Bitcoin Exchange Balance hits 4-year low: How will this impact BTC?

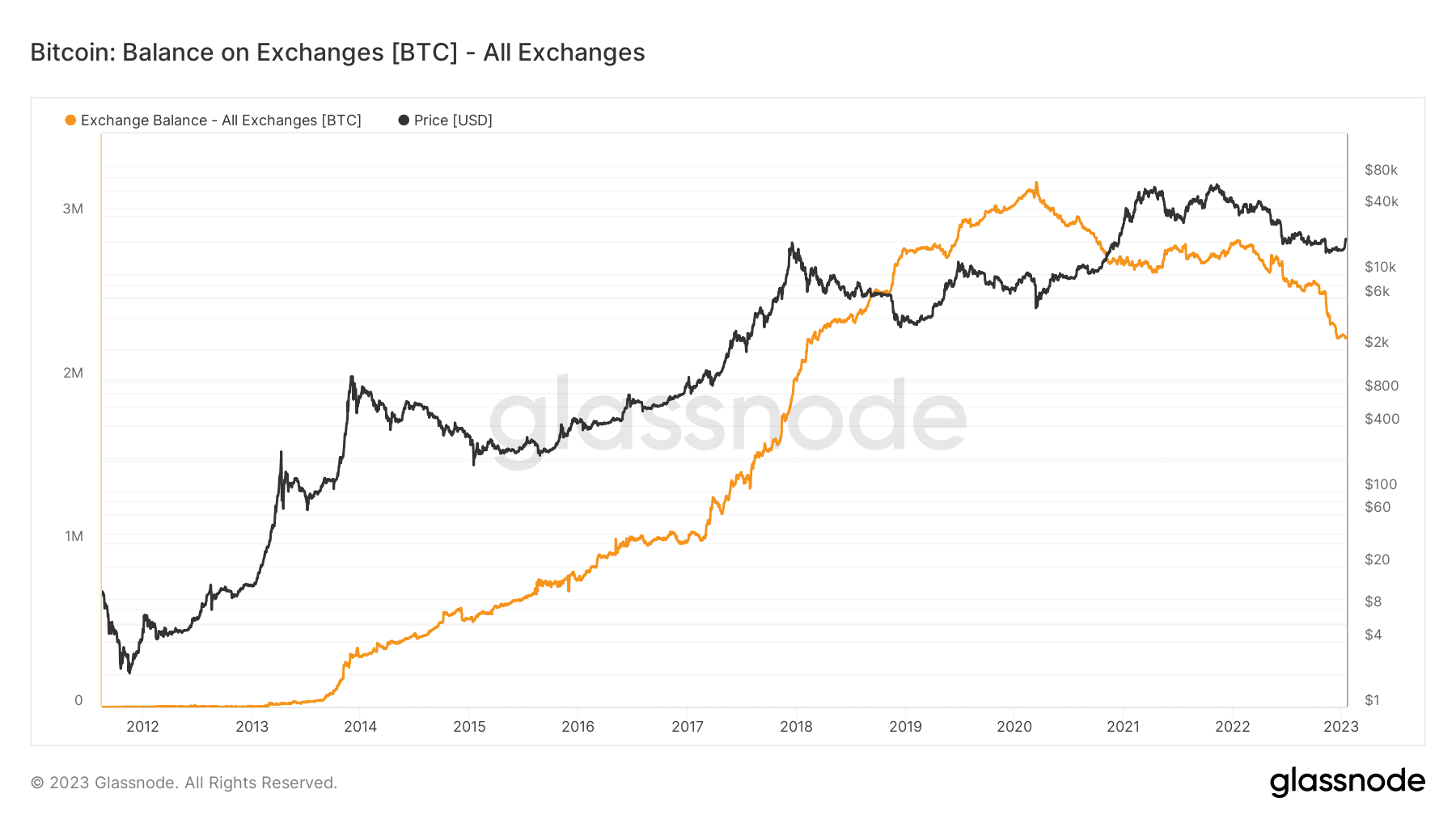

- Glassnode chart revealed that Bitcoin was experiencing a low exchange balance.

- The current downtrend might be indicative of a bull trend rather than a bear trend.

After the FTX meltdown, Bitcoin [BTC] began a rally that saw its value increase by over 25% and make up for the losses. The rest of the cryptocurrency market could also rise thanks to the king coin’s rally. However, Glassnode’s balance on exchanges metric displayed a low volume despite this surge. What might this indicate for BTC?

