Bitcoin, Ethereum face largest correction since 19 May; is it time to buy the dip

Bitcoin and Ethereum have dropped the ball. The market has been witnessing a decline matched by the correction intensity from 19 May, 2021. Needless to say, that the long-term bullish structure is currently fractured. In recent articles, we highlighted the possible bullish scenarios for Bitcoin but none of them panned out like expected. In this article, we will analyze the new on-chain developments and estimate if there is a buying opportunity in the market. Bitcoin and Ethereum are respectively down by 11% and 8% at press time.

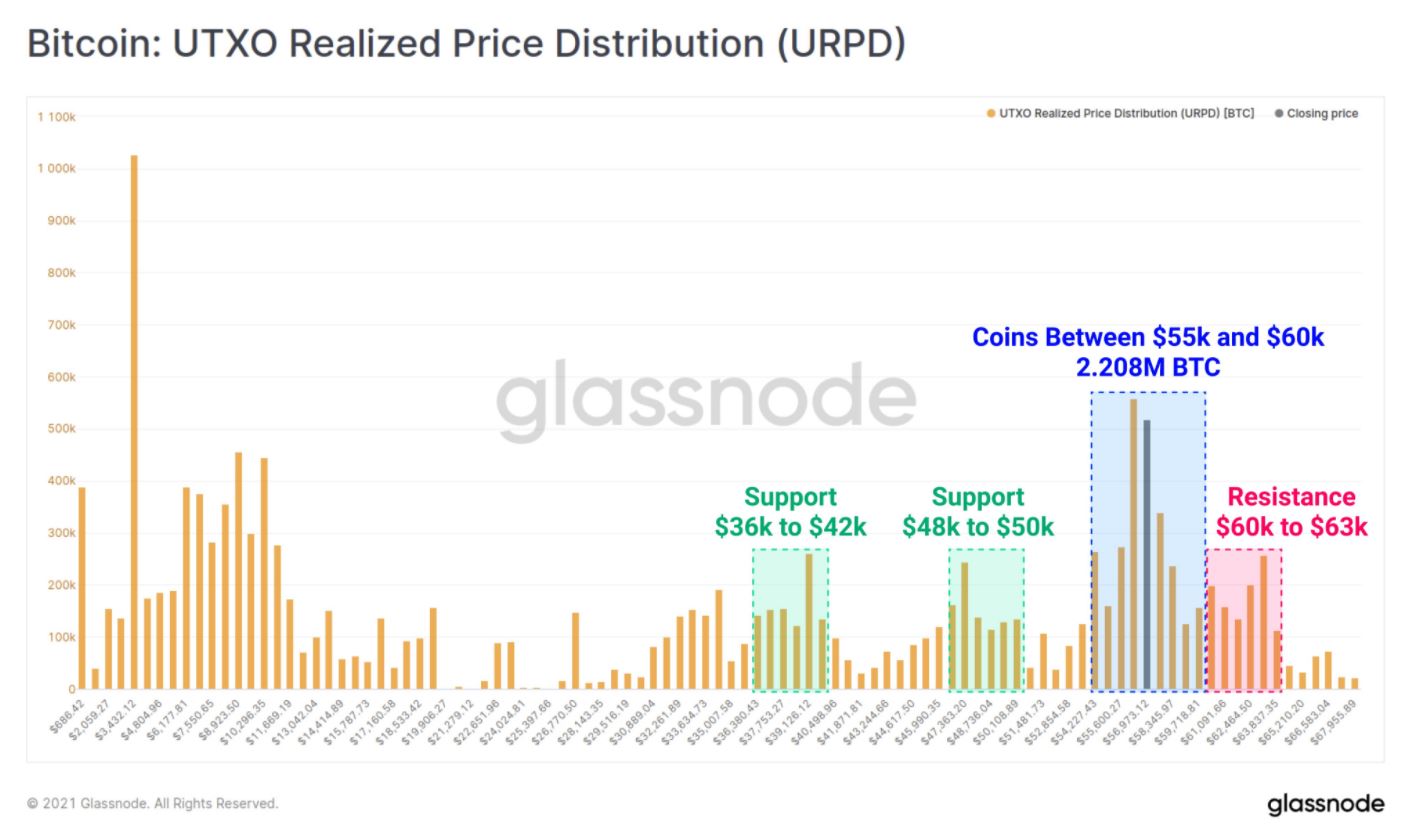

Bitcoin hardly held first on-chain support

Less than 48-hours ago, Bitcoin was consolidating in a range between $55,000-$60,000. The significance of this range was illustrated by the fact that it comprises the highest BTC cluster, with over 2.2 million BTC moved in this range.

