Can Bitcoin mining stocks do the trick if you’re looking for exposure

Over the past few years, the relative stigma of investing directly in Bitcoin has slowly diminished. Previously, direct exposure to Bitcoin was considered risky by most accredited investors. They worried that the volatility aspect of cryptocurrencies was well above their risk appetite.

However, now there are multiple ways to get into Bitcoin via investment vehicles such as GBTC or direct exposure through centralized or decentralized exchanges.

Another unconventional way of investing in Bitcoin could be through Bitcoin mining stocks. Their performances are largely dependent on the asset’s price, but there are certain advantages too.

Mining Stocks – The new way into Bitcoin?

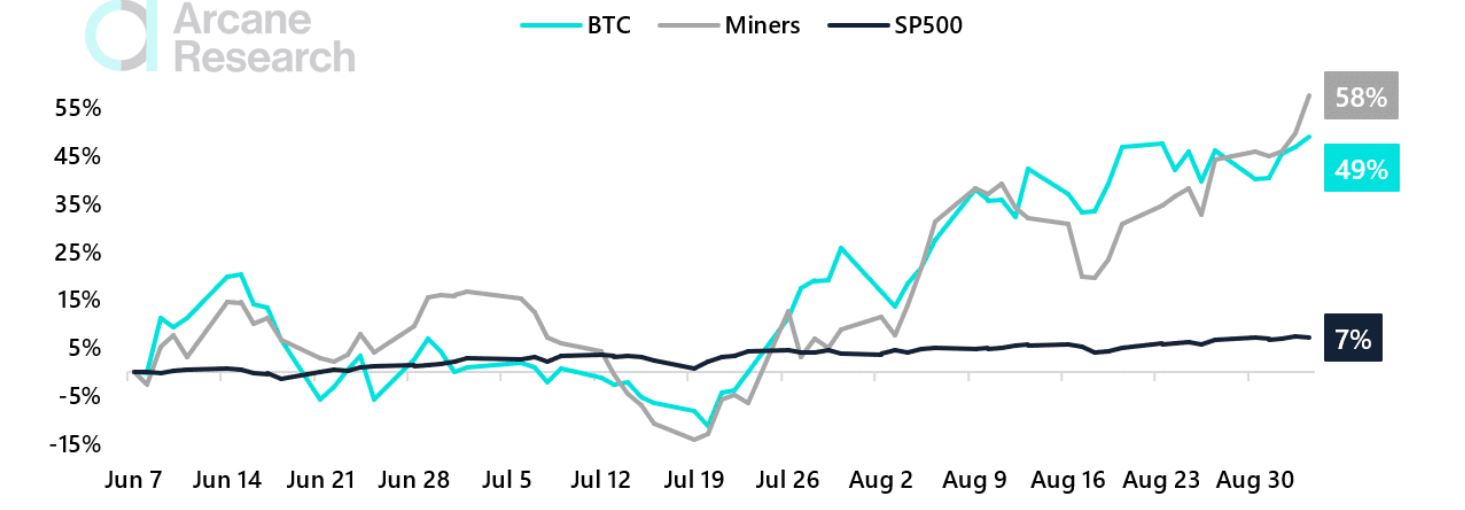

According to data, Bitcoin mining stocks have been outperforming Bitcoin since the beginning of 2020. Since then, these stocks have closely followed BTC’s price. Now, most popular mining companies have a market cap of over $500 million and they also share a high correlation with Bitcoin ranging between 0.7-0.9.

Some popular miners such as Marathon Riot, Hive, Hut 8 are highly correlated with Bitcoin. However, there is another key observation.

Historically, publicly traded miners such as Bitfarms Limited, Riot, and Hive have outperformed Bitcoin during bullish rallies. What’s more, they’ve registered lower losses during periods of breakdown, as illustrated by the chart.

According to Arcane Research,

“In Bitcoin bull markets, the block reward increases in value, while the hashrate lags the bitcoin price increase. Therefore, miners with existing plugged-in capacity enjoy periods of super-profits. In these super profit periods, they can produce bitcoin for a much lower cost than the market price.”

It is also important to note that these publicly traded mining companies also have their own Bitcoin treasuries.

At press time, Bitfarms Limited owned 1678 BTCs, Riot owned 1565 BTCs, and Hive had around 875 BTCs.

Is it a sound strategy?

From a point of asymmetric returns, the investment makes sense since these mining companies would be aligned with improving Bitcoin’s valuation. Since the mining ban in China, North American Bitcoin miners have taken the opportunity to instill a culture of competitive mining, and the mining space is expected to be more important as the Bitcoin supply drops.

Hence, investing in Bitcoin mining stocks isn’t exactly a bad way to attain exposure to Bitcoin. Then again, why wouldn’t one invest in Bitcoin altogether?