Bitcoin: This would be the best time to enter the derivatives market

Bitcoin investments always show some great figures when the prices are high. Spot trading keeps fluctuating to give us some new targets and expectations. But it is the derivatives market that shows us where investors stand when it comes to looking forward. And currently, the market paints a very interesting picture.

Bitcoin Futures and Options

With Bitcoin now above that crucial $42,000 breaker, it could be the right moment for investors to look into the derivatives market. Since this level had been strong resistance for a couple of months now, it made it difficult for BTC to breach it. As it did rise above it, investors’ confidence will rise as well and that is when we could see some strong figures on the Open Interest and Volumes. To reach the levels of April and May, this rally could kick-off based a momentum that is currently building up in the derivatives market.

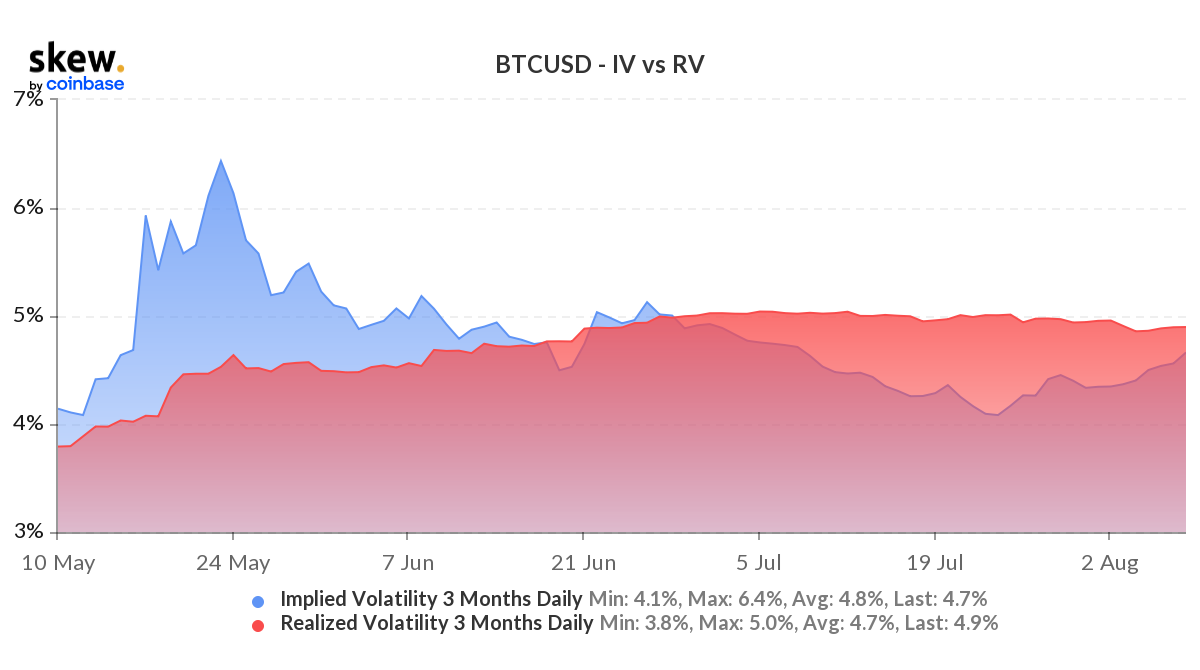

Firstly, the IV-RV ratio is currently at its lowest difference for a month now. Separated by only 0.1% it seems like IV could potentially supersede RV in the next few days. This would act as a pretty good sign for the market.

