Cardano, XRP, Litecoin’s markets are missing this and here’s how they can find it

Bitcoin has not made any noise in the crypto-market of late. It has chosen to confine itself within the $30-$40k price band. What’s more, the likes of Cardano, Litecoin, and XRP, alts that had once taken off on independent rallies, have now begun to follow the king coin’s footsteps.

Most notably, at the time of writing, these three altcoins, apart from Ethereum, shared the highest correlation with Bitcoin around the 0.8 range. To be precise – 0.89 (LTC), 0.80 (ADA), and 0.86 (XRP). All the three cryptos were trading in the green after registering an uptick of not more than 1% in the last 24 hours.

The same was the case with Bitcoin too. Keeping their correlation with BTC aside, it is essential to note the trends set by various market participants to understand where these coins are heading towards.

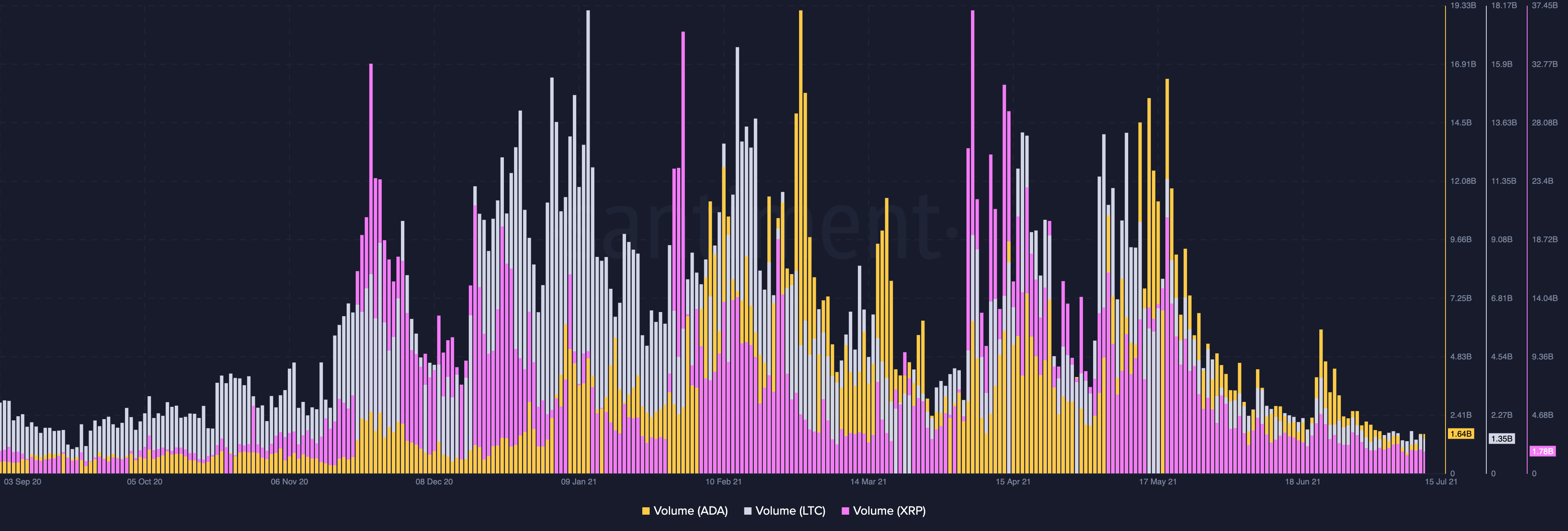

The transactional volume of all the three alts has been dipping for more than four weeks now. Even though there was a slight surge midway, it could not persist. On the 14th of last month, the trading volume for ADA, LTC, and XRP accounted for $2.38 billion, $2.35 billion, and $3.29 billion respectively while the same on 14 July noted figures of $1.64 billion, $1.5 billion, and $1.94 billion.

Additionally, as indicated by the chart, such low levels were previously witnessed only in September last year. At this point, it is essential for the trading volume to pick up the pace. Only when that happens, a potential rally can be expected.

