Bitcoin: Why ‘restless’ traders have no reason to be so

High anticipation, some major consolidation, and many speculations about a bounce above $50k for Bitcoin have left the market hungry for some upward price action. After touching the $50k mark last week, BTC saw corrections of about 4.63% soon after. At press time too, the king coin was down by 1.5% on the daily charts.

Restless Traders

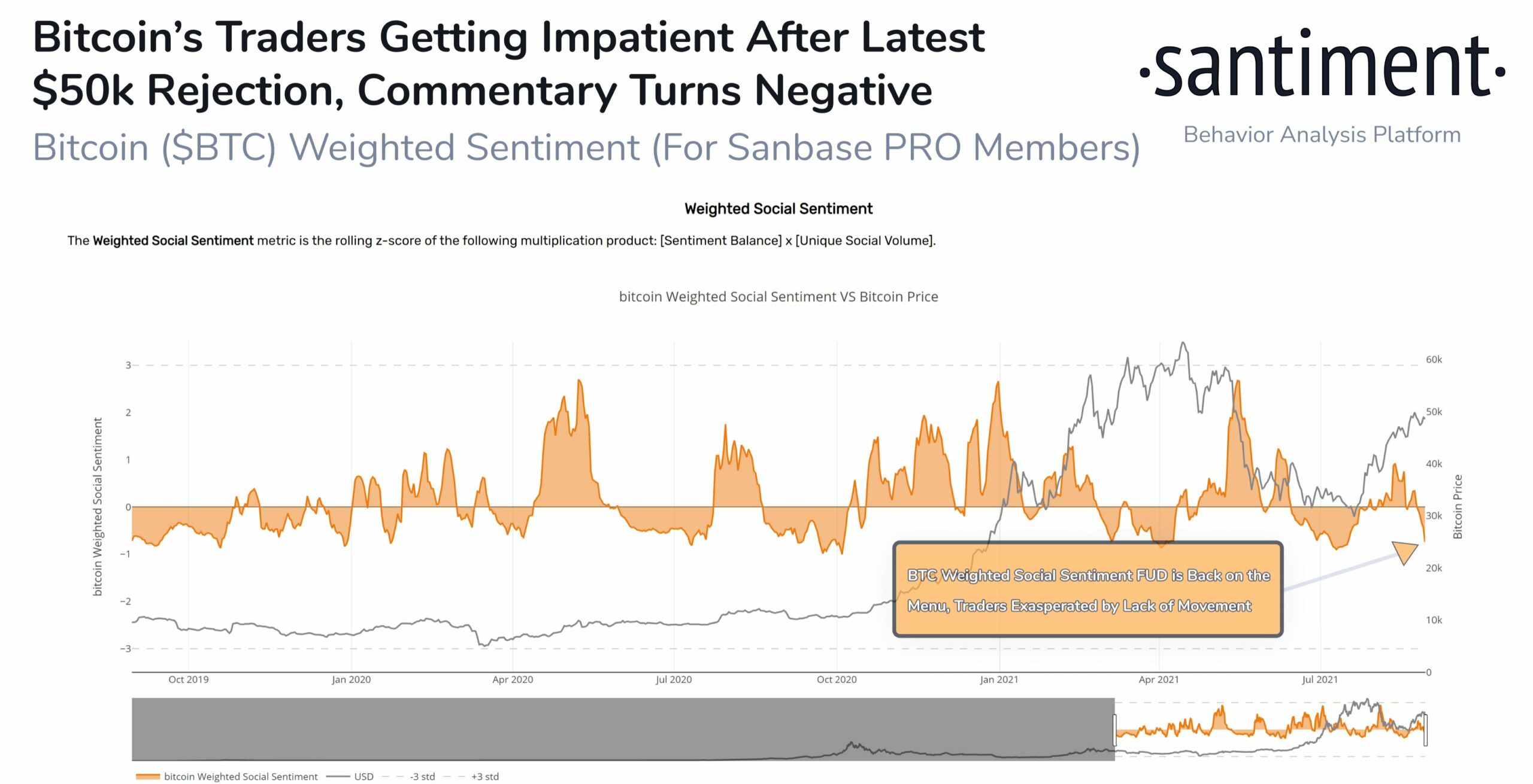

The consolidation following a 60% pump over the last month has left market participants craving for more. However, as BTC traded within the $47,250 and $49,300 range, social sentiment turned negative.

A recent Santiment post noted that the weighted social sentiment for BTC underlined that commentary around the king coin on social media had turned negative once again. Traders seemed to have gotten restless with BTC failing to hit the psychological price of $50k again.

Source: Santiment

However, this negative sentiment could be a secret recipe to the path above $50k. Notably, highly positive social sentiment coincides with dropping prices while a negative sentiment has been known to push prices up.

BTC looking towards a reversal?

