Bitcoin miners reap the rewards as BTC fees hit $60 mln

- Bitcoin fees in the last seven days hit over $60 million.

- BTC hashrate has continued to rise.

Lately, Bitcoin [BTC] fees have experienced a significant surge, driven by heightened network activity. As overall fees have risen, miner fees have also seen an upward trend.

Bitcoin fees climb to six-month high

As per a recent IntoTheBlock post, Bitcoin fees have surged to a six-month peak, exceeding $60 million.

According to the analysis, this fee spike, attributed to growing interest in Ordinals, represents a 60% increase. Further examination on Crypto Fees revealed a noteworthy rise in fees throughout November, hitting their highest points in the last ten days.

Daily fees on 17th and 18th November surpassed $11 million, but as of the latest update, they have decreased to around $3.6 million.

Notably, despite the fee decline, the hashrate remained at one of its highest levels this year.

Bitcoin fees drive up hashrate

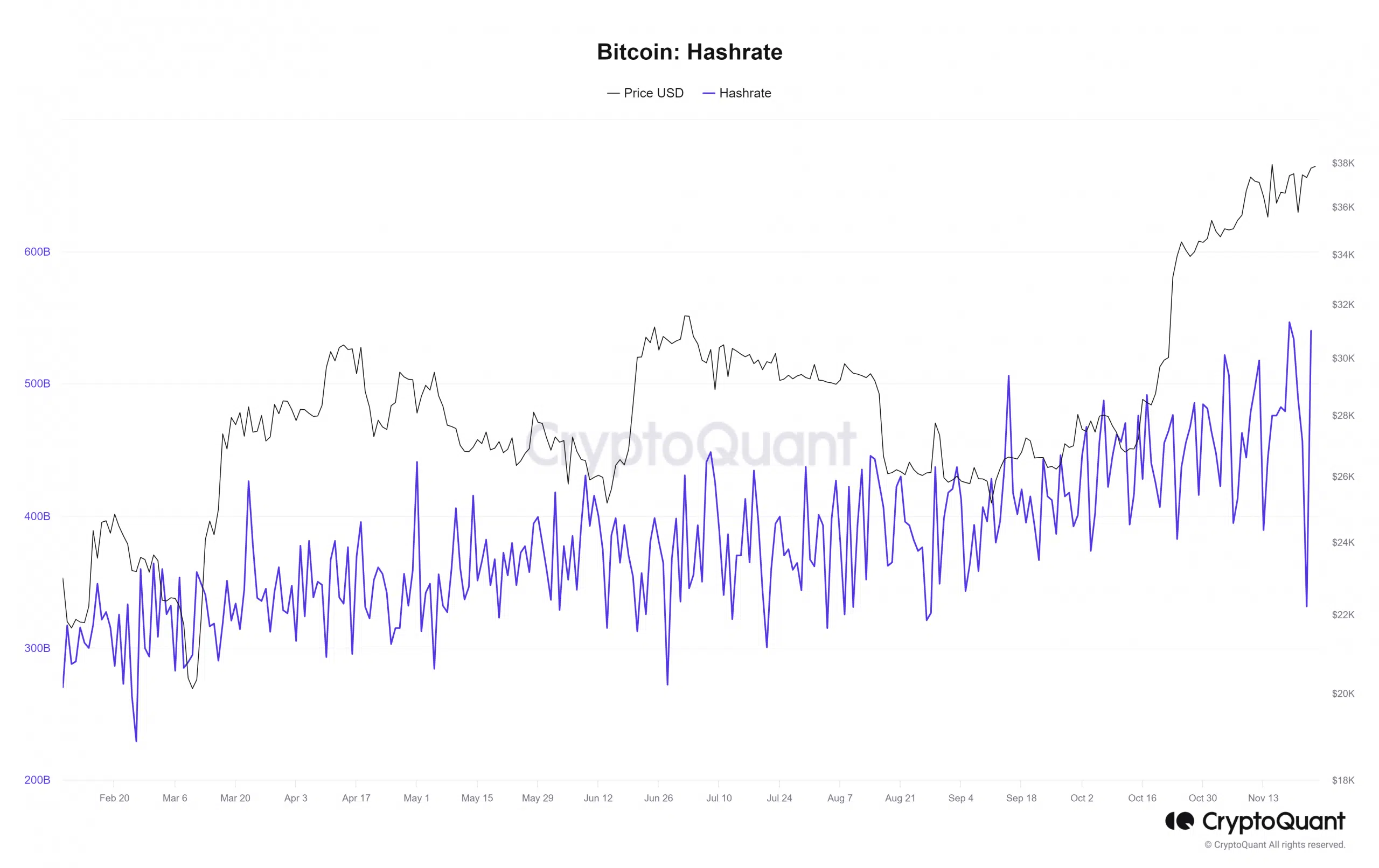

A recent analysis of the Bitcoin hashrate on CryoptoQuant indicated a consistent upward trend in the past few weeks.

This surge can be attributed to the heightened volume of transactions on the network, necessitating increased computational power to process these transactions.

