Bitcoin: You might be wrong about this

The various narratives of Bitcoin undergoing recovery are slowly becoming redundant. Since the beginning of July, positive on-chain data has surfaced multiple times, but the price has hardly acted in the same direction. A period of recovery will unfold regardless of metrics’ impact, but the market might need to buckle up for another correction as well.

Keeping pace with the above scenario, it is essential we keep the doors open for both directions since the market remains unpredictable as ever.

Bitcoin Whales – Collecting more on the way down?

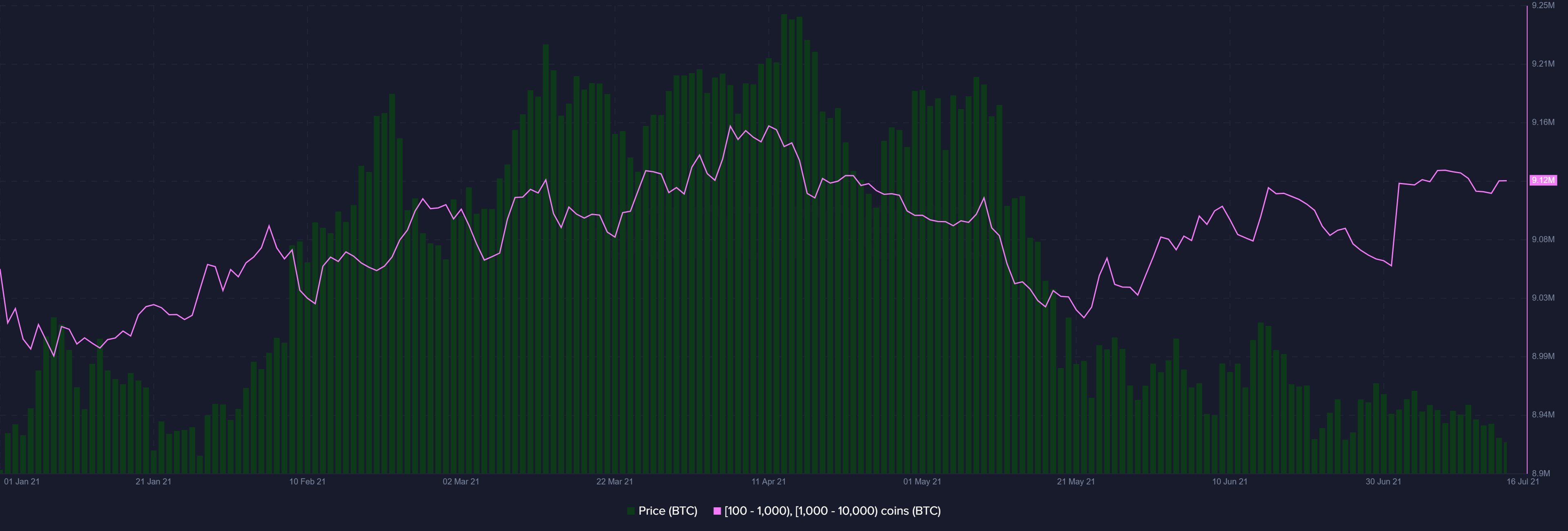

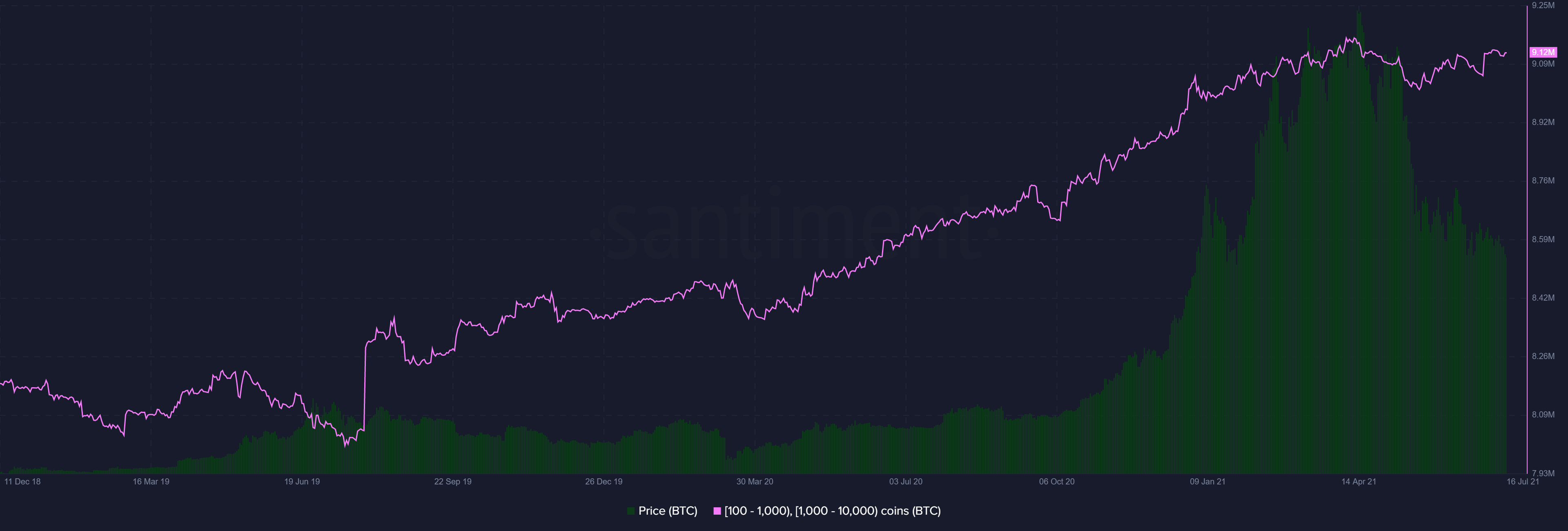

According to Santiment, the Bitcoin ‘millionaire’ tier of addresses holding between 100-10000 BTC has continued to climb despite price corrections. In fact, it was found that the cumulative holdings for these whale addresses increased by 100,000 BTC after 21 May 21.

Now, while on the surface it looks bullish when the chart is zoomed out, it is easier to draw another perspective from the same.

As identified, addresses holding between 100-10,000 BTC have risen historically irrespective of a bullish or bearish market. There have been minor dips in the middle, but these entities have continued to hodl over a much longer period which includes multiple market cycles as well.

Ergo, asserting that current addresses improving their accumulation can cause a price bounce is a little premature, maybe even wrong.

Exchange Whale Addresses – Are they causing more chaos?

While the narrative is still incredibly uncertain for both a bullish and bearish case, according to Ki-Young Ju, whales are consistently depositing BTC to exchange wallets.

Source: CryptoQuant

According to the CryptoQuant CEO, the exchange whale ratio 72MA has remained constantly above 85% for a while now, and historically, they have precipitated a bearish decline for the crypto-asset.

This can further be supported by the fact that large volume transactions have risen up over the past week, so a part of these could be based on the sell-side as well.

One of the major bullish support levels that were observed over the prevailing price decline was that since the 3rd of May, Bitcoin had positively closed its price position above $34,500. The last week (8th week), however, saw it close under, and the current week is now heading towards a close of under $34,500 as well.

From a momentum perspective, it is structurally bad because volumes would usually be cluttered in liquidity pools at both extremes. The further BTC’s value slides lower, value liquidity pools will have more capital inflows and the price will be dragged down even more.