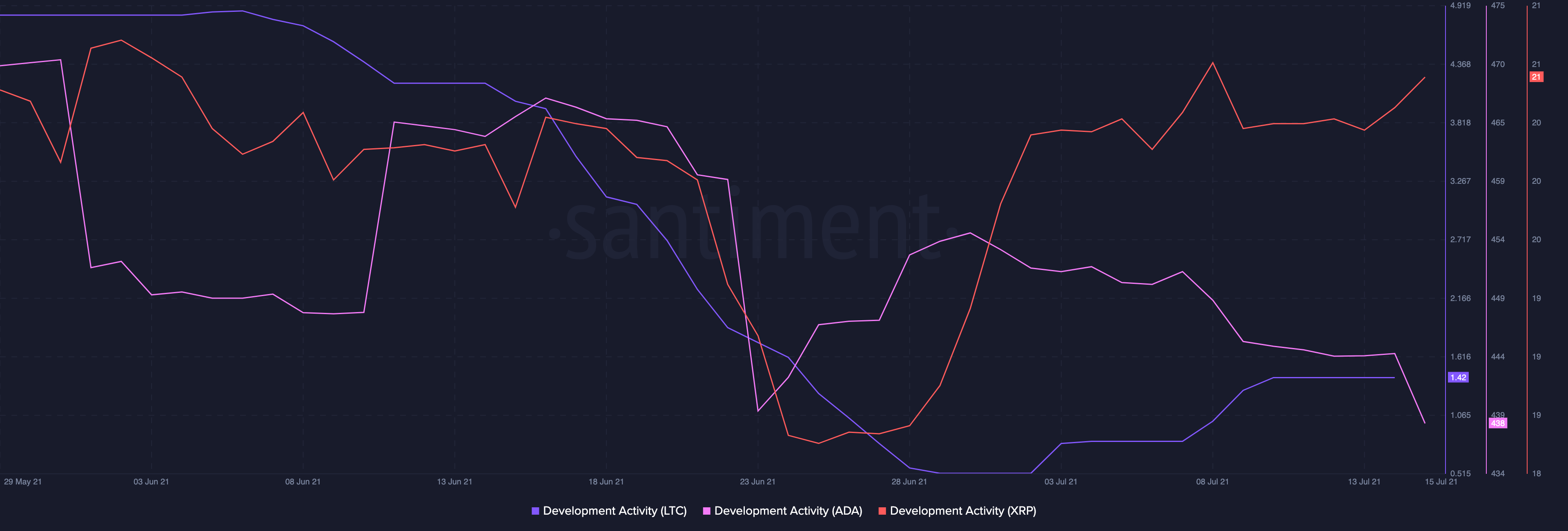

Now, over the same one-month timeframe, the development activity for XRP has notably risen, despite a slight hesitation at different points. Nevertheless, the same hardly impacted the token’s price. Now, even though the dev activity on Cardano and Litecoin’s ecosystem has not been steady, their respective prices did not massively plummet either.

At this point, it won’t be wrong to claim that the price actions of these altcoins do not heavily depend on what is happening in their respective ecosystems. The past few months have only made it clear that this metric, in particular, has taken a back seat, especially during times when the alts follow BTC’s bearish footsteps.

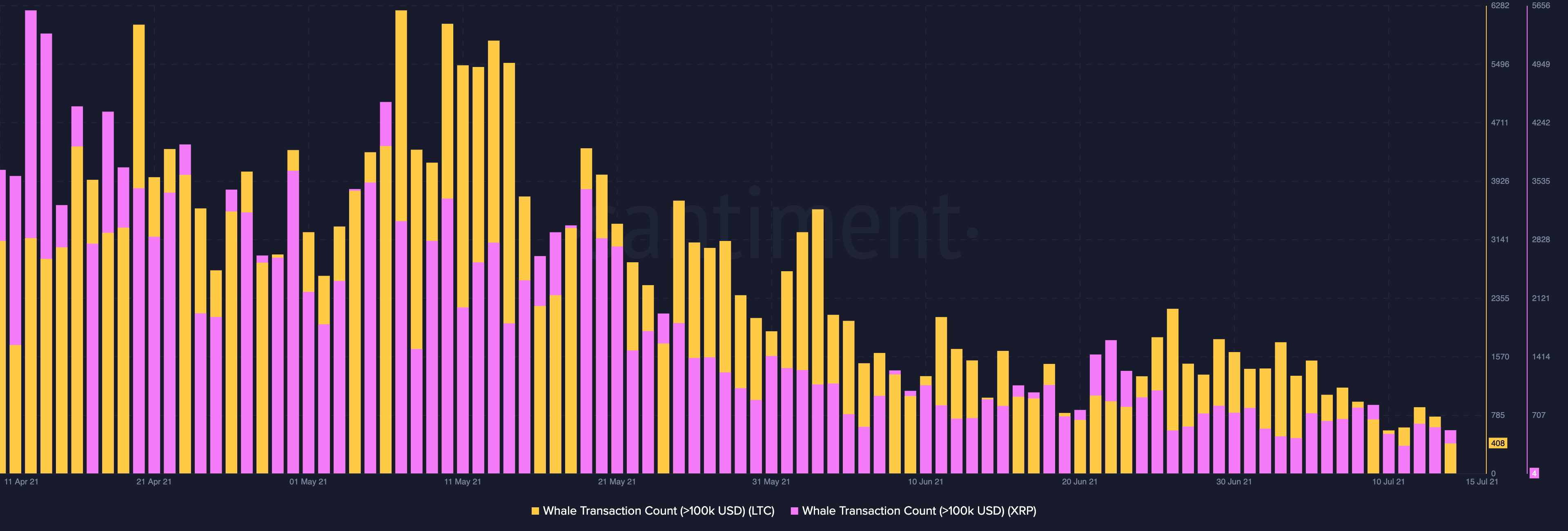

Additionally, the big market players have failed to throw their lifejacket to rescue these alts. On 14 July, for instance, only 408 large LTC transactions (>100k USD) took place, while the same, during the last few days of June, easily crossed the 1500 benchmark on an average. For XRP, on 14 July, close to 527 whale transactions took place while the same witnessed levels of around 1000 towards the end of June.

As far as Cardano is concerned, IntoTheBlock’s data highlighted the concentration held by these large holders. This indicator takes into account the aggregate percentage of circulating supply held by whales (addresses holding over 1% of supply) and investors (addresses holding between 0.1%-1%) and the sum of these two underlines the total concentration by large holders.

ADA’s concentration held by large HODLers amounted to 23.37%, but all in vain.

All in all, for these coins to fare well, they desperately need a push and, perhaps, only Bitcoin can provide that. As soon as BTC’s price starts rallying upwards, the market would most likely witness these alts mirroring BTC’s movements. But for the time being, large players need to step in and the volumes need to spike for the alts’ prices to gain momentum.

![Solana [SOL]](https://ambcrypto.com/wp-content/uploads/2025/08/Solana-SOL-1-400x240.webp)