Bitcoin roars past $47,000 to touch new ATH – When will $50k fall?

Bitcoin’s market has been open to volatility since the beginning of the year, with the digital asset surging substantially on the charts since. In what is yet another milestone for the cryptocurrency, BTC breached the much-anticipated $45,000, $46,000, and $47,000-marks a few hours ago, going on to touch a new ATH of over $47,000 on certain exchanges. In fact, on the back of the trading volume that accompanied the said surge, the cryptocurrency’s market cap also went past $800 billion.

Source: BTC/USD on TradingView

While corrections were already afoot at the time of writing, the cryptocurrency did climb by almost 10% during a 6 hour period.

Bitcoin’s latest price movements were triggered by Tesla’s announcement regarding its purchase of a whopping $1.5 billion in Bitcoin.

Tesla buys $1.5 billion U.S in Bitcoin according to SEC filings. Bitcoin jumps 6% to a record high. Source:CNBC

— mike eppel (@eppman) February 8, 2021

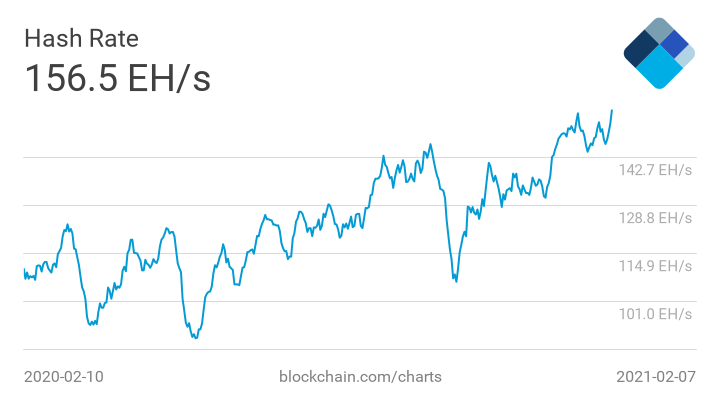

Along with these developments, network fundamentals have also confirmed the healthy state of the Bitcoin network. According to blockchain.com, the network hash rate hit 155 EH/s earlier in January, with the same maintaining a level above 150 since.

Source: Blockchain.com

Even though the hash rate was high, the network difficulty was high too. After the last difficulty adjustment on 23 January, the mining difficulty saw a 1% adjustment higher and was set to 21 trillion before the weekend. Even after the drop on 21 January when BTC briefly dipped to $30k, most ASIC miners were profiting at this level.

Nevertheless, the current difficulty is the highest seen in the last 12 years, indicating that it is tough for miners to mine a BTC block or even find a hash below the given level. However, as the hash rate is maintaining itself between 140EH/s and 165 EH/s, the difficulty might see smaller shifts rather than a drastic move.

With the price hitting new ATHs, such a small adjustment will help miners earn higher revenues. At the time of writing, miners’ revenue had hit $45.6 million, equivalent to what miners earned earlier in January when BTC was surging.

