Bitcoin: November might see 40% gains, but what next in the near term

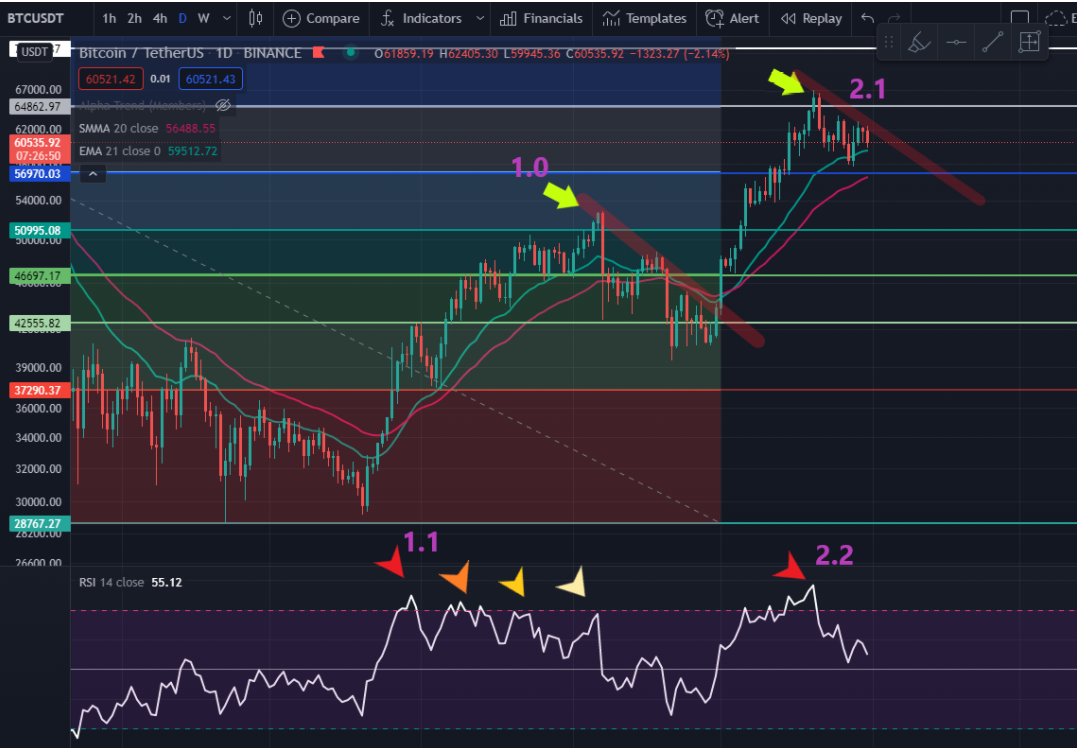

For a long time, Bitcoin’s price was attempting a move above the key $62,500 resistance level. However, BTC failed to gather strength as the larger price structure since 21 October moved sideways. At the time of writing, however, on the back of some recovery, the aforementioned levels had been breached, with BTC at $62,900.

Now, investors and traders are hyped up after a BTC hit an all-time high monthly close.

However, the FOMC meeting scheduled for 3 November has managed to keep market skepticism up. The last time the FOMC meeting took place, Bitcoin faced some choppy price action. For this reason, it can be anticipated that BTC might see more sideways action. Nonetheless, there are signs that could direct BTC’s momentum in the near future.

November gains on the way

In general, the month of November has been magnificent for Bitcoin. The king coin, on average, has registered more than 40% price gains over the years. However, at the beginning of November, investors are unclear about what may happen next. Ergo, they don’t want to risk accumulation before the FOMC meeting.

Despite the apprehension, it shouldn’t be forgotten that the larger narrative for Bitcoin remains bullish.

Notably, the stablecoin supply ratio has been on a downtrend-accumulation trajectory. Generally, a low trend in SSR value is usually associated with a potential bullish trend. The SSR is on the conditional uptrend line. Further, with a successful defense of the uptrend, the crazy use of stablecoins to buy BTC could finally begin.