However, this particular range was hardly held by the digital asset, dropping down to as low as $42,000 in the chart. The asset currently remains under the next support range as well ( i.e. $48k-$50k) and the market structure indicates the price is yet to bottom.

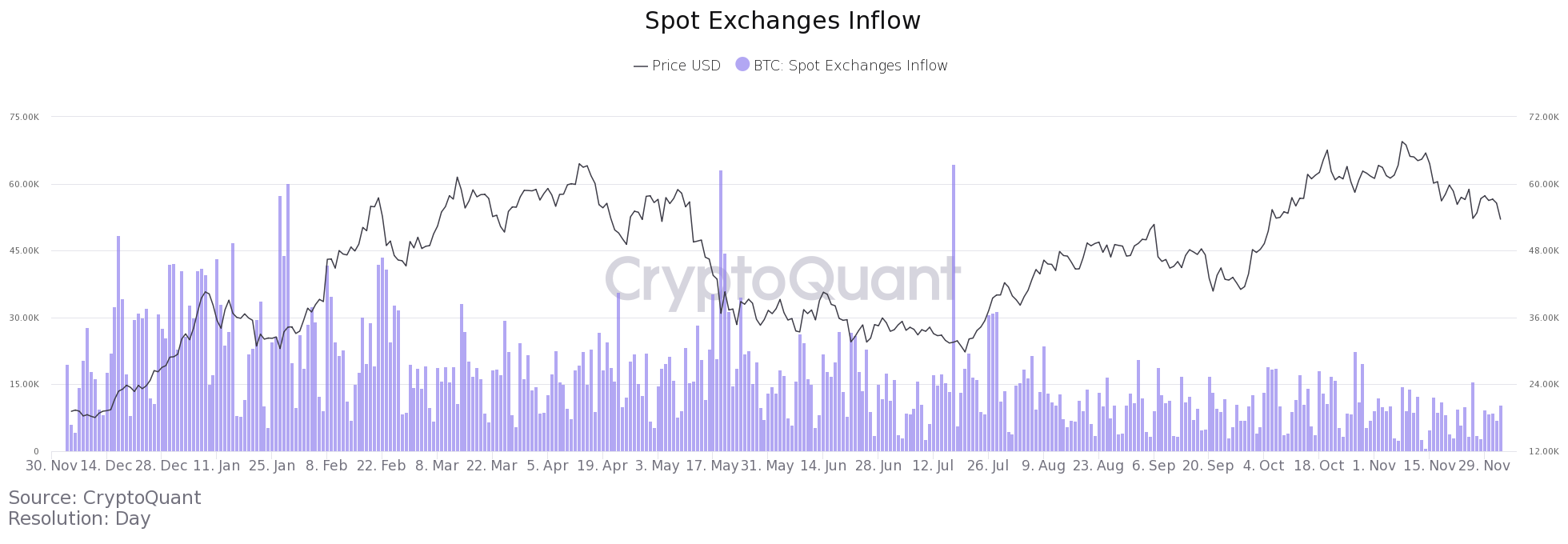

Yesterday, AMBCrypto reported 39,000 BTC re-entering exchanges and at that time, a hidden bullish narrative was developed. Right now, it appears to be completely invalidated but spot exchange inflows continue to remain low. Frankly, on-chain fundamentals remained contradictory as bullish narratives can still be identified however, price charts are re-structuring and there is nothing bullish about it.

BTC, ETH; Time to welcome another bearish phase?

