Can FTT follow Binance Coin’s lead to go parabolic

Exchange tokens have enjoyed a lucrative 2021. While Binance Coin and Uniswap have been the primary flagbearers of the asset category, there have been repeated discussions about FTX and its native token FTT being part of the big boys’ table.

In terms of market cap, BNB and UNI remain above the rest. However, as far as growth is concerned, FTT might be following a similar, tried, and tested protocol. One which is likely to guarantee success on paper.

Now the question is – Will the aforementioned success finally unfold in the market?

FTT – The story so far

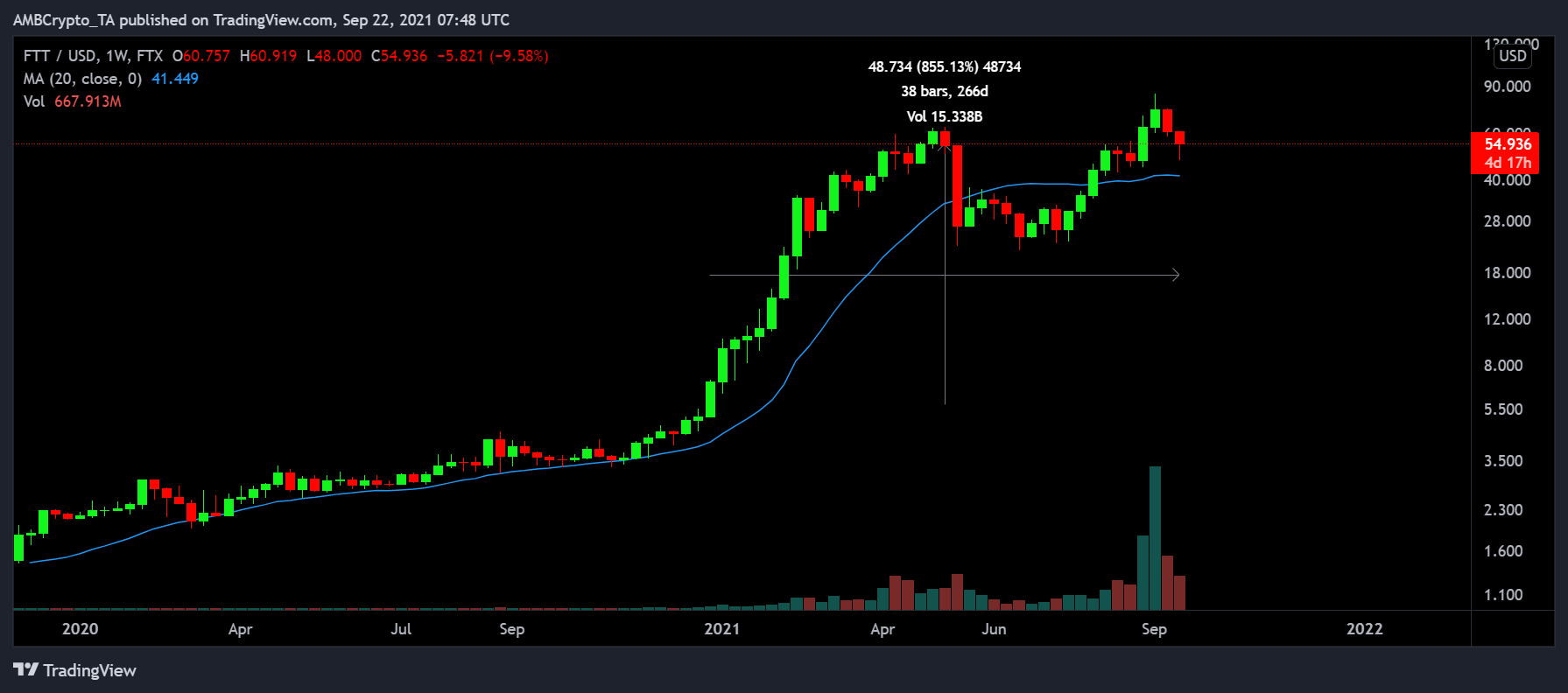

Like most assets in 2021, FTT has also surged this year. In fact, it has been one of the top-performing assets across the market. Since the beginning of January, FTT has risen by 885% on the charts. However, one key metric highlighting a major ongoing development is the aggressive trading volume over the past week.