Bitcoin Implied Volatility vs Realized Volatility | Source: Skew – AMBCrypto

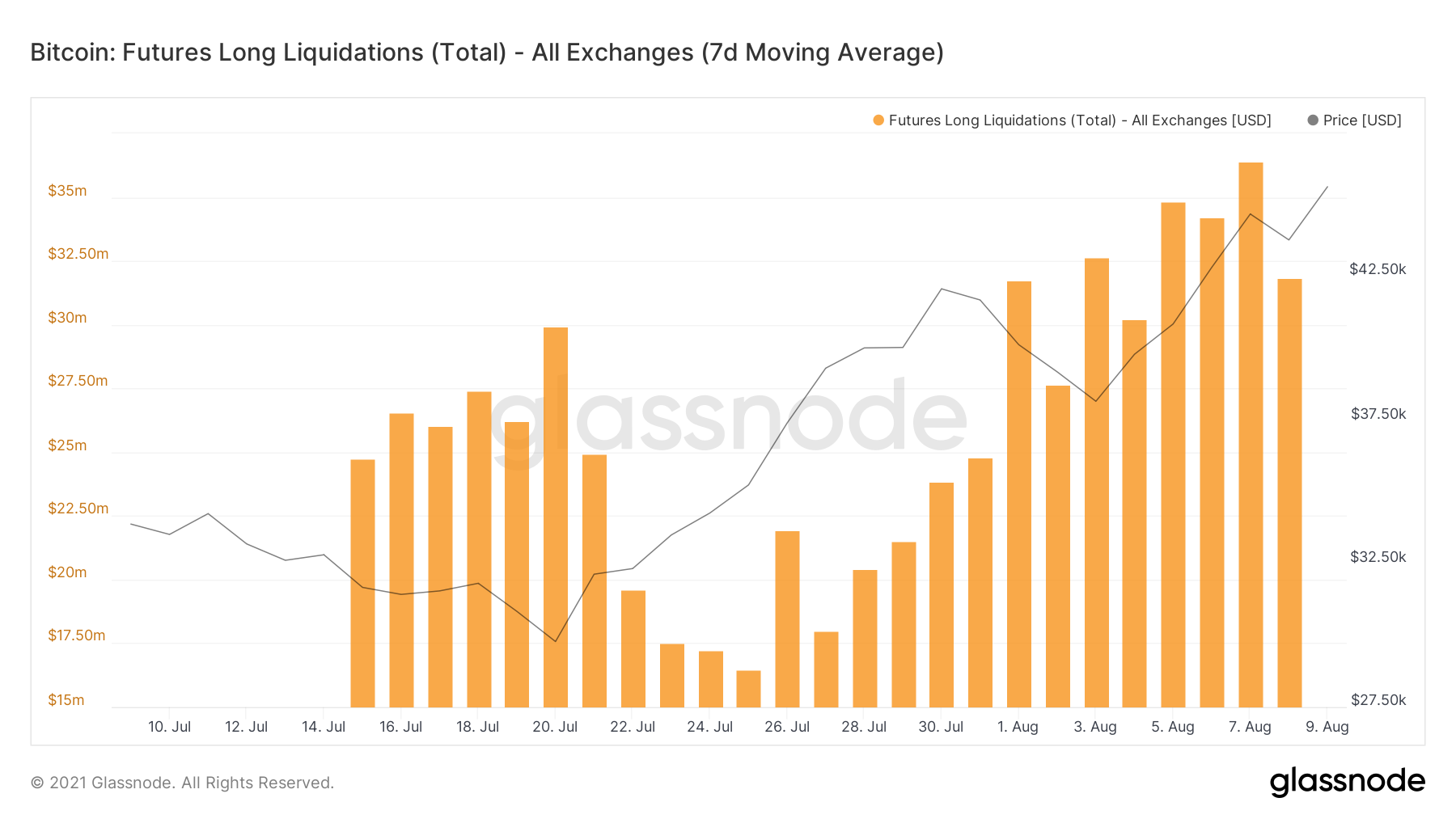

Secondly, going forward there’s a good chance that bullish investors might take long positions. At the moment, long liquidations are at $31 million, moving close to their recent high of $36 million. Short liquidations appear slightly weaker currently. Even though short liquidations amount to $33 million, they are still lower when compared to earlier volumes of $60 million.

Bitcoin Futures Long Liquidations | Source: Glassnode – AMBCrypto

What about the price going forward?