At the beginning of Q4, 2021, a majority of the market expected Bitcoin to reach $100,000 and Ethereum close to $10,000 before 2021 ends. However, we might have seen the all-time high for now, and the current correction will probably lead to an extensive bearish phase.

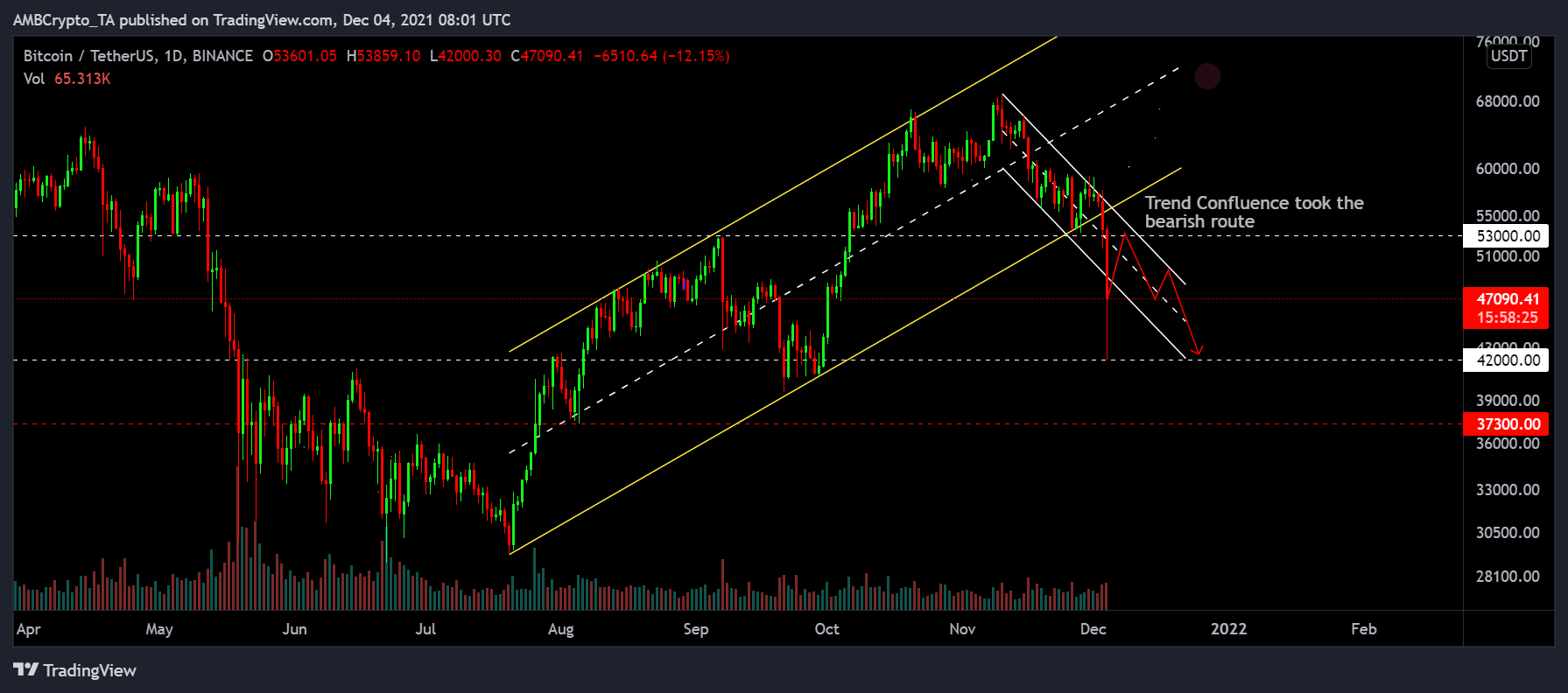

In earlier charts, we observed Bitcoin bouncing off from the lower incline support quite a few times but over the past days, the market went right through it. In that sense, now its long-term daily chart has broken an ascending channel pattern too.

In addition, BTC was also oscillating within a descending channel recently, and a confluence between both the patterns needed a bullish outcome. That was not the case, and now the market finds itself at the mercy of bears.

