Bitcoin: The last dip to buy will come soon

Bitcoin‘s price dropped by approximately 25% after hitting a new high of $42,000 on 8 January. While the aforementioned price drop was contained as U.S markets opened, Bitcoin isn’t out of the woods yet, with many on-chain indicators suggesting that yet another drop might be on the cards.

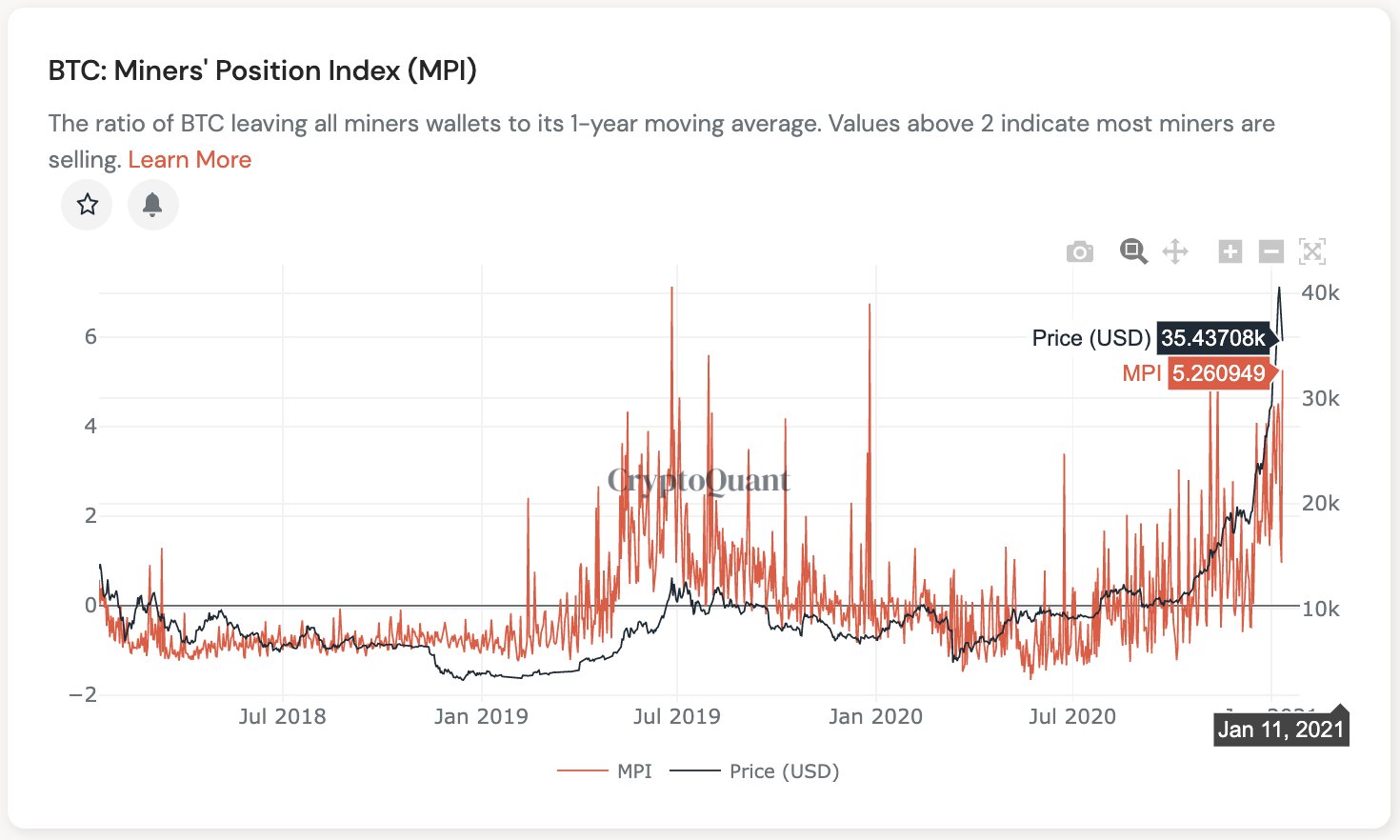

For instance, the Miners Position Index [MPI] is a metric that spikes when miners are selling their holdings. However, contrary to miner outflows, this metric is a ratio of miner outflows to its 1-year moving average, giving an analysis a more nuanced outlook.

Historically, an MPI value of over 2 has fueled a sell-off on the charts. Bitcoin’s crash from its ATH was due to the MPI’s spike to 4.07. In fact, at press time, this metric had hit 5.26 on the graph, pointing to a higher outflow of miners followed by a drop soon.

