Bitcoin firm Bitfarms mines 189 BTC in June – Why is this important?

- Bitfarms mined 189 BTC in June.

- The mining firm now holds over 900 BTCs.

A recent earnings report from Bitfarms, a prominent player in the cryptocurrency mining sector, highlighted a marked improvement in its financial performance for June.

This positive development comes in the wake of a significant corporate challenge—an attempted takeover—which the company successfully managed to fend off.

Bitfarms ups its earnings

Bitfarms, a notable player in the cryptocurrency mining sector, reported an increase in its Bitcoin [BTC] production for June, according to a press release dated the 1st of July.

The firm successfully mined 189 BTC in June, substantially improving from the 156 BTC mined in May. Out of the June earnings, it sold 134 BTC for approximately $8.8 million.

Currently, the company holds 905 Bitcoin in its treasury, valued at around $57 million.

Despite the positive performance in June, a year-over-year comparison provided by Bitfarms revealed a significant drop in productivity. By this time in 2023, the company had accumulated 2,520 BTC.

However, its earnings to date in 2024 have decreased to 1,557 BTC, marking a decline of over 50%.

This reduction in Bitcoin earnings is not solely due to changes in productivity; a significant factor has been the reduction in BTC miner rewards, which has impacted the overall yield for many in the sector.

How Bitfarms emerged from a hostile takeover

In June, the cryptocurrency mining sector witnessed significant corporate activity involving Riot Platforms and Bitfarms. Riot Platforms made a substantial buyout offer to acquire Bitfarms for $950 million.

Despite the sizeable offer, the acquisition attempt did not succeed in its entirety.

However, Riot was able to secure a 14.9% stake in Bitfarms. Efforts by Riot to increase its stake to 15% or more were thwarted, keeping its influence just below a more controlling interest.

During the same period, Riot Platforms also aimed to increase its influence within Bitfarms by attempting to replace three members of Bitfarms’ board of directors.

This move was part of Riot’s broader strategy to potentially steer Bitfarms more directly. However, this effort also faced resistance and ultimately failed.

In response to these aggressive maneuvers by Riot, Bitfarms took strategic defensive measures by adding a new member to its board.

This action was likely aimed at strengthening its governance and preventing further takeover attempts.

Miner revenue continues to decline

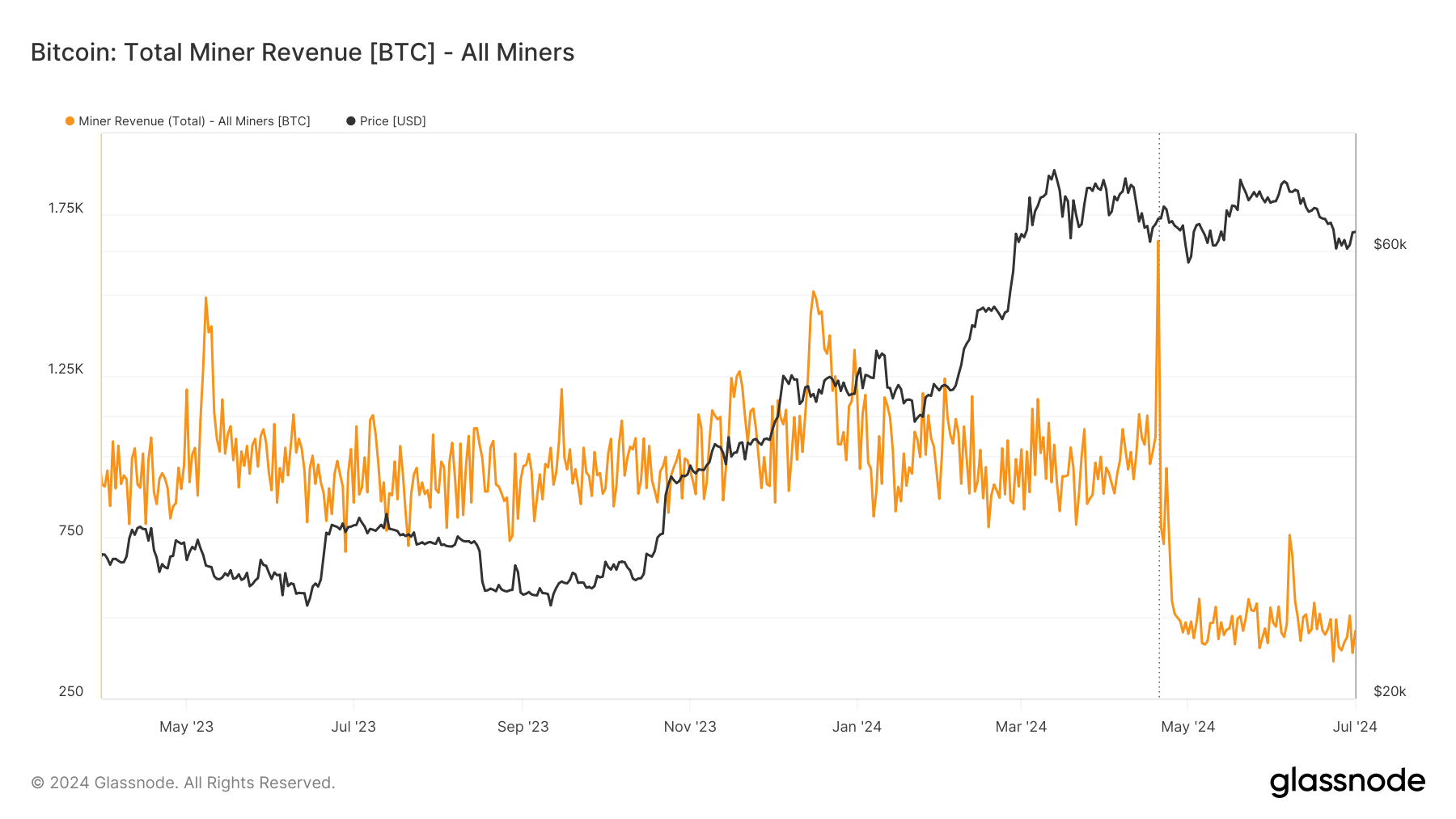

AMBCrypto’s analysis of Bitcoin’s miner revenue, as reported by Glassnode, indicated a sustained decrease following the Bitcoin halving event. This expected reduction halves the reward for mining new Bitcoin blocks.

This event had a profound impact on the economics of Bitcoin mining.

Before the halving, daily revenue from mining operations hovered between 900 and 1,000 BTC. Post-halving, this figure has significantly declined to around 400-500 BTC.

Read Bitcoin’s [BTC] Price Prediction 2024-25

As of this writing, the daily revenue was around 456 BTC.

As demonstrated by the recent financial disclosures from Bitfarms, this reduced revenue stream from mining activities is a trend that is likely impacting miners across the industry.