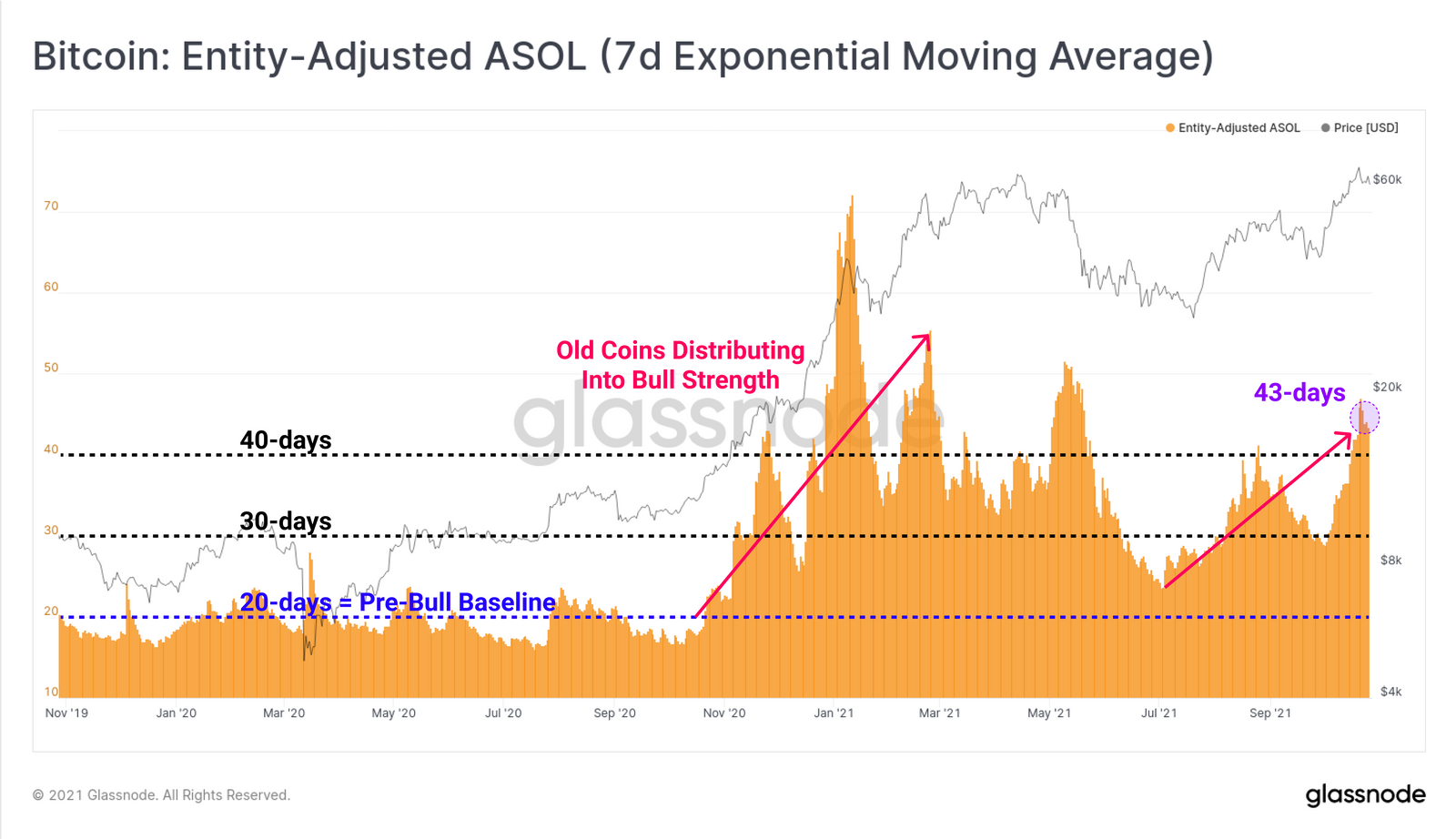

In order to corroborate the increased daily spent volume of coins older than 1 month, we can look at Average Spent Output Lifespan (ASOL).

The ASOL has seen an uptick over the 40-day average line. This typically aligns with price volatility in either direction. For now, a hike in old coin activity (ASOL) with low levels of profit-taking paints a larger bullish on-chain picture for Bitcoin.

More room for growth

While on-chain activity has been glimmering, there is still room for more growth. Looking at Bitcoin’s active addresses, the indicator suggested that the network seemed to be lagging behind the price.

In the attached chart, it looks like Bitcoin, at the current price high, is still nowhere as exhausted as it was in April. This also highlights massive strength on the on-chain side, presenting BTC’s readiness to rally in the upcoming weeks.

While all this was good, the possibility of a short-term correction can’t be discarded either. Looking at BTC’s weekly and daily RSI, the same showed signs of a potential overbought situation. This usually results in a price reversal.

Thus, while November looks promising, it’s better to be prepared for a short-term correction, despite recent recovery, as this might be a good buying opportunity.