Cardano: Here’s how traders are ‘dealing’ with ADA after a bear trap

- Participants in the derivatives market remain long on ADA.

- The token price decreased as the short-term outlook calls for consolidation.

As Cardano [ADA] looks to end its overall monthly performance on a positive note, traders remain enthusiastic about the token. Well, the reason for this perception is not one that needs a lot of convincing.

For a token that wrestles with notable upticks, ADA had its bizarre moment in March, outperforming top-ranking cryptocurrencies including Bitcoin [BTC].

Read Cardano’s [ADA] Price Prediction 2023-2024

This uptrend helped the Market Value to Realized Value Ratio (MVRV) ratio to exit the negative region where it resided at the beginning of the month. The MVRV ratio shows the relationship between the current price of an asset and the value at which it was acquired.

Gains and the quest for more

At press time, the metric was 6.017% according to Santiment. This indicates that the average token acquired when March began up until the time of writing was in profit. Consequently, this price action seems to have also driven traders’ resolve.

As shown above, the ADA funding rate was 0.01%. And a look at the data revealed that it had remained like that for quite a while. The funding rate acts as the force that drives perpetual contract prices to converge with the price of the underlying asset.Now, since the token’s funding rate was positive, it implied that long-position traders were dominant, and were willing to pay short traders. Hence, indicating bullish sentiment.

Furthermore, it was not just a case of open long positions. But the Open Interest (OI) centered around ADA was extremely high. At the time of writing, the OI on several exchanges was all in green.

This suggests that there was massive strength behind the ADA price trend. And also, a lot of market participants had an ADA open contract.

ADA’s sideway trend could be next

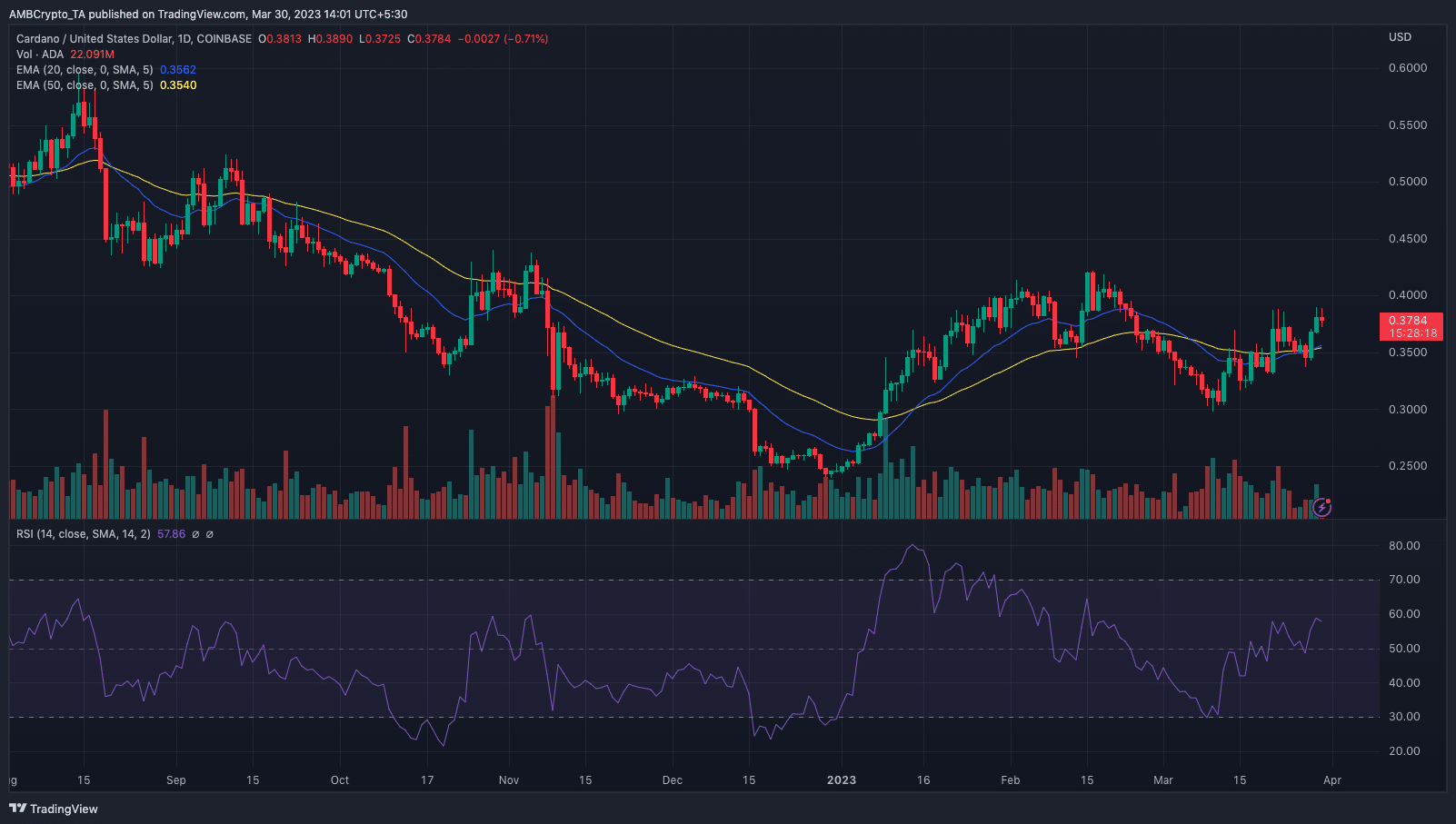

On the technical side, ADA seemed to have maintained a solid buying momentum, based on the Relative Strength Index (RSI).

At press time, the indicator’s value was 58.04. Such a position exudes favor for the bulls. Except it hits an RSI value of 70, the ADA price shouldn’t succumb to bearish demands.

Is your portfolio green? Check the Cardano Profit Calculator

However, it was unclear how long ADA could sustain the current momentum as indicated by the Exponential Moving Average (EMA). Based on the daily chart, the 20 EMA (blue) and 50 EMA (yellow) were situated at almost the same spot. This suggested consolidation in the short term and a possible end to the ADA uptick.

However, at press time, ADA had already established a downside to its price at $0.378. This triggered its 30-day performance to end with a 5.47% hike.

![Cardano [ADA] funding rate and MVRV ratio](https://ambcrypto.com/wp-content/uploads/2023/03/Bitcoin-BTC-08.20.43-30-Mar-2023.png)

![Cardano [ADA] Open Interest](https://ambcrypto.com/wp-content/uploads/2023/03/Screenshot-2023-03-30-at-09.19.48.png)