Cardano’s ‘deep work’ in spotlight, here’s how you can trade smart

The general cryptocurrency market has continued to reel under increased selling pressure. Despite that on-chain data revealed that some crypto assets had recorded noteworthy growth in the last month.

With its Vasil hard fork a few weeks away, the Cardano Project takes the lead as the project with the most developmental activity in the last 30 days. Interestingly, even with Ethereum’s anticipated merge, the developmental activity on Ethereum Network in the last 30 days trailed behind Cardano with an index of 272 as opposed to the latter’s 362.

According to the on-chain analytics platform, Santiment, development activity can be used as a metric to determine ‘a project’s commitment to creating a working product, and continuously polishing and upgrading its features.’

Well, investors can also deploy this metric to gauge the seriousness of a project about its business proposition.

With a 4% uptick in price in the last month, let’s look at other vital on-chain metrics to see how ADA has fared.

A glance at network activity

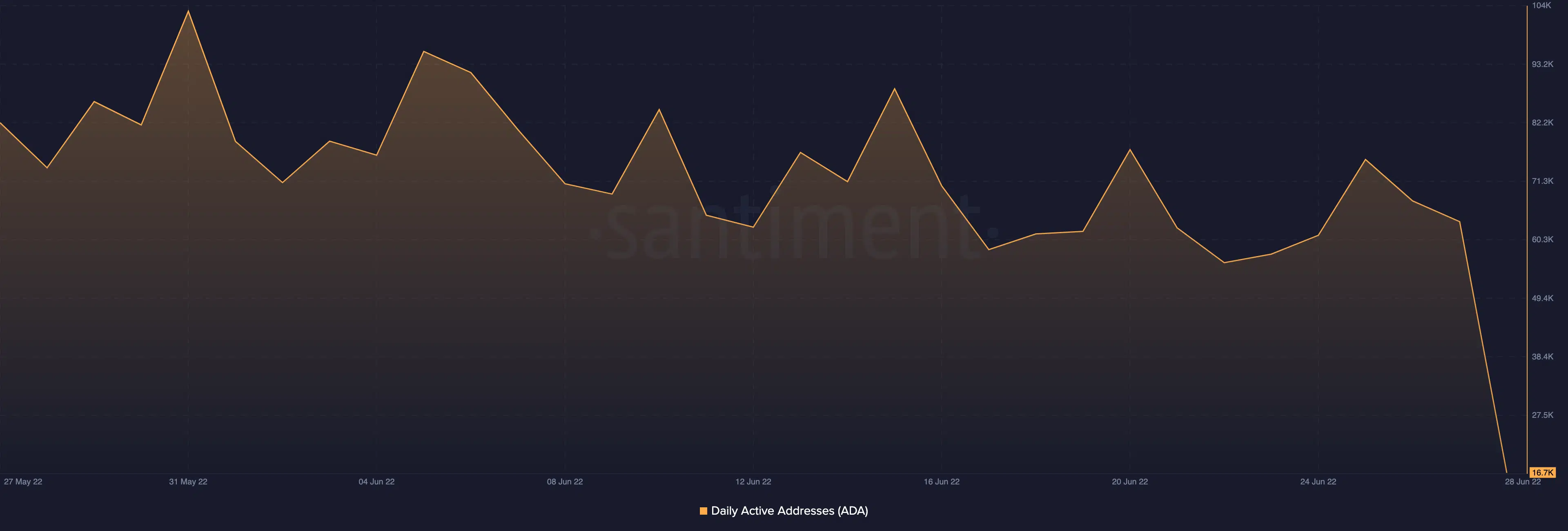

As per data from Santiment, within the last 30 days, the number of addresses that transacted ADA daily declined significantly. After touching a high of 103.11k on 31 May, the index for daily addresses on the network embarked on a steady decline. It registered an 83% drop and was pegged at 16.3k at the time of writing.

