Can whales finally sustain a Bitcoin rally beyond $50k

Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be taken as investment advice

Even though the Bitcoin ship may have steadied of late, its market has been positioning itself for the next big swing. A descending channel, the daily 200-SMA (green), and EMA Ribbons can be expected to play out in favor of the buyers. Additionally, an increase in Whale activity suggested renewed confidence in the BTC market, possibly laying the foundation for an incoming rally.

At the time of writing, BTC was being traded at $47,223, up by 0.55% over the last 24 hours.

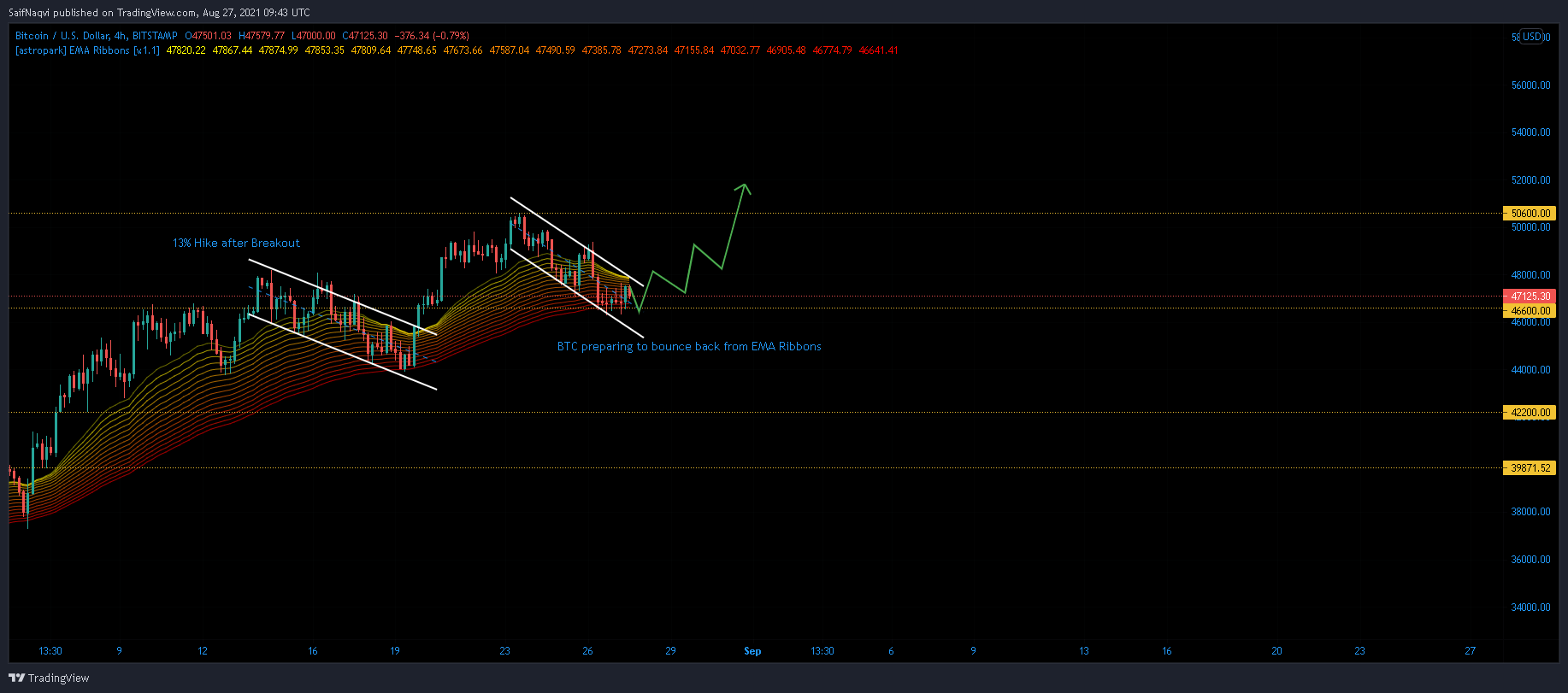

Bitcoin 4-hour Chart

Source: BTC/USD, TradingView

Descending channels are quite common on BTC’s 4-hour chart. Since August, BTC has formed four of these patterns and witnessed a price hike on each occasion. Combined with the EMA Ribbons, the channels can be used to identify critical price points that trigger a swing to the upside. At press time, BTC was in a similar situation, with the crypto trading close to the lower end of these Moving Averages.

Bitcoin seemed to be very close to its 200-SMA on the daily chart – Something that can be expected to inject a fresh round of buying pressure. In case of a reversal, expect BTC to comfortably climb above 23 August’s swing high of $56,600. Levels such as $60,000 and $64,000 would be targeted next. To negate such an outcome, sellers would need to target a close below $44,000.

Reasoning

Not only did BTC trade at an important price area, but so did its RSI. The RSI bounced back from the support around 40 – Something that led to a 12% price surge when BTC formed its previous descending channel.

According to the MACD, some buying pressure had already crept into the market. The histogram noted receding downwards pressure and geared for a bullish crossover. While the aforementioned signals seemed to be certainly positive, it is important to note that these indicators still traded below their respective half-lines.

Conclusion

Bitcoin can be expected to break north of its descending channel and trigger another market rally, ideally above $50,600. Whales have formed the building blocks for such a move and it is only a matter of time before traders jump into the mix.

While the market is still susceptible to another dip towards $46,000, the same would be an ideal buy entry for traders.