Cardano can surge to $5, but these conditions stand in its way

Looking back at 22 July, ADA was trading at $1.1 at the time. On 22 August, however, Cardano registered a new ATH of $2.65. With ADA oscillating around $2.5 at press time, the third-ranked altcoin was bullish on the one-day, one-hour, and one-week charts.

It can actually be argued that ADA is one of the few cryptocurrencies to have overturned the effects of the 19 May crash. All 100% holders were making money, at press time, which is a rare phenomenon. So, are these signs of the times that ADA is an unmatched investment? And, is this move close to $3 a sign that ADA might end up near $5 soon?

High development and higher euphoria

The upcoming Alonzo update has fueled social sentiment as well as the crypto’s price performance. The actively developing Cardano ecosystem and its development activity contributors have a lead role to play in the asset’s rally.

Cardano’s development activity and development activity contributors have maintained decent levels, irrespective of the price dropping or pumping. This acts as the backbone of its ecosystem. It is also one thing that a lot of alts miss out on and it ends up weakening their credibility on the development front. This usually has a corresponding effect on the price too.

Apart from that, another thing that has been aiding Cardano rallies is the hyped social sentiment. Notably, social mentions of both Cardano and ADA hashtags have absolutely exploded with the alt’s new all-time high of $2.65. According to a tweet by Santiment,

“The crowd & its euphoric behavior at this level will have a major hand in whether prices continue toward $3.00 & beyond.”

It will also have a major hand in whether the price continues towards $5.00 too.

Why it’s worth Hodling Cardano

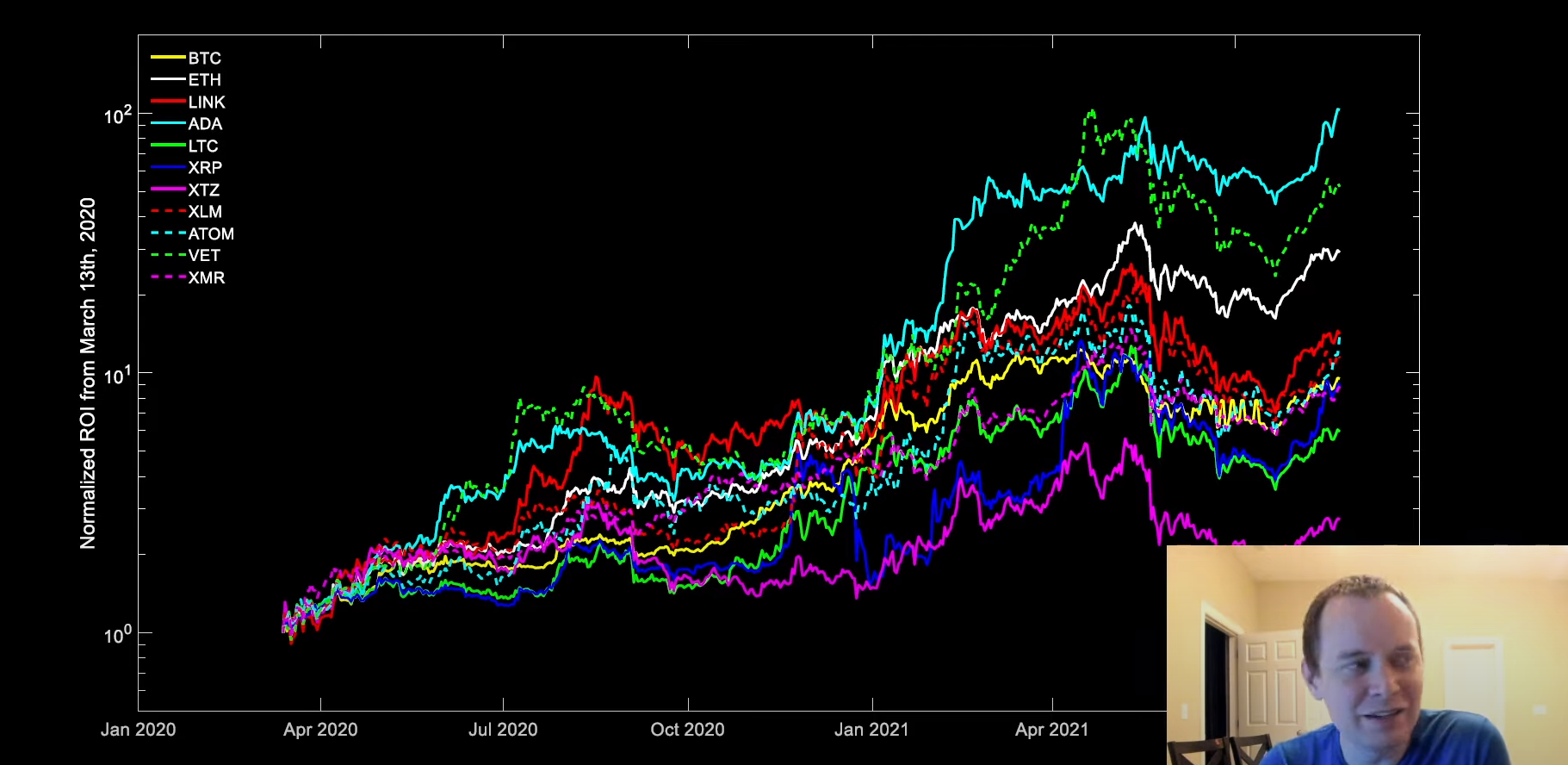

When comparing the ROIs of the top alts v. Bitcoin, it is notable that Cardano has consistently been either the top performer or one of the top performers. At this point, Cardano seems to be registering modest returns of over 100x from its recent bottom. Furthermore, as highlighted by analyst Benjamin Cowen, if Bitcoin stays above the 20week SMA (it was well above that at press time) in the days to come, ADA will continue to perform well.

Source: Benjamin Cowen

As cruisers (mid-long term holders) form a majority of ADA holders, this section of investors has been playing a big part in Cardano’s price growth. At the time of writing, 72.85% of ADA hodlers were cruisers i.e. they have a holding period of 1 to 12 months.

Additionally, both exchange and derivative signals flashed bullish signs as the bid-ask volume imbalance had a reading of 2.88%. Futures market momentum turned bullish too.

Don’t miss this caveat

Keeping everything aside, it can’t be ignored that ADA too has bled pretty bad in the past. In fact, if we compare it with the 2017-2018 peak, Bitcoin was doing better, at press time, because Bitcoin was more than 2x since its 2017 peak. What’s more, ADA has shown a propensity to depreciate whenever the king coin has. Any major corrections could therefore prove costly.

Thus, while the question of ADA hitting $5 is credible, it’s imperative to prepare well for minor dips on the way.