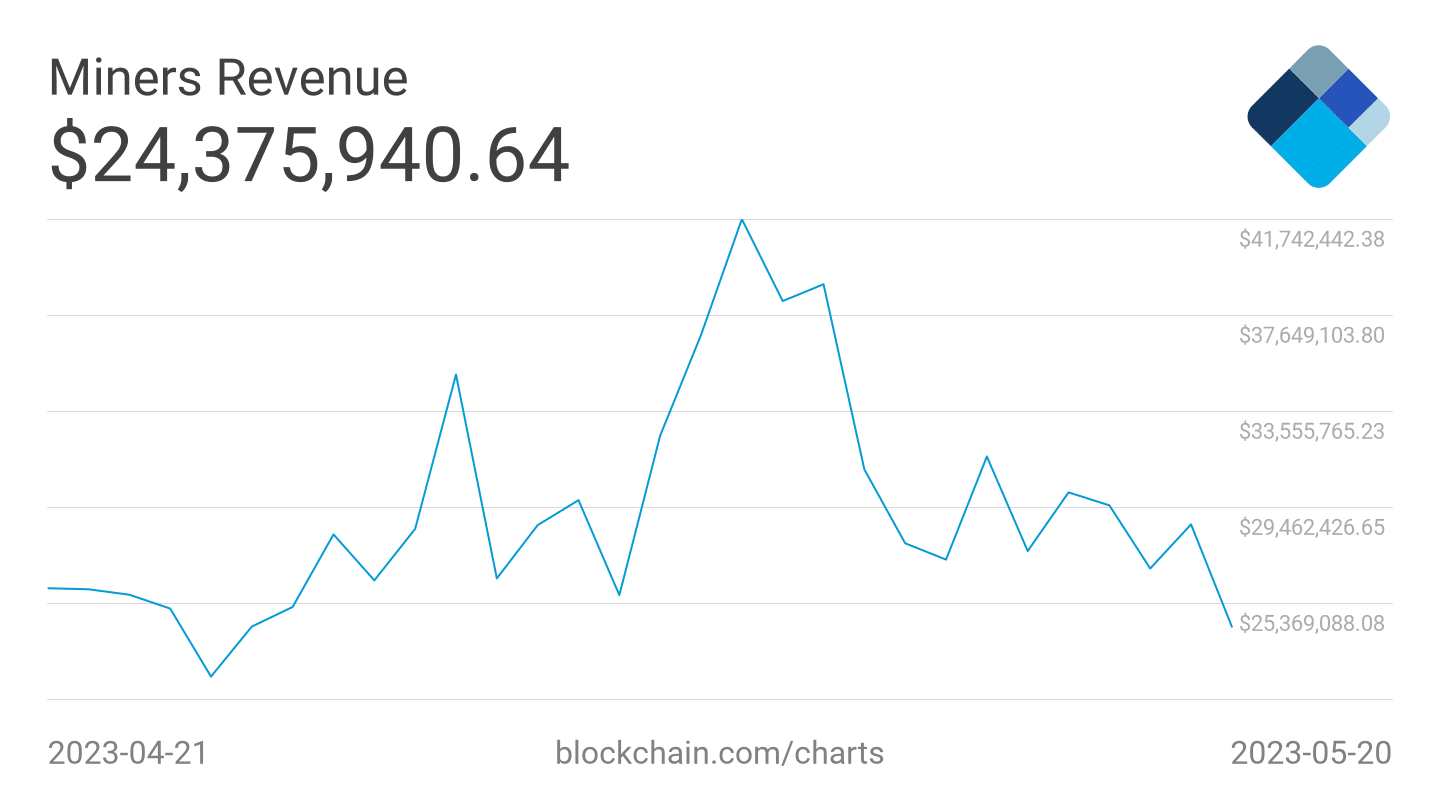

The declining fees generated by Inscriptions may have an impact on Bitcoin miners. Since Inscription transactions contribute a significant portion of transaction fees, a decrease in their share could potentially lead to a reduction in the overall fees received by miners.

Read Bitcoin’s Price Prediction 2023-2024

Miners rely on transaction fees as part of their revenue stream, in addition to block rewards, to incentivize their mining activities. If the fees generated by Inscription TXs decline, miners may experience a decrease in their total fee income.

At press time, daily miner revenue declined from $41.74 million to $23.375 million in the last few days.

If this decline in revenue continues, the miners will be forced to sell their holdings to remain profitable. This would drive down the price of BTC even further.

Despite these factors, long-term holders continued to show faith in the king coin.

According to recent data, it was observed that long-term addresses holding Bitcoin reached an all-time high. These addresses are mostly unlikely to sell and succumb to selling pressure during volatile periods.

Bitcoin held by long-term holders fresh all-time high ? pic.twitter.com/Ok3jqBDWCi

— Will Clemente (@WClementeIII) May 20, 2023