BTC could retest $19k mark, boosted by current U.S. inflation rates, details inside

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- BTC could retest the $19.00K mark.

- A break below 7-period EMA would invalidate the above bias.

The U.S. CPI data confirmed that the country’s inflation rate had cooled off to 6.5% at press time. Markets were upbeat afterward, and the S&P 500 Index (SPX) climbed to $3983.16 from the $3969.60 mark on the previous day.

Read Bitcoin’s [BTC] Price Prediction 2023-24

Similarly, Bitcoin [BTC] rallied, breaking above its mid-December high of $18.40K, but faced a bearish order block at $19,046. A retest of this level is likely if U.S. stock markets continued to rally, based on slightly favorable macroeconomics.

Is a retest of $19,046 likely?

Bitcoin’s RSI has been hovering around the overbought zone since 7 January on the three-hour chart. Similarly, the OBV rose as well. However, at press time, RSI was slightly flat but in the overbought zone while OBV dipped.

This showed that buying pressure was strong despite being relatively stagnant at press time. Therefore, BTC could attempt to break above $18,835 and retest the bearish order block at $19,046.

BTC could trade within the red zone ($18.72K – $19.14K) in the next few hours or days. In an extreme scenario, BTC could break above the range and target $19.70K if SPX (S&P 500 Index) broke above $4000.

Is your portfolio green? Check out the Bitcoin Profit Calculator

However, if bears force BTC into a downtrend, the seven-period (blue line) or 13-period EMA (orange line) could keep them in check. But such a move would invalidate the above bullish bias.

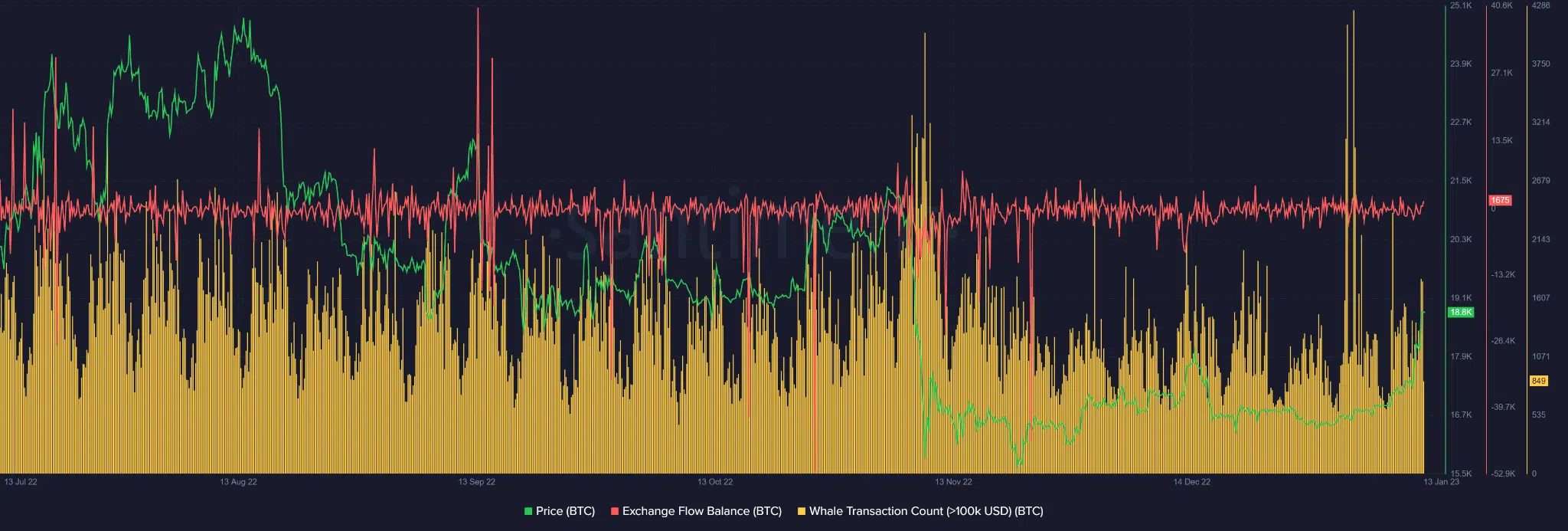

BTC’s open interest rose as the Exchange Flow Balance remained positive

BTC’s open interest rate has been increasing since 5 January. Therefore, more money flowed into the BTC futures market, which could further boost BTC prices.

As such, investors could expect a possible uptrend momentum that could boost BTC bulls to target $19.05K in the near term.

In addition, BTC saw an uptick in Whale Transaction Count with more than $100K and $1M between 7 January at the time of writing, which could have influenced the recent price surge.

Moreover, the Exchange Flow Balance remained positive at press time, showing more BTC flowed into exchanges than out. It could point to BTC demand due to its current bullish momentum.

Therefore, BTC could remain bullish and aim at $19.70K or $20K in the next few hours or days. But such an upswing could depend on SPX moving above $4000. So, investors should track S&P 500 Index (SPX) performance before making moves.