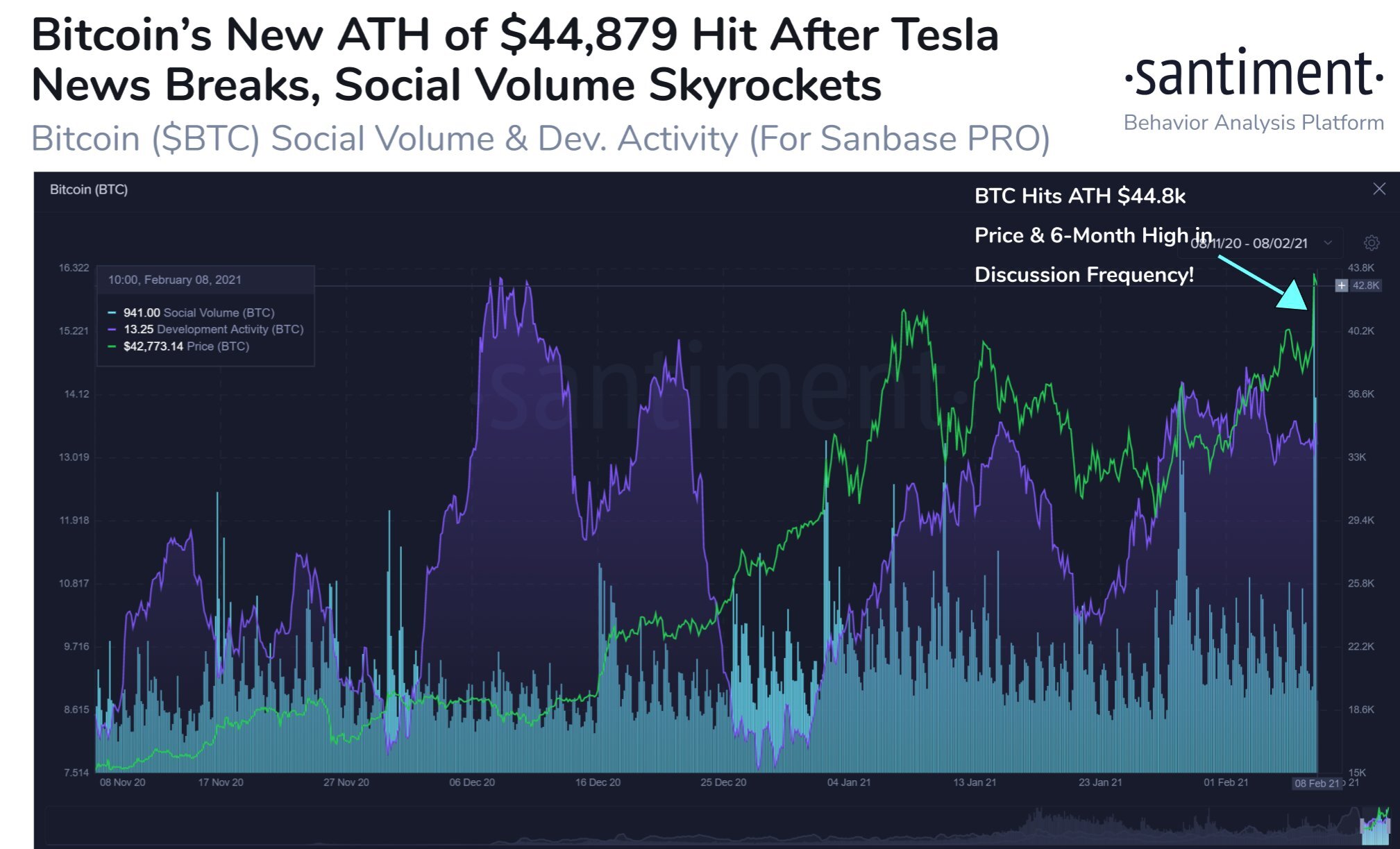

Bitcoin’s surge has been backed by other fundamental metrics as well, Consider this – While the cryptocurrency hit a new ATH within 4 hours of the Tesla announcement, hourly social volume on $BTC also hit a 6-month high at the same time.

