Vienna-based fintech Bitpanda launches gold and silver trading for its 1 million users. The new product Bitpanda Metals allows users to securely and conveniently invest in gold and silver and benefit from ultra-low fees. The assets are 100% physically backed, fully insured and stored in a high-security vault in Switzerland.

- Users can buy gold and silver to diversify their portfolio

- Gold and silver are asset-backed by physical gold and silver bars

- Transparent and low fees

- Duty-free, 100% insured and safely stored in Switzerland

- Swap gold and silver with any digital asset on Bitpanda

- Set up savings plans for regular invests

Bitpanda, the Viennese fintech with around 1 million users and more than 100 employees is adding gold and silver as a new asset class to their trading platform. With Bitpanda Metals the company is introducing the user experience and convenience of buying digital assets to the world of precious metals trading.

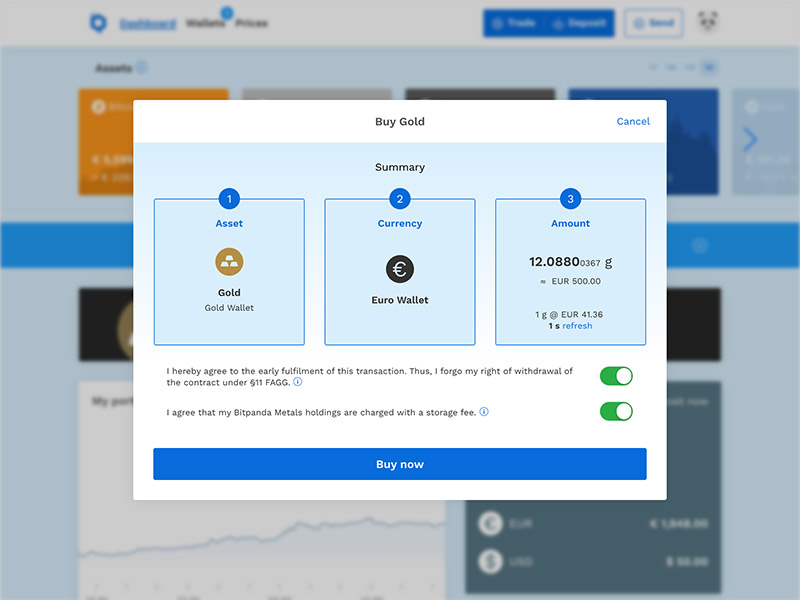

Bitpanda partnered with precious metals brokers pro aurum and philoro to securely store the physical underlying of the gold and silver tokens offered by Bitpanda. The physically-backed digitized gold and silver can be traded with the same ease as with other digital assets on the Bitpanda platform. Users can buy small amounts beginning from €1 using a wide variety of payment methods and pay in Euro, Swiss Franc, British Pound or US Dollar.

Gold can be bought for no fees no matter the amount (after the launch promo for a low fee of just 0,5%) and stored for a transparent and industry-wide unique storage fee of just 0,0125% per week. Gold and silver holdings are 100% insured. Users can sell anytime they see fit, and they are also able to instantly swap any amount of their gold or silver holdings with Bitcoin and any other available digital asset available on Bitpanda.

Bitpanda CEO Eric Demuth stated,

“Gold and silver stood the test of time as an asset class, and we are now bringing it to the 21st century. With high transparency, very low fees and the same convenience as for other assets on our platform, we are disrupting the gold trading business. With Bitpanda Metals we allow small investors to buy without having to pay horrendous fees. This is a real game changer.”

To celebrate the launch of Bitpanda Metals, Bitpanda charges no fees on buying gold until 15 June 2019, plus users receive 5 to €200 worth of digitized gold or silver when they invest at least €25 gold or silver on the Bitpanda platform.

About Bitpanda

Bitpanda is a fintech based in Vienna, Austria founded in 2014 by Eric Demuth, Paul Klanschek and Christian Trummer. The company is a firm believer in the innovative power of cryptocurrencies, digitized assets and blockchain technology. Bitpanda’s mission is to tear down the barriers to personal finance and bring traditional financial products to the 21st century.

Today, Bitpanda has around 1 million users and more than 100 team members. With a PSD2 payment service provider license, state-of-the-art security and streamlined user experience, Bitpanda have grown into a popular trading platform for newbies and experts alike. Users can currently trade Bitcoin, Ethereum, gold and over 20 other digital assets.