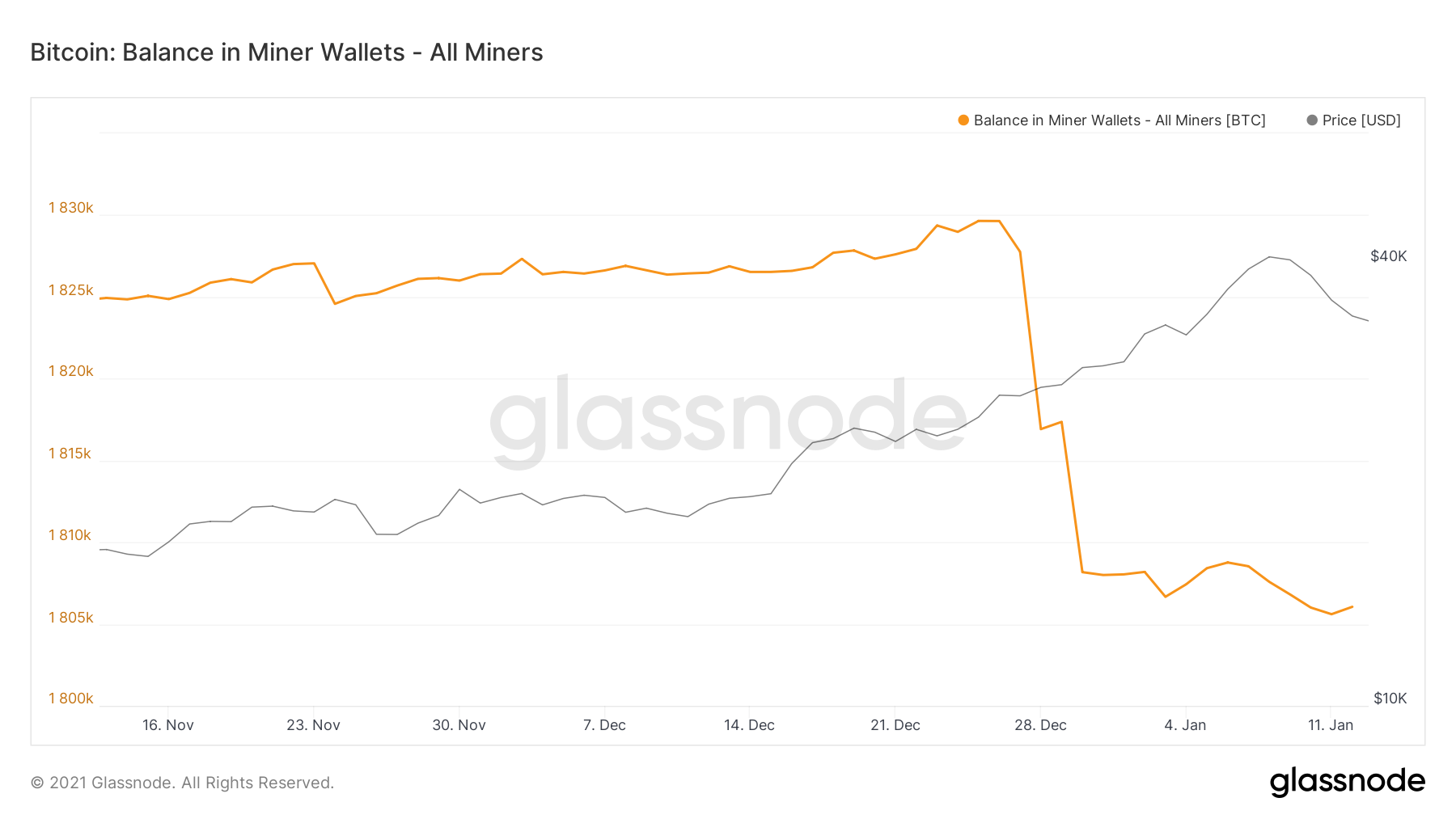

Further, Miner Reserves showed a relative fall in holdings, a finding that could suggest one of two things – Miners are holding or miners are selling their holdings.

This drop in miner reserves further supports the argument that a price drop is incoming. One can argue that CryptoQuant CEO Ki Young Ju said it best when he tweeted about the market’s bearish outlook,

“Miners are selling, no significant stablecoin inflows, no Coinbase outflows, and 15k BTC flowed into exchanges since yesterday. We might have second dumping.”

Where to?

With the exception of the latest drop on the charts, a correction seemed to be totally absent in the recent parabolic move. The yearly open at $29,000 seems like a good place for BTC to correct to. This would mean a drop of 12-15% from Bitcoin’s press time price.

The current outflow of miners could be more than enough to push the cryptocurrency’s price to its yearly open. However, there is always a chance for the sell-off to cascade due to FOMO, with BTC also likely to head down to as low as $27,000, a level which was the wick of the recent price crash seen on 4 January.

Either way, the two levels to keep an eye out for include $29,000 and $27,350.

![Hedera [HBAR] defies market trend - All you need to know about altcoin's 27% hike!](https://ambcrypto.com/wp-content/uploads/2025/03/Hedera-1-400x240.webp)