Source: Santiment

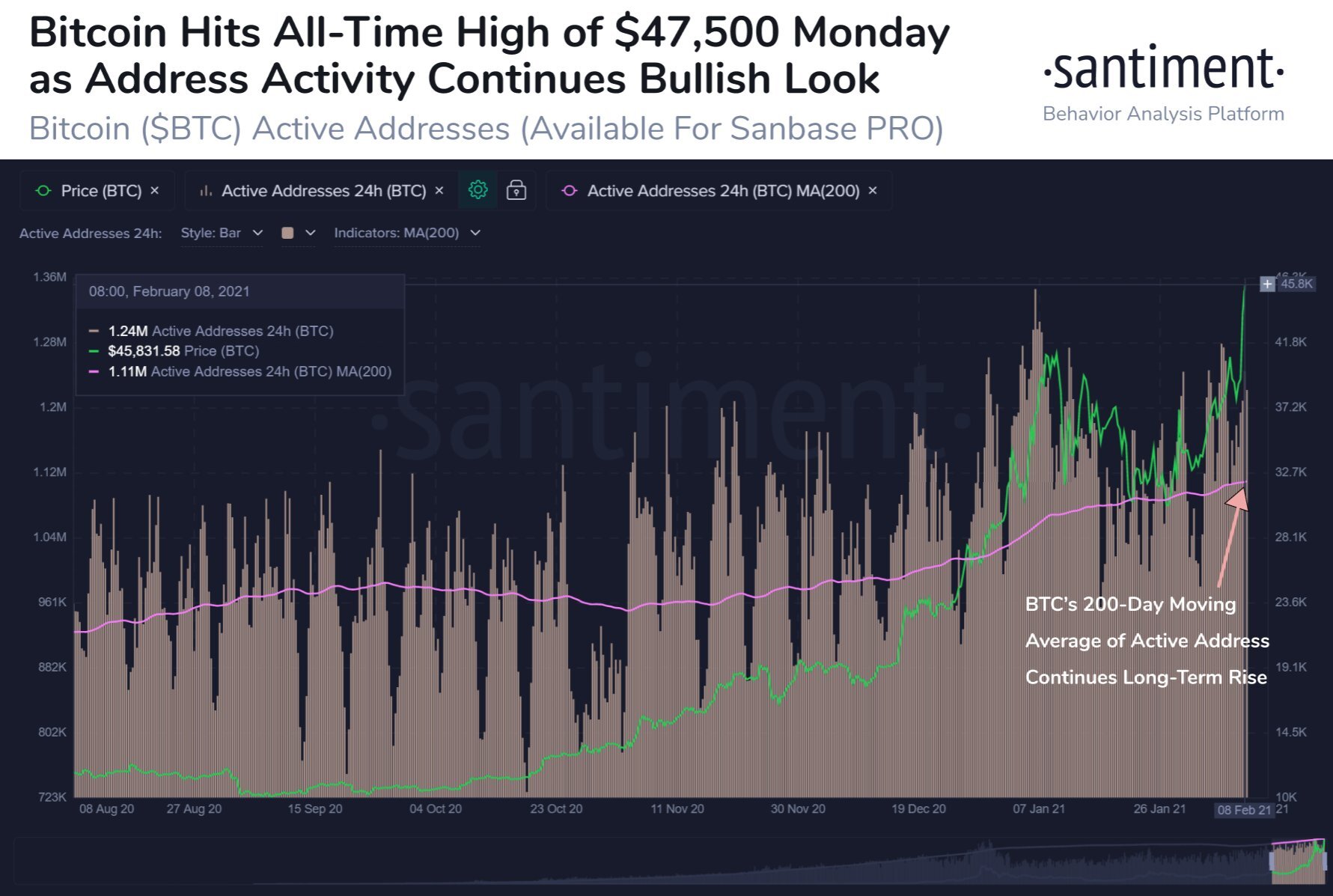

Finally, the 200-day moving average for active addresses on the Bitcoin network has also continued to rise on the charts, further supporting the aforementioned hike.

Source: Santiment

Focusing on just the progress of the digital asset Bitcoin, analysts have long believed that the bull run is not yet done. According to Dan Held, Growth Lead at Kraken, this run will be similar to the 2013 cycle, one which saw two bull runs with a bearish market in the middle. However, the bear in the current market may not last long and the drawdowns may not be similar to previous bull cycles.

In fact, the bears in the current market appear to have been temporary as we saw strong bullish sentiment flowing into the market and driving investment. Here, Elon Musk’s recent tweets and the latest Tesla purchase can be best characterized as the latter.

In light of the current bullishness and the capital flows into Bitcoin, it might just be a matter of time before the world’s largest cryptocurrency is priced at $50,000.

Hope everyone is ready for $50K #bitcoin

— Alex Krüger (@krugermacro) February 8, 2021