Well above any average registered beforehand in 2021, activity is fairly evident for FTT token right now.

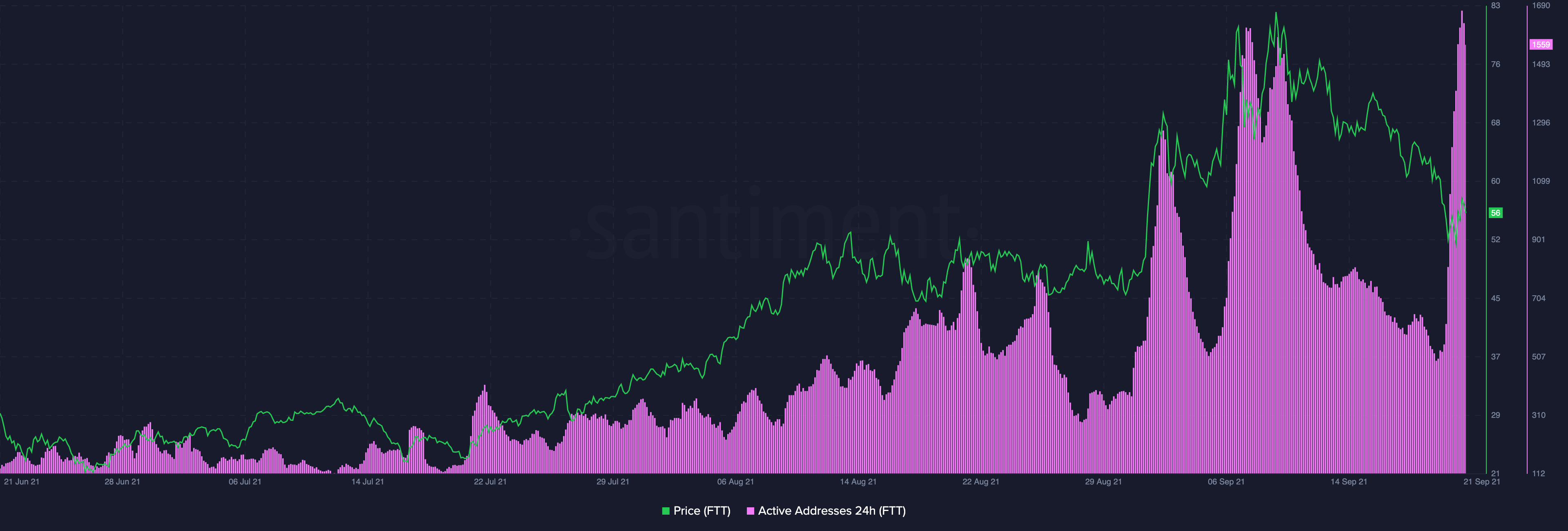

According to Santiment, on-chain activity also remains outstanding for the token at press time.

Aligned with rising trading volumes, FTT’s active addresses also hit an all-time high on the charts. Additionally, whale balances have been at ATH levels too.

Now, according to the aforementioned report, while there has been a bullish divergence, with the collective market appearing bearish, immediate recovery may or may not happen.

That being said, investors might be looking at long-term returns with FTT, with respect to some recent developments.

Burn it like Binance?

Popular exchange FTX recently announced the expansion of its platform through two subsidiaries in Gibraltar and the Bahamas. Its subsidiary, FTX digital markets, is now recognized as a digital asset business under the Securities Commission of the Bahamas. While this might be positive press for the exchange, the main reason why FTT can be expected to rise irrespective of future trends is its burn protocol.

The exchange has a fixed liquid supply of 350 million tokens, and it is expected to continue burning tokens until the circulating supply reduces by half. When compared to BNB, it sounds pretty similar. Especially since BNB’s quarterly has the same objective of reducing circulating supply till it is reduced by 50%.

And, we have all witnessed BNB’s explosive growth over the past 1 year.

While FTX burns 33% of the fees generated, its burning protocol takes place bi-weekly, rather than quarterly like Binance. FTX’s burning protocol has allowed the token’s inflation rate to remain at 1.82%, which is extremely impressive. Just like Binance, FTX may be here to stay as well.

Hence, it is quite possible that FTT follows BNB’s success story and commences on a parabolic trajectory in the future.