Bitcoin: Korean market shows strong appetite for the king coin

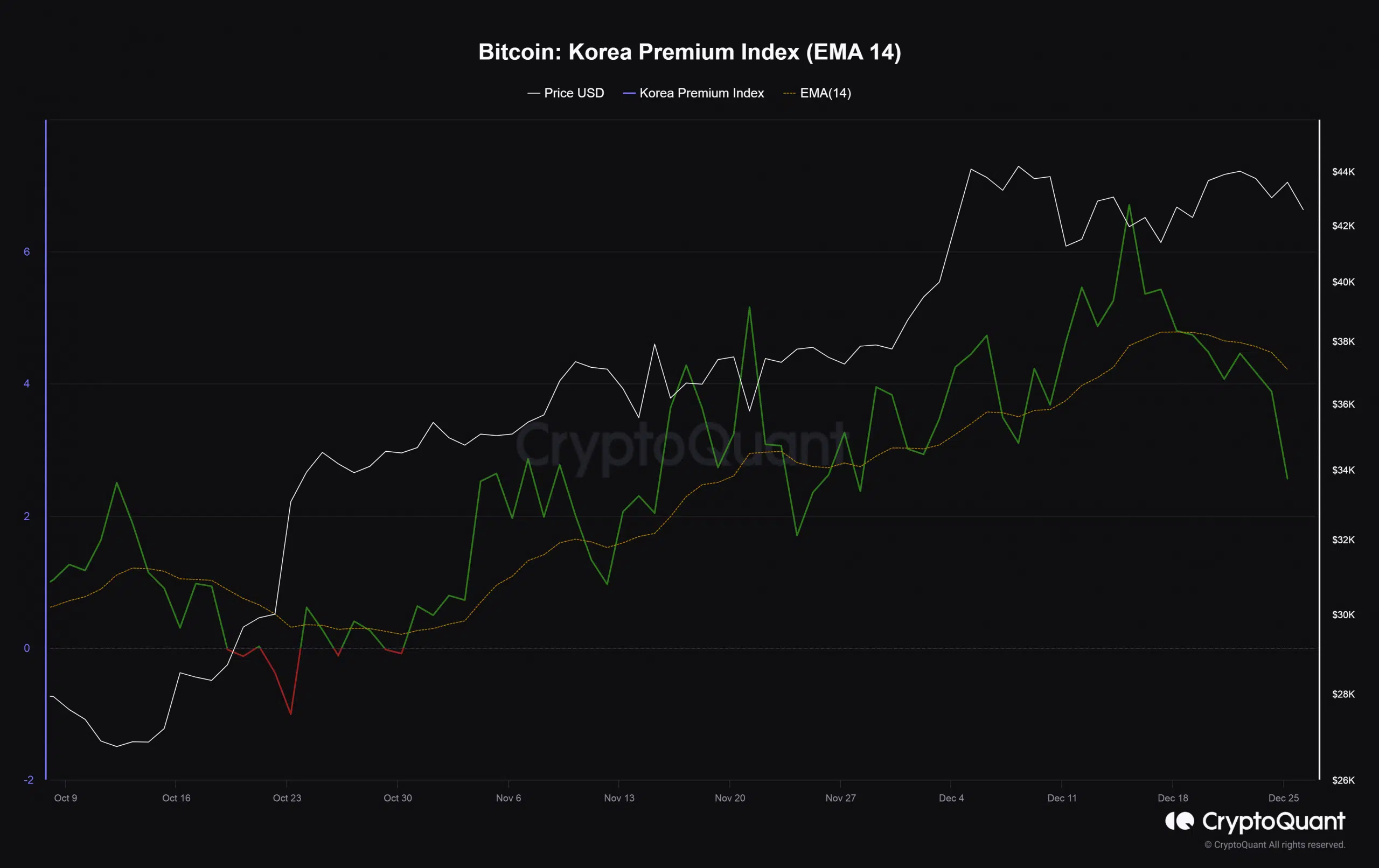

- The Korea Premium Index reached levels similar to the time when Bitcoin hit its peak in November 2021.

- Korean retail investors were willing to pay a premium for Bitcoin’s purchase.

Bitcoin’s [BTC] demand in the U.S., the biggest financial center of the world, increased manifold even as institutional investors in the country started placing their bets on the coin owing to spot exchange-traded funds (ETFs) hype.

More than 6,400 miles (ca. 10,300 km) away, an Asian country had a similar thirst for Bitcoin, except this time it was driven by retail investors.

Korean traders amp up demand for Bitcoin

Bitcoin’s Korean Premium Index, an important barometer of the South Korean market’s buying power, soared dramatically in December.

As per AMBCrypto’s analysis of CryptoQuant, the index has reached levels similar to the time when Bitcoin hit its peak in November 2021.

Korea Premium Index, also popularly known as the Kimchi Premium, is the percent difference between the market price of Korean exchanges and other exchanges.

For the uninitiated, the Korean market is mostly made up of retail investors due to regulations against institutional investors.

This is a historical phenomenon and is driven by a high demand for cryptos in the country.

As evident, the index was positive, implying that retail investors were willing to pay a premium for the purchase. Moreover, the rising trend signaled that more and more traders were willing to buy Bitcoins at a higher price.

Korean exchanges see a surge in Bitcoin trading

Over the past 24 hours, BTC was the third most-traded asset on Upbit, the country’s largest exchange, according to CoinGecko. Moreover, the BTC/KRW pair accounted for over 7% of the exchange’s total trading volume.

On the other hand, the pair captured a whopping 48% of the total volume on Bithumb, another major crypto trading platform in the East Asian nation.

The indicator, according to a Cryptoquant researcher, provides key signals concerning price tops. They attributed this to Koreans’ access to cash to buy coins on exchanges and the FOMO hype.

Read Bitcoin’s [BTC] Price Prediction 2023-24

While the current level was similar to Bitcoin’s peak, it remained to be seen if there is a correction on the way or Bitcoin would continue to fly higher.

As of this writing, BTC moved in the $42,000 region, with losses of 1.33% in the last 24 hours, according to CoinMarketCap.