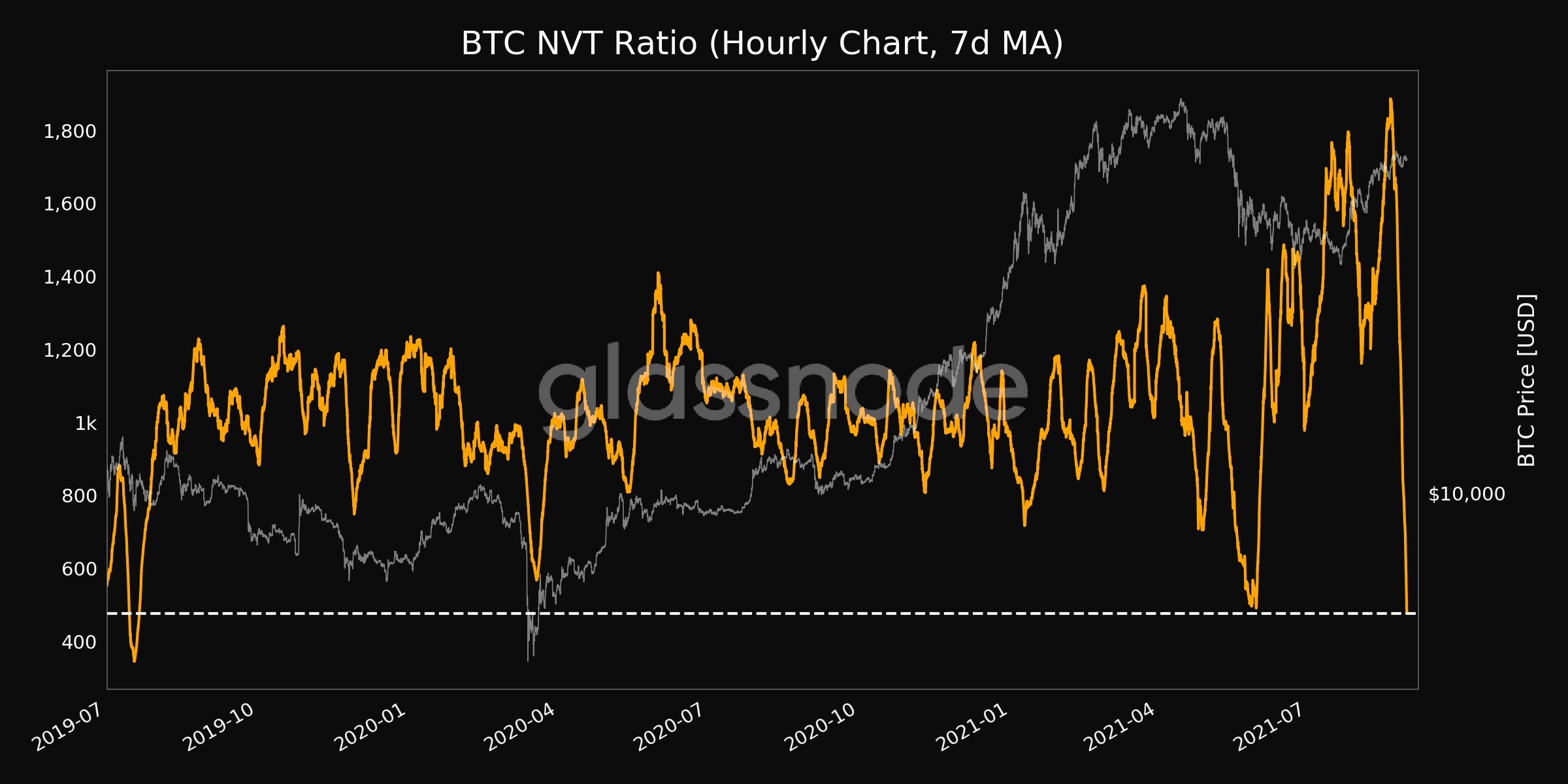

Bitcoin’s NVT ratio presented an interesting trend. BTC’s NVT Ratio (7d MA) touched a 2-year low of 476.495 on 29 August. Now, this could foreshadow a reversal and a massive bounce after the price’s week-long consolidation. What it also highlighted was that the network value wasn’t keeping up with greater usage of the network.

Source: Glassnode

Further, another striking metric was the average coin dormancy (7d MA) which reached a 2-year low of 6.295. As highlighted by Glassnode’s data, the previous 2-year low of 6.324 was observed back on 7 April 2020.

So, what do these numbers mean for Bitcoin?

The aforementioned trends are indicative of a state of growing long-term holder conviction as HODLers acquire younger coins off the market, or at the very least, stop spending their old coins.

However, in the light of consolidating prices, it could also mean that coins are being accumulated by smart money investors and transferred to cold storage where they begin to mature. This leads to sideways movement and relatively low dormancy as few old coins are spent. So, if the price ticks up again, this could be a major sign of an early bull cycle.

While Bitcoin’s consolidation has turned newer participants and traders restless, there are signs of a strong reversal from the same.