Bitcoin L2 Stacks rises 10%; here’s why

- STX may jump higher when the Nakamoto upgrade hits Mainnet.

- Despite decoupling from Bitcoin a few weeks back, STX may rise in BTC’s direction.

The price of Stacks [STX], the native token of the Bitcoin [BTC] L2 for smart contracts development, increased by 10% in the last 24 hours. The rise was a result of a widespread crypto recovery which saw BTC hit $45,000.

However, there could be more in store for STX because of the Nakamoto upgrade set for Q1.

Stacks gained popularity in 2023 on the back of a rise in the adoption of Bitcoin Ordinals. Following the traction it received, the Stacks Foundation came up with the Nakamoto upgrade in its roadmap.

Nakamoto is ready to breathe, and so is STX

The Nakamoto upgrade aims to boost STX’s price. According to the project, the boost would also come with faster block generation, improved security, and sBTC launch.

Details from the roadmap showed that sBTC would be the noncustodial, programmable 1:1 Bitcoin-backed asset.

AMBCrypto also found out that the upgrade would allow users to represent their Bitcoin holdings in the form of sBTC on the Stacks blockchain.

At press time, the Nakamoto upgrade was still in Testnet stage. However, the Stacks Foundation had earlier mentioned that it plans to complete the upgrade before the next Bitcoin halving.

Unlike the upgrade, the Bitcoin halving would happen in Q2, probably around April 2024.

If the Stacks’ team achieves its aim of completing the upgrade before the halving, then the STX price may rally afterward. Following the price increase, many eyes are now on the Stacks project.

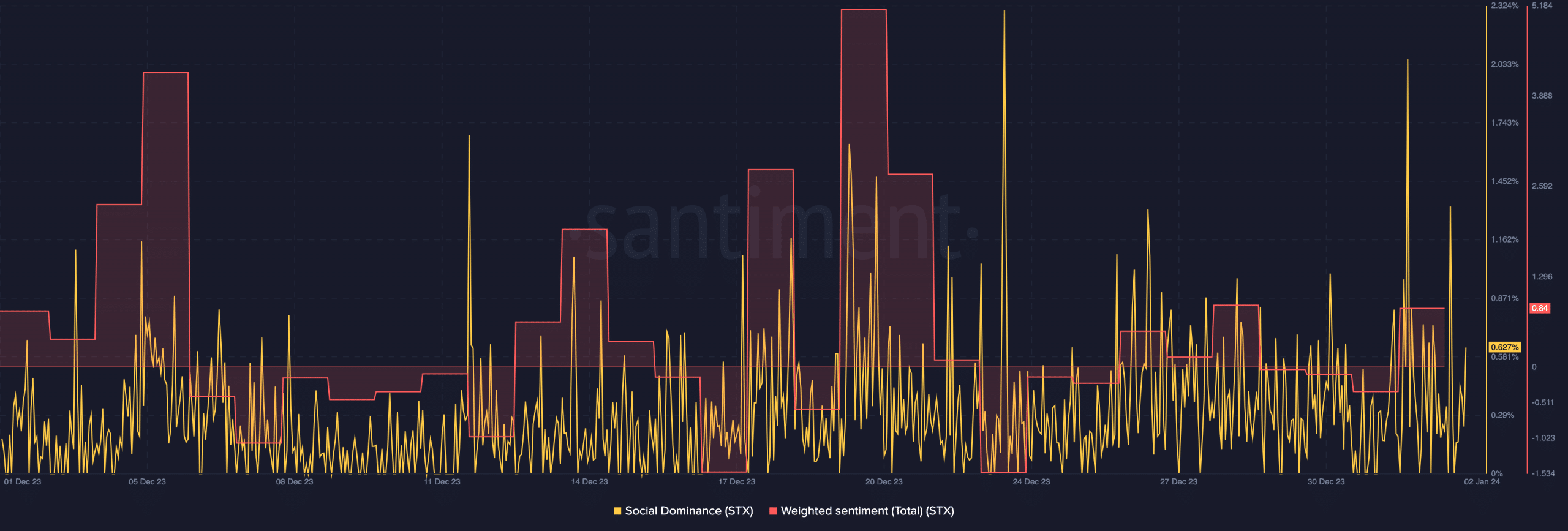

This was confirmed by AMBCrypto’s analysis of Social Dominance.