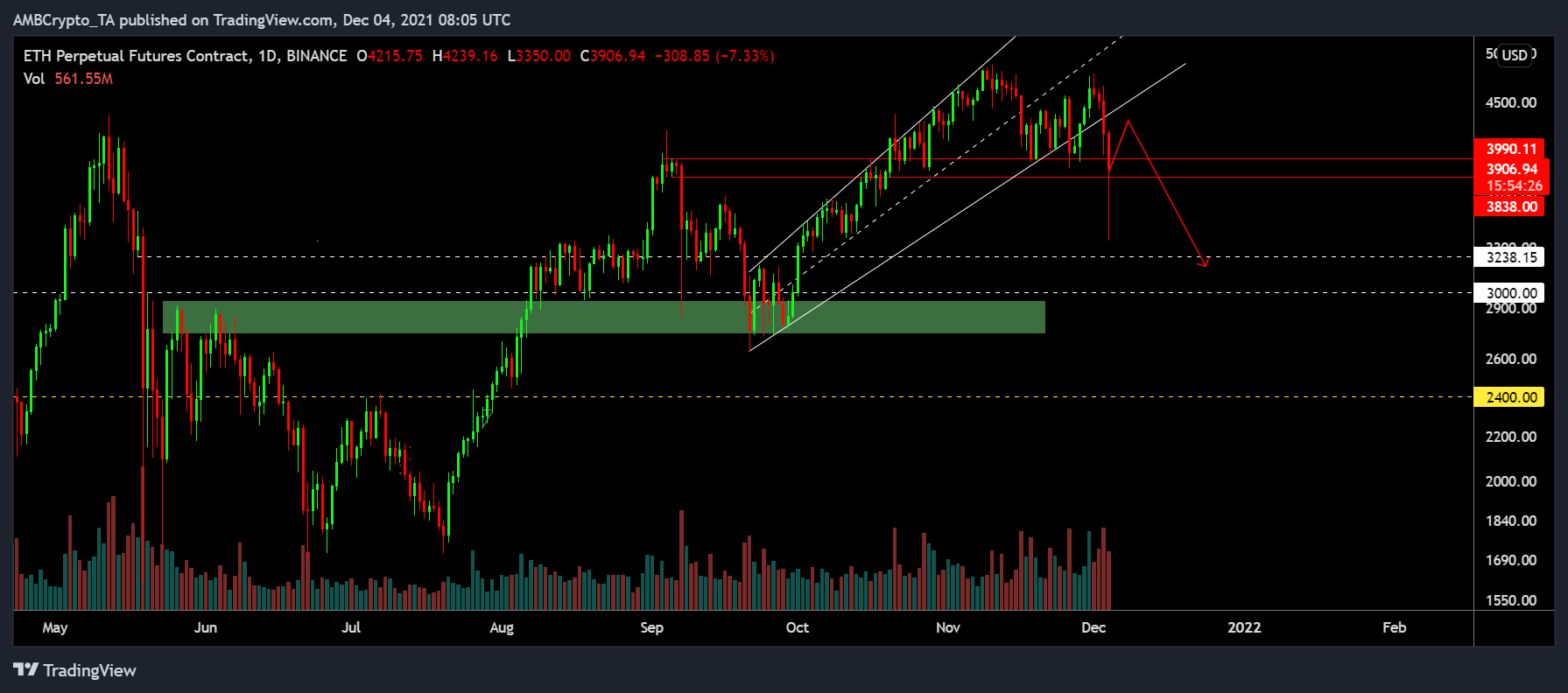

For Ether, it was pretty much the same. Although the asset came $100 short of its ATH after 26 November, BTC’s liquidity exit possibly led to Ether’s decline. While Etherum might re-test back up to $4300 in the next few years, it will probably be a reactionary pull-back.

The question remains, should investors buy the dip?

Here are the facts. Bitcoin’s current daily correction wick is the largest since 19 May at 22%. There’s still before a daily close but it is unlikely that BTC’s correction has reached a conclusion out here. The price is probably going to fall further in the charts, and there will be corrections down to $42,000 in the near future. For Ethereum, a similar trend can be expected with a drop-down to $3200 in the next few weeks.