Bitcoin: Everything latest you need to know before taking long position

Bitcoin [BTC] went as low as $17k in 2022, shedding more than 70% from its all-time high. This prompted many crypto pundits and analysts to announce the beginning of the crypto winter, which would imply a prolonged bear market.

However, with everyone expecting one thing, it is more likely the market will do just the opposite. That’s exactly the case here.

Fact check

Bitcoin, the largest cryptocurrency witnessed a similar event this month.

BTC’s largest July transactions primarily happened during the bottom, which means that dominant buyers, whales took to opportunity to buy the dip at a discounted rate.

At present, transaction volume is beginning to normalize as seen in the graph above. This could mean that the buyers already bought the dip as the network showcased some signs of recovery.

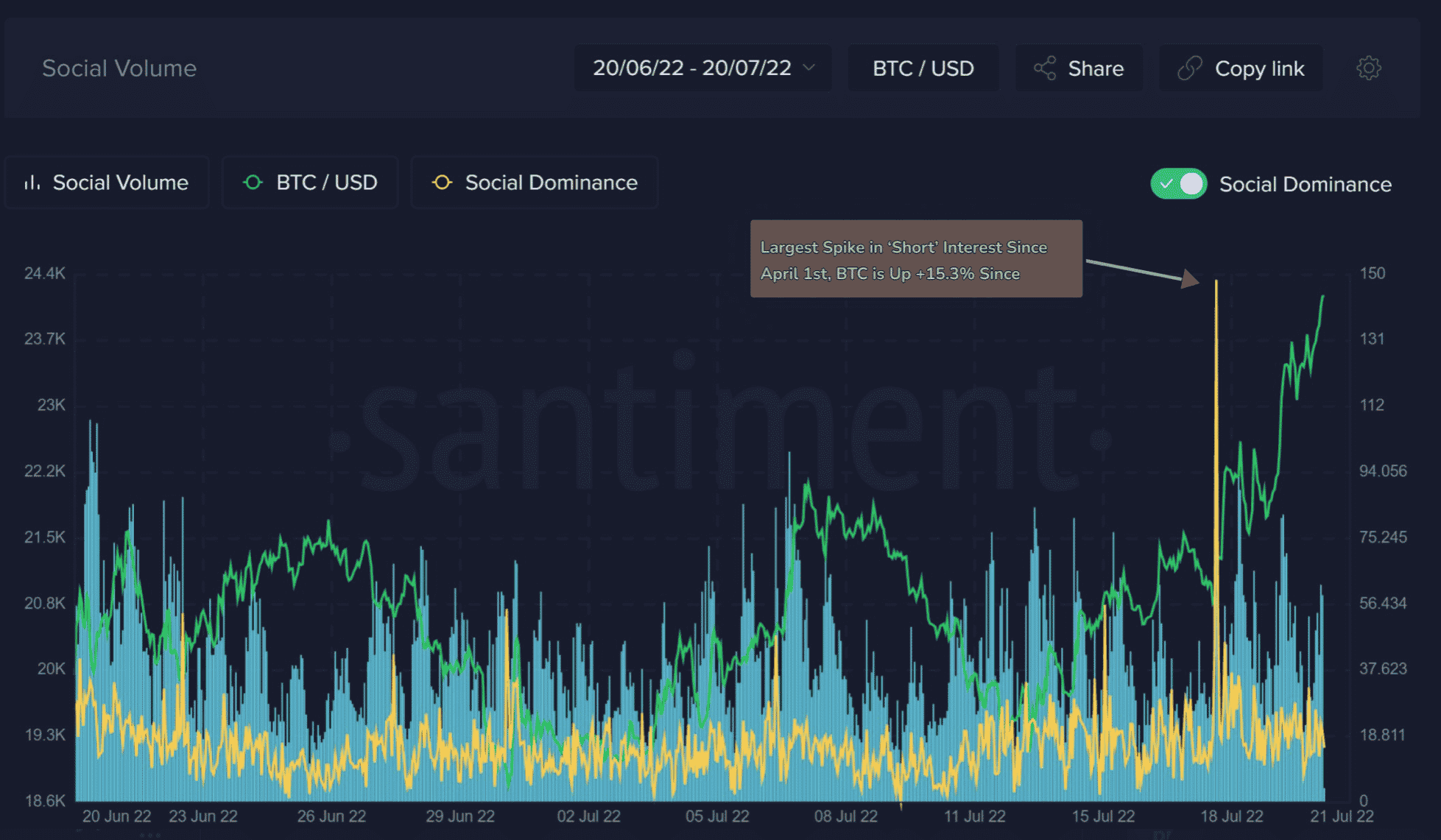

Nonetheless, here’s an interesting narrative as highlighted by the analytical firm, Santiment.

July has been headlined by a new Bitcoin address (35PPdr9CSZuqwi2S7vj9ResHQCVTsYuB3z) receiving 50.56k BTC on 8 July. Indeed a positive sign for Bitcoin.

In fact, the said address went from being worth $0 to $1.178 billion due to that transaction. This is far rarer than a $1 million transaction, and one of the largest of the year.

Did this help the network? Well, yes, it certainly played a part to mellow down the ‘shorting’ narrative.

BTC blasted off (>15%) right when traders aimed to short the network at the highest rate in nearly four months.

BTC had a great rebound in July. Even though the profit-taking activity maintained a modest/neutral rate as compared to altcoins such as ETH, the on-chain transaction volume in profit to loss ratio narrowed down to a bullish picture.

Any concerns?

Everything comes down to one aspect- Can the BTC market sustain this uptick (trajectory). Or, this bearish phase will continue to see new developments?

Well, one of the largest names in the crypto-verse chose the latter. Grayscale’s “Bear Markets in Perspective” report suggested that the current bear market might last for another 250 days.

At press time, BTC suffered a fresh correction as it slid to the $22.8k mark. Could the aforementioned prediction come true? Only time can answer.