Can MATIC’s recent pump help it achieve new highs in November?

The month of October was quite exciting for the Polygon [MATIC] ecosystem as several developments and integrations took place.

Beginning with the launch of Polygon’s new zk-EVM public testnet, which is a layer 2 construction on top of Ethereum that solves its scalability through mass transfer processing rolled into a single transaction, to several integrations, such as the one with SuperLayer.

Here’s AMBCrypto’s Price Prediction for Polygon [MATIC] for 2023-24

What Happened to the @0xPolygon Ecosystem in October ?

Let's take a look at the highlights of this month's events ? pic.twitter.com/OHIpcSQ3RT

— Polygon Daily ? (@PolygonDaily) November 2, 2022

Moreover, last month, Polygon also outperformed Ethereum by a large margin in terms of the number of new unique addresses.

According to the statistics, Polygon’s number of unique addresses in October crossed 13 million, which looked pretty promising for the network.

The Growth of the Number of Unique Addresses in October 2022 ??@ethereum X @BNBCHAIN X @0xPolygon #Polygon +13.2M#BNBChain +14.8M#Ethereum +6.8M pic.twitter.com/IufuaTmUis

— Polygon Daily ? (@PolygonDaily) November 2, 2022

These developments hinted that this new month would also be in MATIC’s favor. Incidentally, things were turning out to be true as Polygon registered a massive 10% growth in the last 24 hours.

CoinMarketCap’s data revealed that at press time, MATIC was trading at $0.9575 with a market capitalization of more than $8.3 billion.

Trend reversal soon?

The recent pump of MATIC’s price sparked excitement among investors as they expected higher returns in the coming days. However, a look at MATIC’s on-chain metrics suggested otherwise.

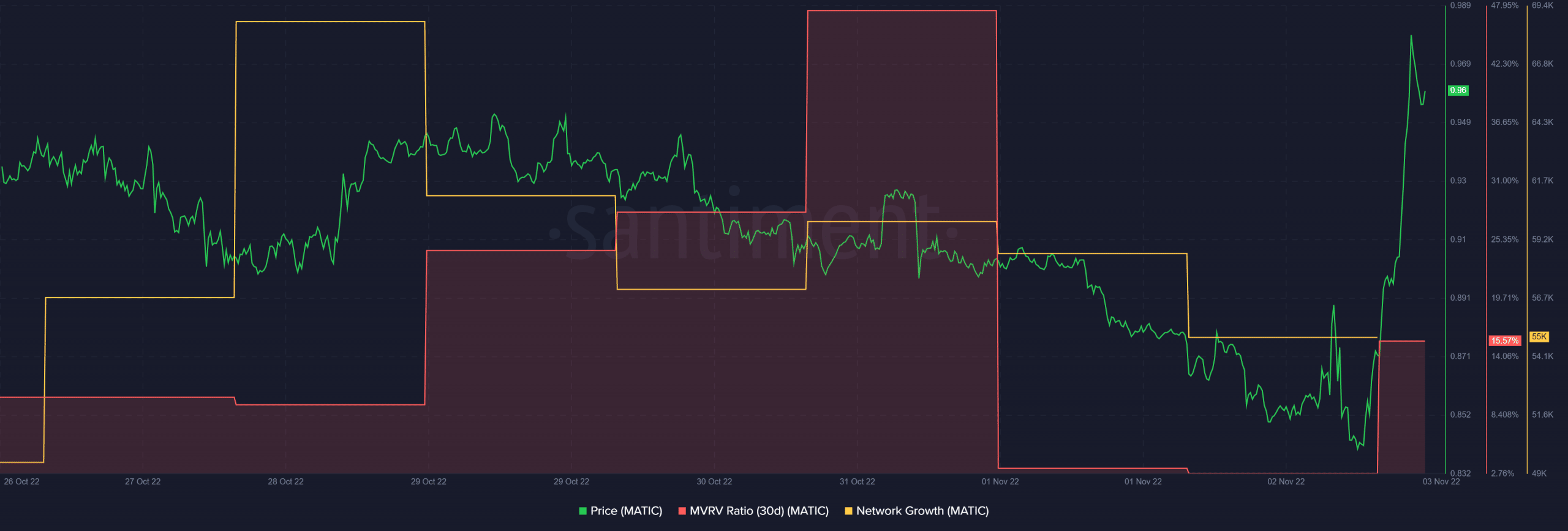

MATIC’s MVRV Ratio took a downward path after registering a spike last week, which is a bearish signal suggesting a price plummet. MATIC’s network growth also followed a similar route and registered a decline.

As per CryptoQuant’s data, MATIC’s exchange reserves were rising, which is yet another red flag for the token as it indicated higher selling pressure.

Nonetheless, a few things were also working in MATIC’s favor, which provided much-needed relief. For instance, at press time, MATIC’s active addresses and the number of transactions went up compared to 2 November.

In fact, MATIC was also quite popular in the crypto community, at the time of writing. Its social dominance spiked recently. Another piece of good news for MATIC came in as it recently flipped MATH to become the most traded token among the top 100 Ethereum whales.

This development suggested that the whales had much confidence and trust in MATIC.

? JUST IN: $MATIC @0xPolygon flipped $MATH for MOST TRADED token among top 100 #ETH whales

Check the top 100 whales here: https://t.co/N5qqsCAH8j

(and hodl $BBW to see data for the top 5000!)#MATIC #MATH #whalestats #babywhale #BBW pic.twitter.com/GpSgE7clNZ

— WhaleStats (tracking crypto whales) (@WhaleStats) November 3, 2022