Bitcoin: This data clarifies whether investors should remain in fear or go all in

- Investors remain terrified of trading BTC despite a possible bullish breakout.

- Altcoins dominated the market in the first week of 2023; although on-chain signals protected a BTC market balance.

The antics of Bitcoin [BTC] over the last few months have been swindled in unpredictability, leading many investors torn between aping into “opportunities” or anticipating another nosedive. In light of all this, the Bitcoin fear and greed index still showed that there was still extreme fear in the market.

Bitcoin Fear and Greed Index is 26. Fear

Current price: $16,836 pic.twitter.com/cQQHquwj1a— Bitcoin Fear and Greed Index (@BitcoinFear) January 6, 2023

How many BTCs can you get for $1?

The hope to gain and the need to be careful

Off the back of dismay, CryptoQuant analyst Tomáš Hančar opined that BTC could switch to bullish conditions sooner than expected. Hančar, who published his analysis on the market data platform, cited the exchange depositing transactions hitting a four-year low as one of his reasons.

Situations like this usually align with the fear and greed index position of lack of trade consideration. Other than the deposits on the 30-day Moving Average (MA), the analyst pointed to the Bollinger Bands (BB).

Based on his analysis, the BB exhibited intense contraction, which has never been the case. Hence, this position could bring about a breakout and significant uptick.

While he solidly stood his bull ground, Hančar asked traders to be cautious of the long consolidation, which could affect the potential of a profitable breakout. He wrote,

“This can be a very profitable break out trade either way, but if you play these stop buy/stop sell “through the roof” or “through the floor” set ups after such a long consolidation, be sure to manage your risk properly.”

Altcoins’ dominance causing unease

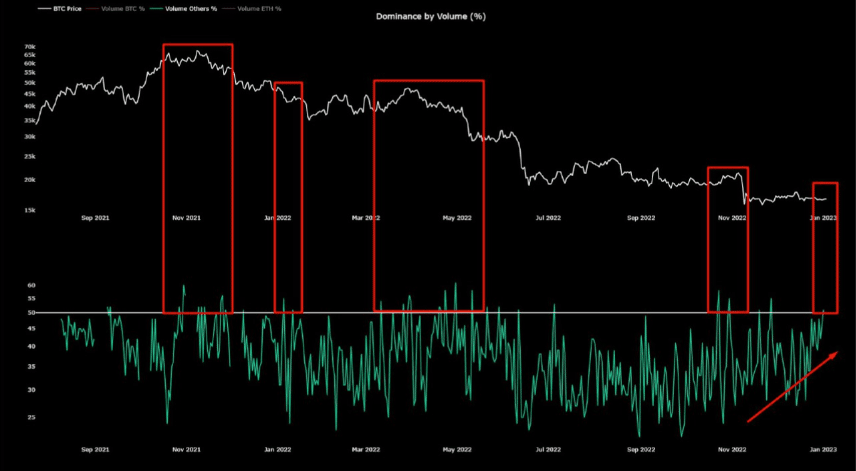

Another CryptoQuant publication was concerned for BTC as many altcoins outperformed it in the first few days of the year. According to Maartunn, a 50% altcoin dominance over BTC was unhealthy.

The circumstances meant traders were discontented with BTC while attending to other options. This placed risk on the BTC curve. Maartunn also compared the state to the end of the bull run in 2021 and the massive altcoin supremacy over BTC during the Ethereum [ETH] Merge.

A 0.02x potential value decrease if BTC hits Polygon’s market cap?

In the case where the dominance abounded, BTC could drop further below the $16,800 region. However, information from CoinMarketCap, at press time, showed that the altcoin surge had subdued. So, there might be no need for an exorbitant fall.