Social Dominance measures the rate of discussion of a project compared to others in the top 100. At press time, the Social Dominance had increased to 0.627%.

Like the Social Dominance, the Weighted Sentiment reading also increased. Weighted Sentiment tracks the positive/negative commentary about a token. So, the Weighted Sentiment at 0.84, suggests that market players are bullish on the Stacks project.

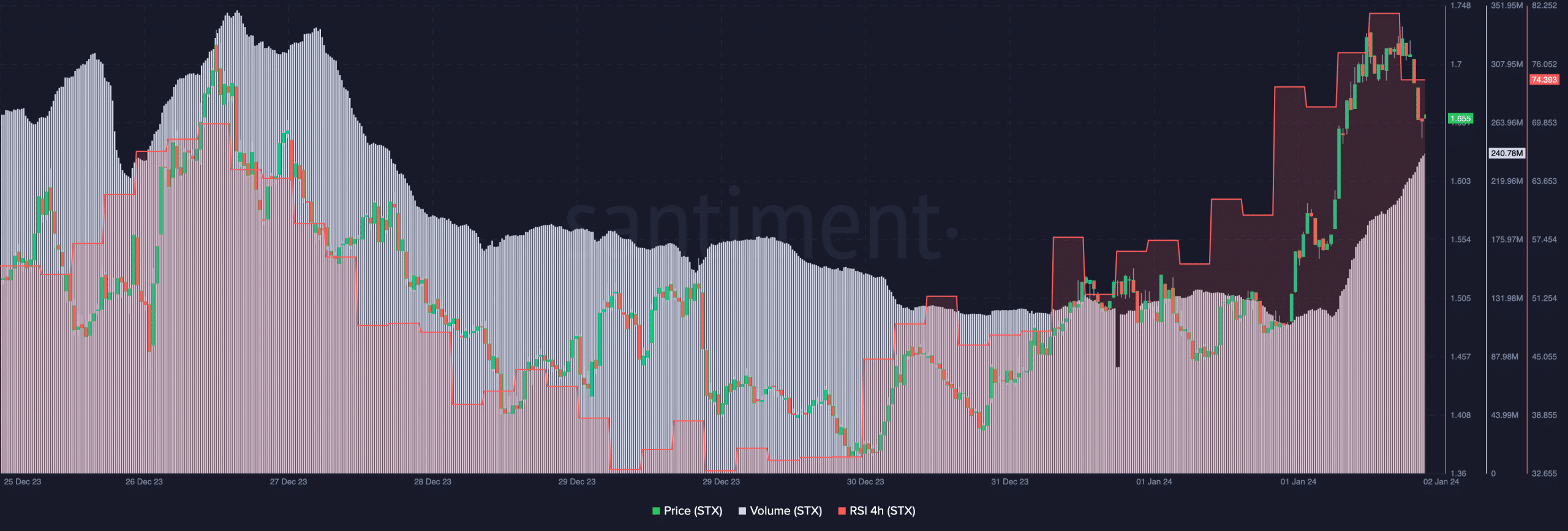

AMBCrypto also looked at the STX volume. As of this writing, the volume had risen to 240.78 million. The surge in volume was proof that the number of STX tokens moving in and out of exchanges and external wallets has been impressive.

Should the volume continue to increase, the STX price may also follow in the upward direction. However, the RSI on the 4-hour chart showed that the bullish momentum might stop for a while. This was because the reading fell from 81.42 to 74.39.

Read Stacks’ [STX] Price Prediction 2024-2025

This also affected the STX price, which led to a drop to $1.65. One reason the price decreased was that the cryptocurrency was overbought. In the short term, STX might retest $1.73 if buyers continue to dominate the market.

In the long term, there is a high chance that STX will follow Bitcoin’s direction. So if BTC taps a new high All-Time High (ATH), it is expected that STX would do the same.