? #Bitcoin $BTC Balance on Exchanges just reached a 4-year low of 2,249,824.148 BTC

Previous 4-year low of 2,249,845.086 BTC was observed on 19 December 2022

View metric:https://t.co/9vOOAmwh32 pic.twitter.com/0xWWsLeIXM

— glassnode alerts (@glassnodealerts) January 18, 2023

Read Bitcoin’s [BTC] Price Prediction 2023-24

Balance on Exchange declines

Bitcoin had been trading at around $17,000 for November and December 2017. Recent gains of nearly 26% have pushed the price over its level of initial resistance.

It was anticipated that after the rally, a flurry of activities would occur that could lead to a decline in price. However, Glassnode reports that there are fewer BTC available on key exchanges.

As per the tweet above, BTC’s Balance on Exchanges was 2,249,824.148 BTC, on 18 January, a new all-time low. Before this new low, on December 19, 2022, the volume of Bitcoin first fell to 2,249,845.086 BTC. Could this impact the price of BTC negatively?

It is not always the case that low Bitcoin balances on centralized exchanges indicate a downward market trend. Fewer people holding Bitcoin may sell them on exchanges, preventing a significant market correction. This shift to longer-term holding options, such as cold wallets, may mean an optimistic sentiment among Bitcoin owners.

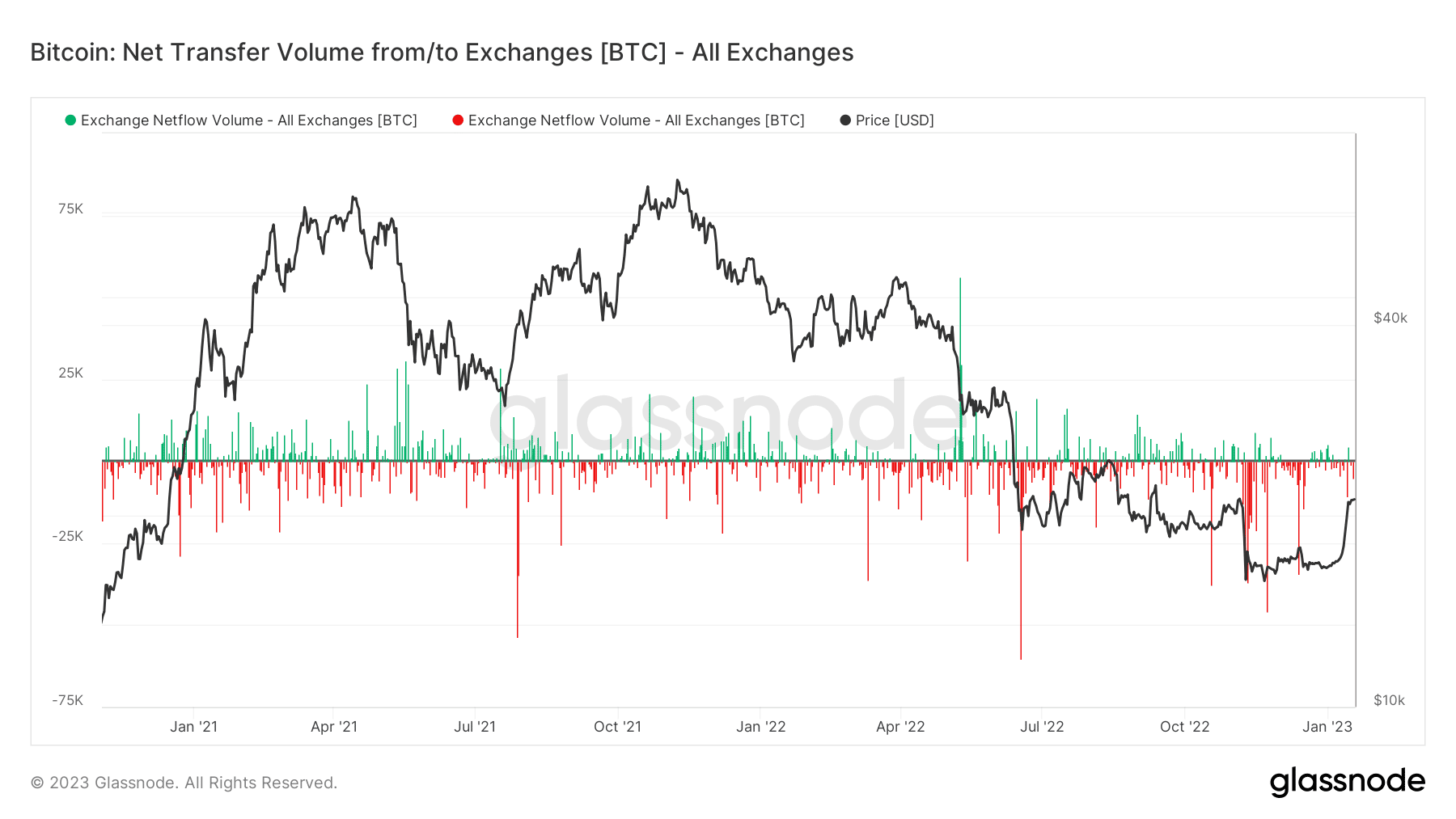

Bitcoin (BTC) Netflow shows outflow bias

The outflow that the asset has been experiencing over the previous months was also evident in the Bitcoin Exchange Netflow Volume measure. The statistics indicated that there had been a greater outflow of BTC from significant exchanges than inflow. This aids in further contextualizing the Balance on Exchange metric.