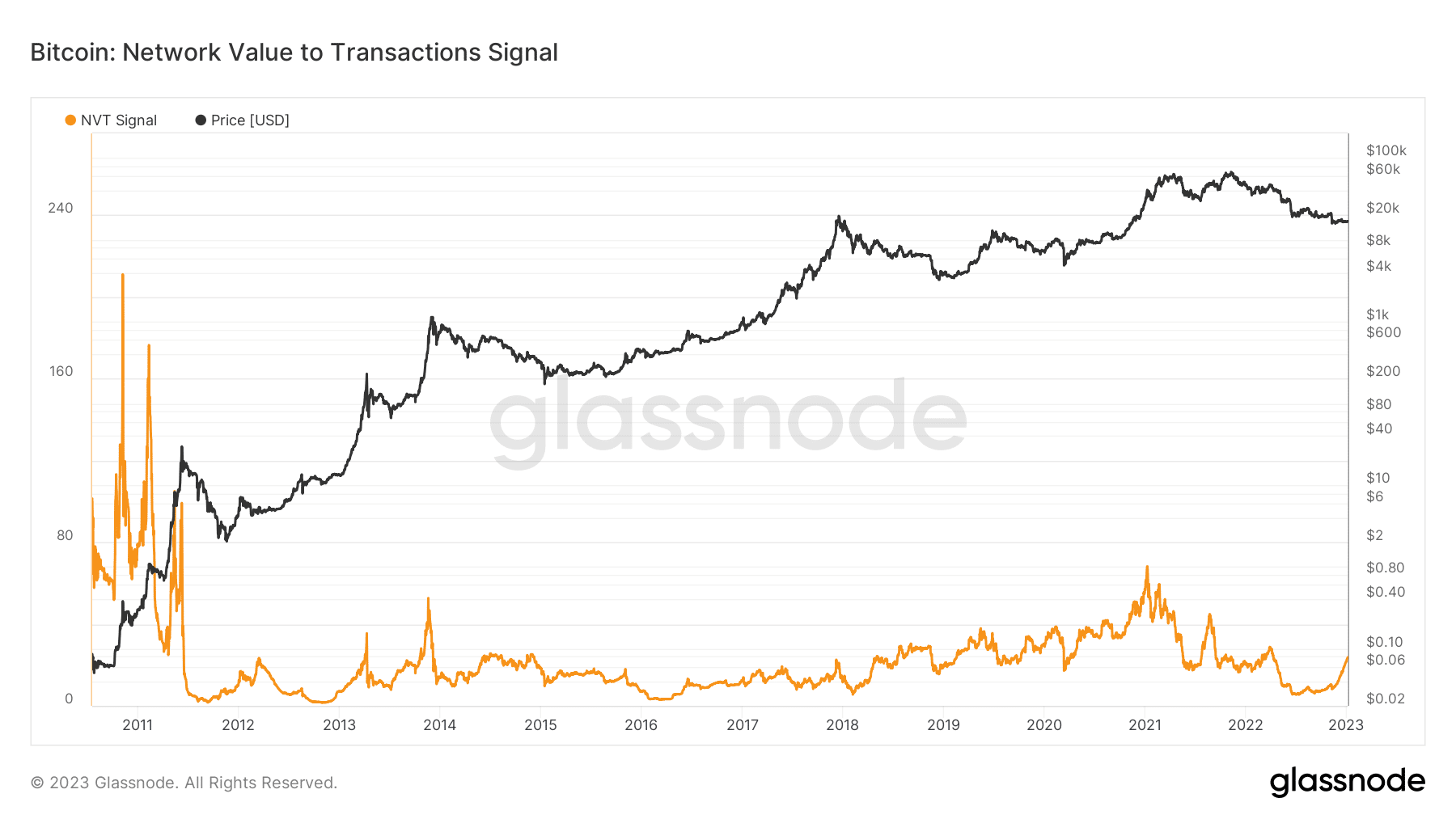

For the Network Value to Transaction (NVT) signal, Glassnode showed that it has slightly risen from its downfall in November 2022. This metric uses the 90-day moving average to assess how the market cap outpaces transaction volume.

At 18.96, the NVT signal was approaching equilibrium. This suggested some sort of market stability and a possible mid-phase of the bear market.