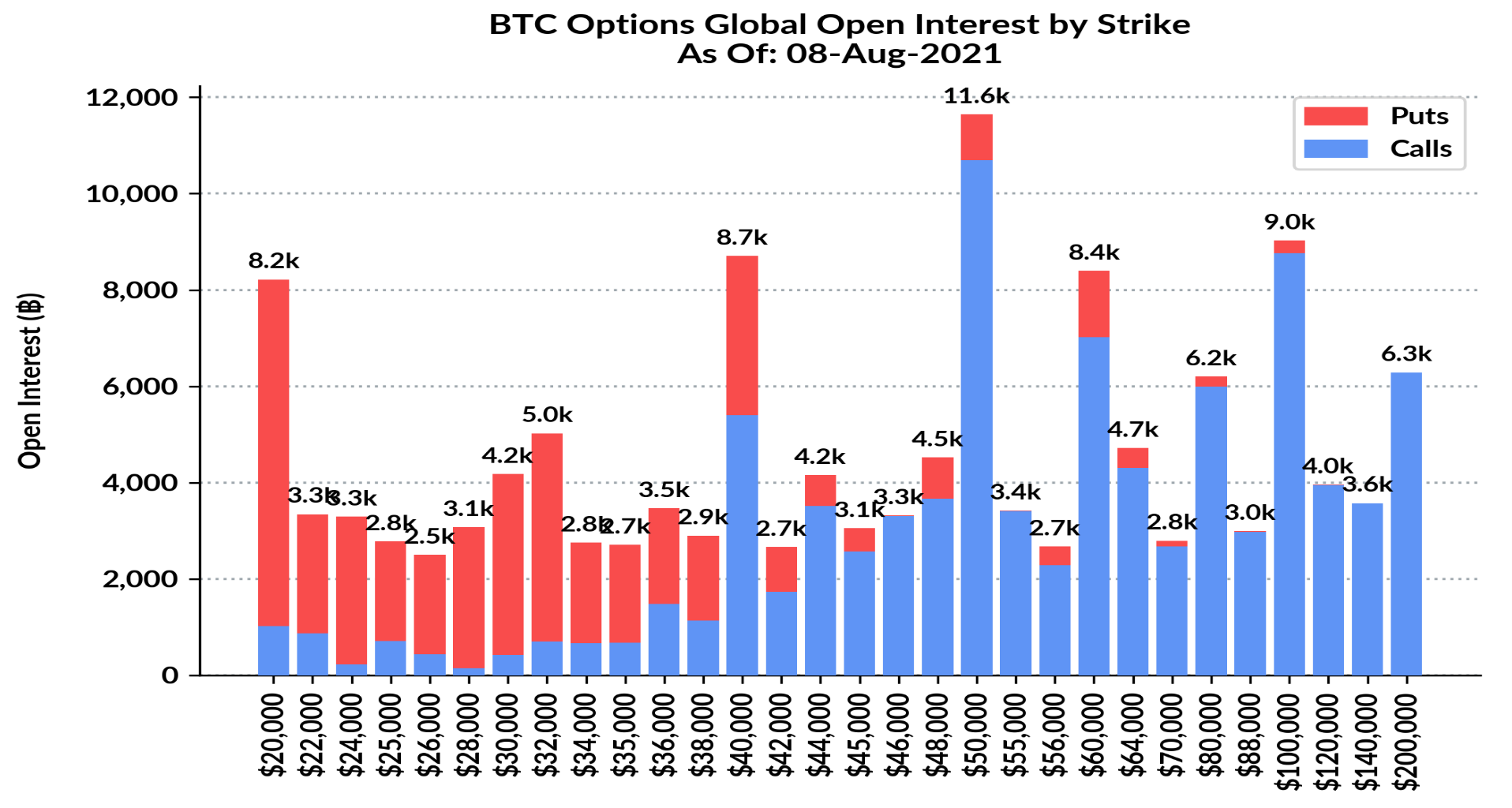

A price prediction during a changing market can never be accurate. But looking at what people want we could get an idea of where it could be headed. As the market is beginning a correction, Bitcoin appeared to have begun a correction phase. Looking at the hedging contracts, it becomes clear that there is a strong demand for a price fall. Puts are dominating the $36k-$38k region presently.

Bitcoin OI by strike shows hedging for a price fall | Source: Skew – AMBCrypto

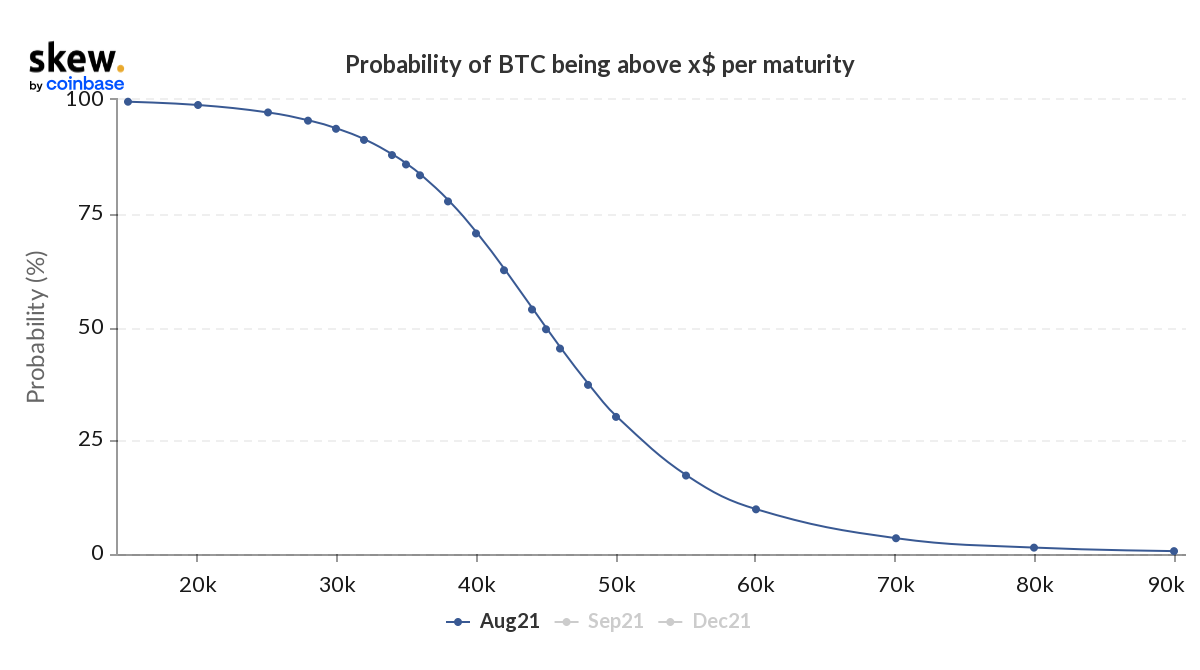

Additionally, a possibility of that is supported by the probability index which shows that there are 73% – 80% chances for the price to reach the aforementioned range.

Bitcoin probability index for $36-$38k | Source: Skew – AMBCrypto

If Bitcoin closes above $42,000 regularly over the next few weeks, the market could witness a rise in OI and Volumes and that would be the signal to enter the markets. As an investor whether you are bullish or bearish about Bitcoin, entering derivatives only then will be the right move.