How much are 1,10,100 BTCs worth today?

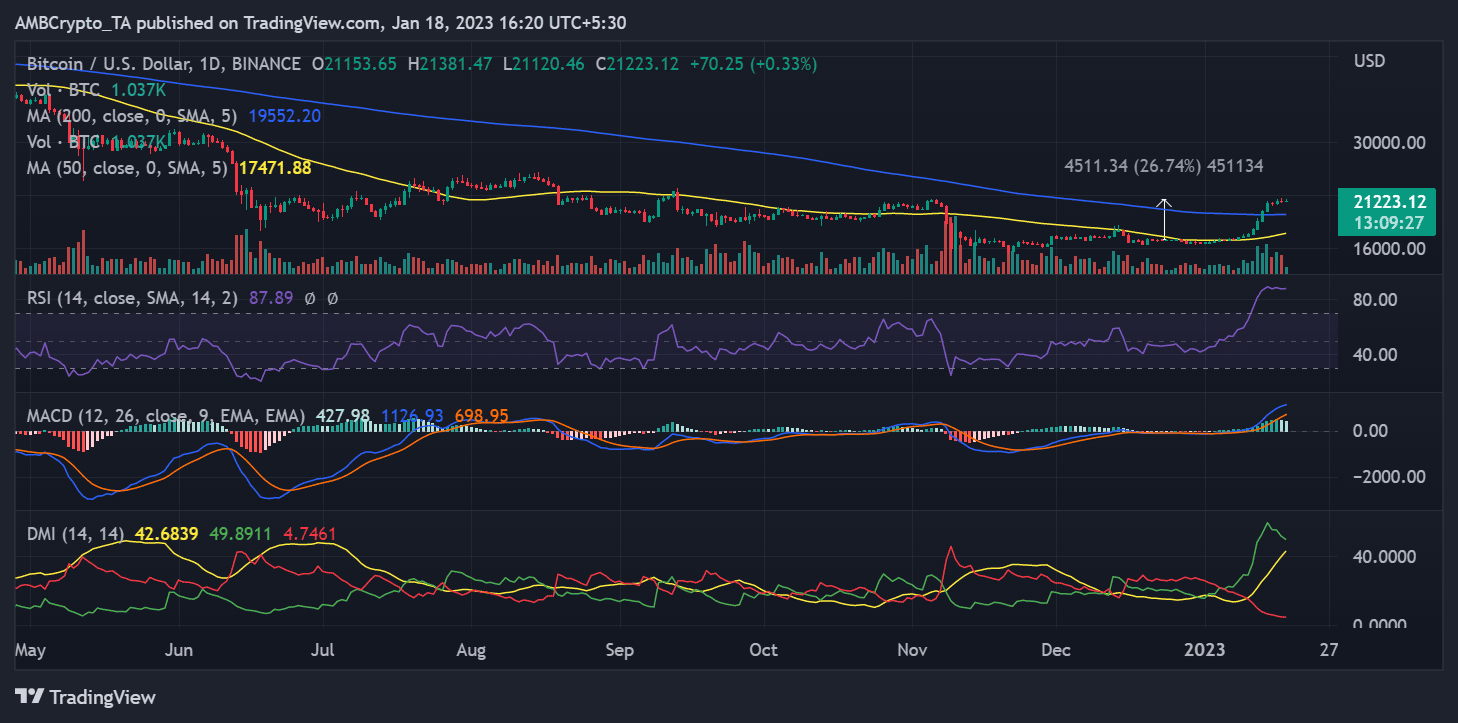

BTC’s current trend might not end soon

BTC was still in a bull trend on the daily timeframe. Additionally, the asset was creating a new support level to consolidate the existing price. As of the time of this writing, BTC had surpassed the psychological resistance mark of $20,000 and was trading at over $21,200.

The Relative Strength Index line was firmly in the overbought area at the current price level. Usually, a price correction would be anticipated at the current level of the RSI. However, the asset might stay there for longer, given the declining supply of major exchanges.