The chart showed that the hashrate peaked for the year, surpassing 546 million on 19th November.

Although, it experienced a subsequent decrease to around 331 billion on 23rd November. As of this writing, the hashrate has rebounded to over 540 billion, marking the second-highest level in over six months.

More revenue flows to BTC miners from fees

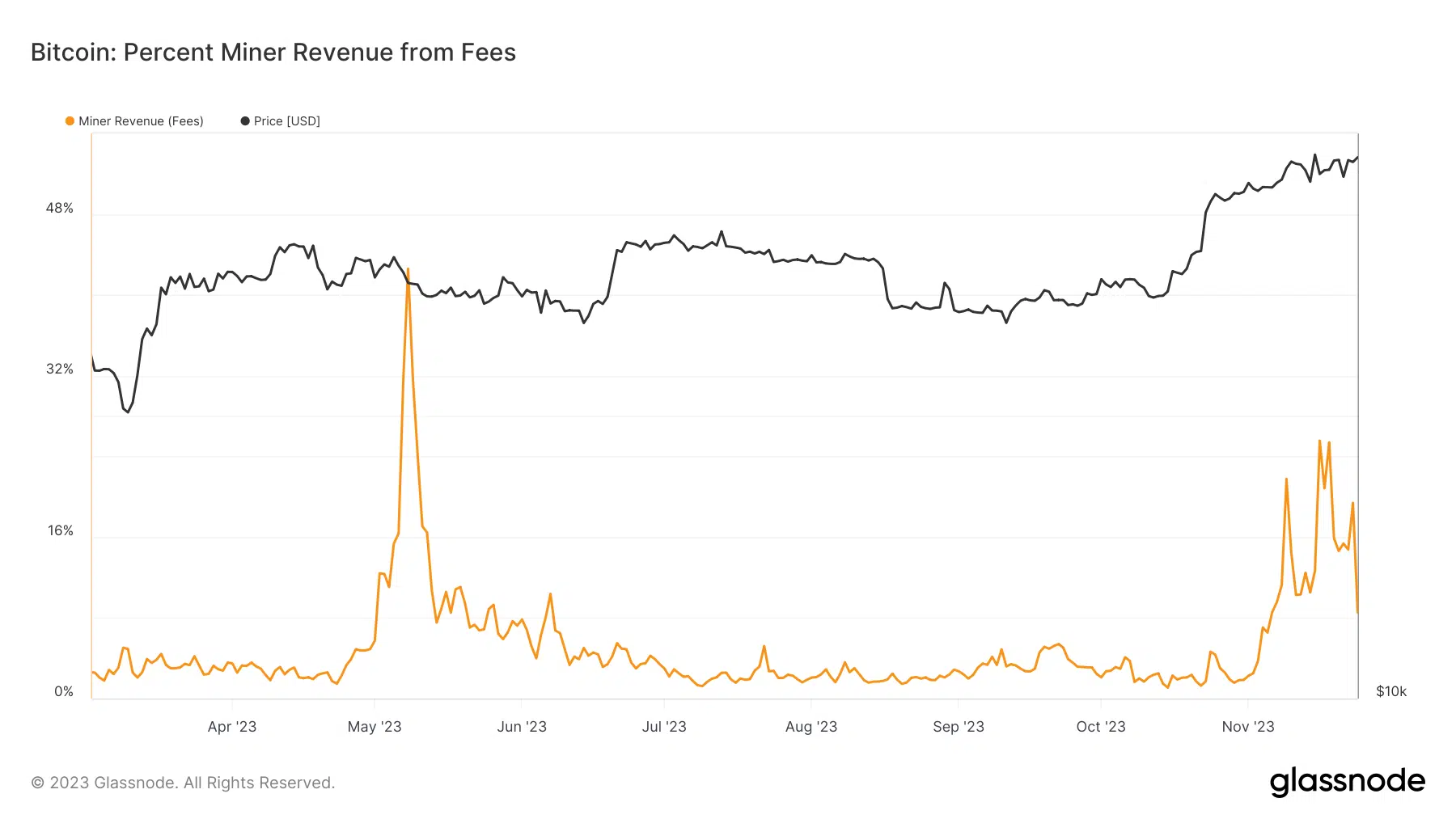

Another notable observation is the increase in Bitcoin miner revenue from fees over the past few weeks.

While not reaching the peak observed around 8th May, its consistency sets this trend apart. The chart analysis reveals that miner revenue from fees has exceeded 20% three times in the current month.

As of this writing, the revenue from fees has dipped to approximately 8.5%. Despite this decline, it remained higher than observed in the preceding three months.

This indicates a substantial contribution of fees to miners’ revenue in recent months.

Read Bitcoin (BTC) Price Prediction 2023-24

BTC trend remains strong

As of the current assessment, the Bitcoin daily timeframe indicates it was holding steady within the $37,000 price range.

The chart showed a marginal increase of less than 1% following the previous session that saw a rise of over 1%. It continued to exhibit a strong trend as the week approached its conclusion.