Arbitrum price targets $2: Will predictions beat 2023’s high?

- ARB prices burst past $1.74 and could target $2 next.

- The OBV has also begun to trend higher to underline buying pressure.

Arbitrum [ARB] prices surged enormously to reach $1.79 at press time. CoinGecko noted that this is ARB’s all-time high, although TradingView data from Binance showed ARB reached $1.82 on the 18th of April 2023.

The emergence of Layer 2 solutions to address the problem of scalability was a necessity due to the growing transaction fee and slower processing speeds. Arbitrum saw heightened user activity in December and a growth in revenues.

Two key levels near $1.8 are expected to act as resistance but…

The one-day chart above shows that the 22nd of November was a turning point. The $0.93-$1 resistance region was flipped to support and saw prices bounce higher.

On the 25th of November, the market structure on the D1 chart flipped bullishly and has remained so since then.

The RSI has also mostly stayed above neutral 50 in the past six weeks. This also pointed toward a bullish trend. At press time, the indicator was at 76 to signal intense upward momentum.

On the other hand, the OBV has only trended higher after Christmas. This was a conflicting signal, as it belied the idea of a lack of buying pressure even as prices climbed higher.

The Fibonacci levels plotted showed some key extension levels. In recent weeks, the 23.6% and 61.8% levels have been respected. Therefore, it is likely that $1.79, $1.94, and $2.14 could prove a sizeable obstacle to the buyers.

The two levels of importance are from mid-April of 2023 when ARB reached $1.74 and $1.82 on Binance. Hence, it is possible that the bulls could be pushed backward a little from this area.

The high MVRV ratio outlined an overvalued asset

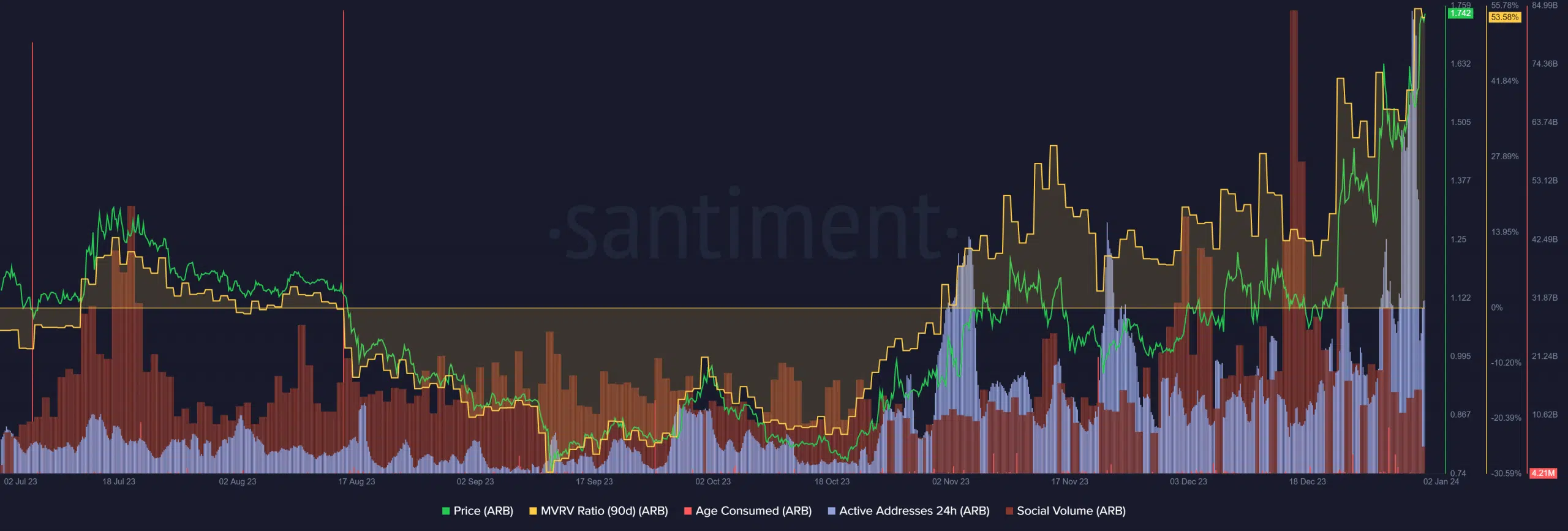

Source: Santiment

The social volume of ARB saw a strong peak on the 16th of December to reach a six-month high. While the volume has dwindled since then, it has trended upward as a whole since early November.

The active addresses metric saw a violent surge higher and is a strong sign of health.

The MVRV ratio was also at a six-month high, meaning that holders are at a large profit. This could spur selling pressure as they look to book profits. The market could be overextended in the short term, which again could see a pullback.

Read Arbitrum’s [ARB] Price Prediction 2023-24

This does not justify shorting the token, but a drop to $1.6 and $1.5 would likely interest swing traders. The age consumed metric has been quiet, apart from a leap on the 28th of December.

A surge in this metric would denote a large movement of previously dormant ARB tokens, which could precede a wave of selling.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.