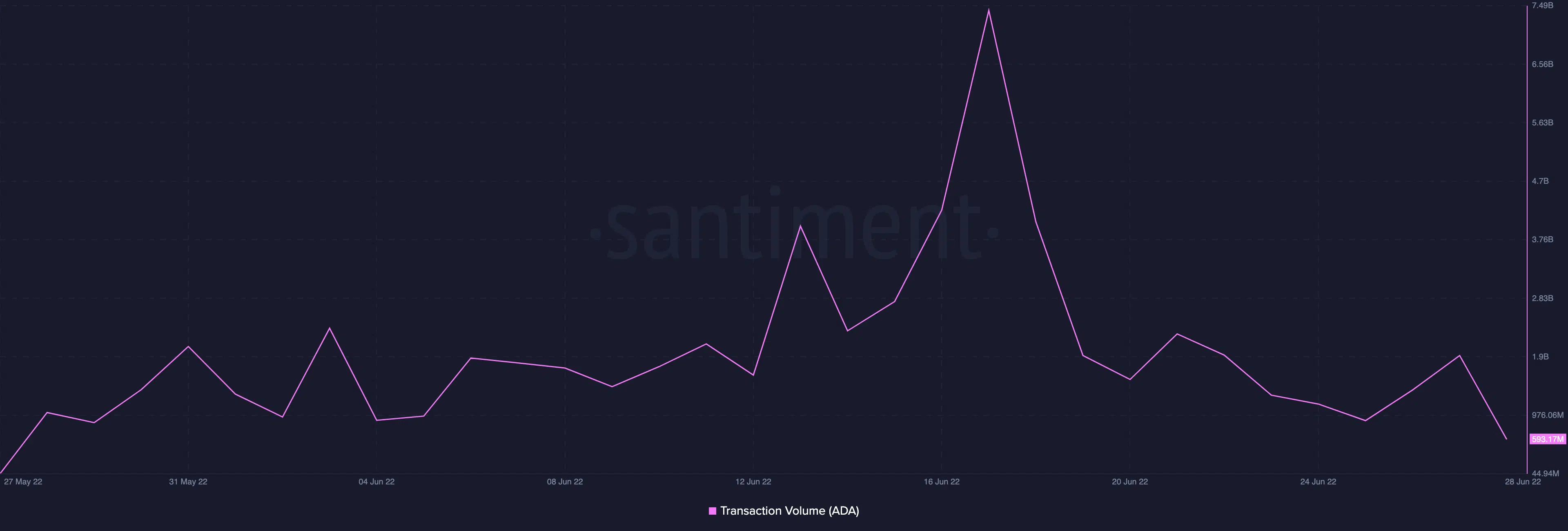

Furthermore, the aggregate amount of ADA across daily transactions on the network rose steadily to a high of 7.41 billion by 17 June. Spotted at 593 million at press time, this declined significantly by over 90% in just 10 days.

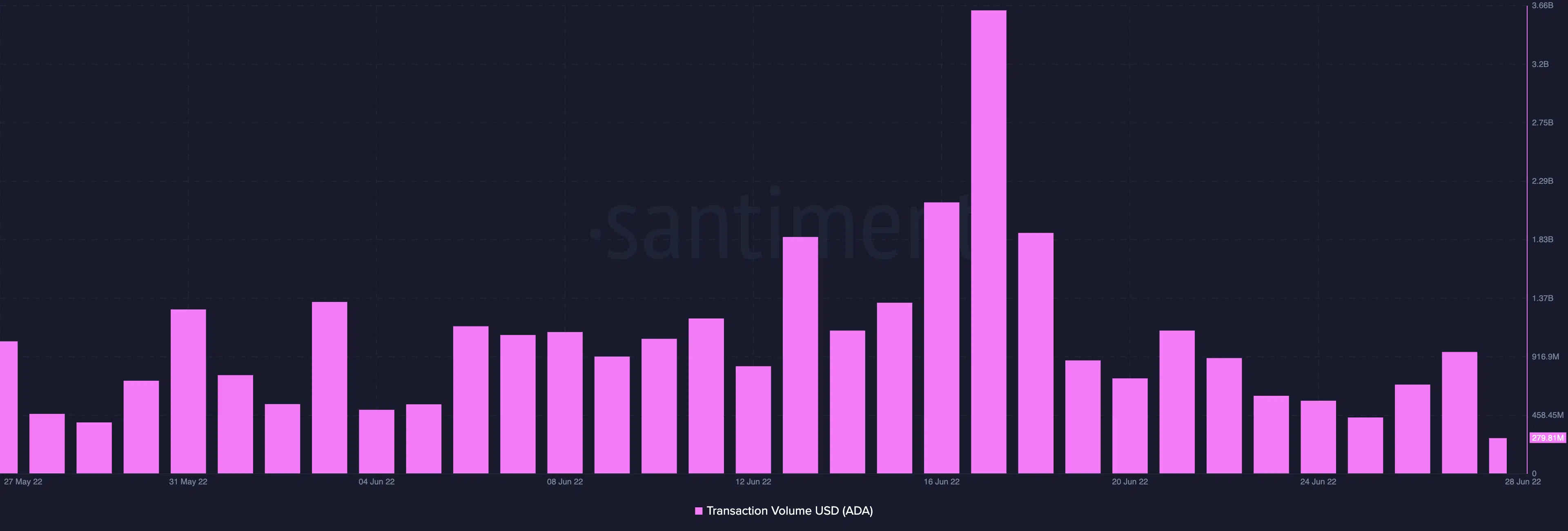

Quantified in USD, the value of transacted ADA coins saw a high of $3.63 billion on 17 June and declined steadily in the last 10 days. At press time, this was stationed at $279.81 million.

Moving on to social activity

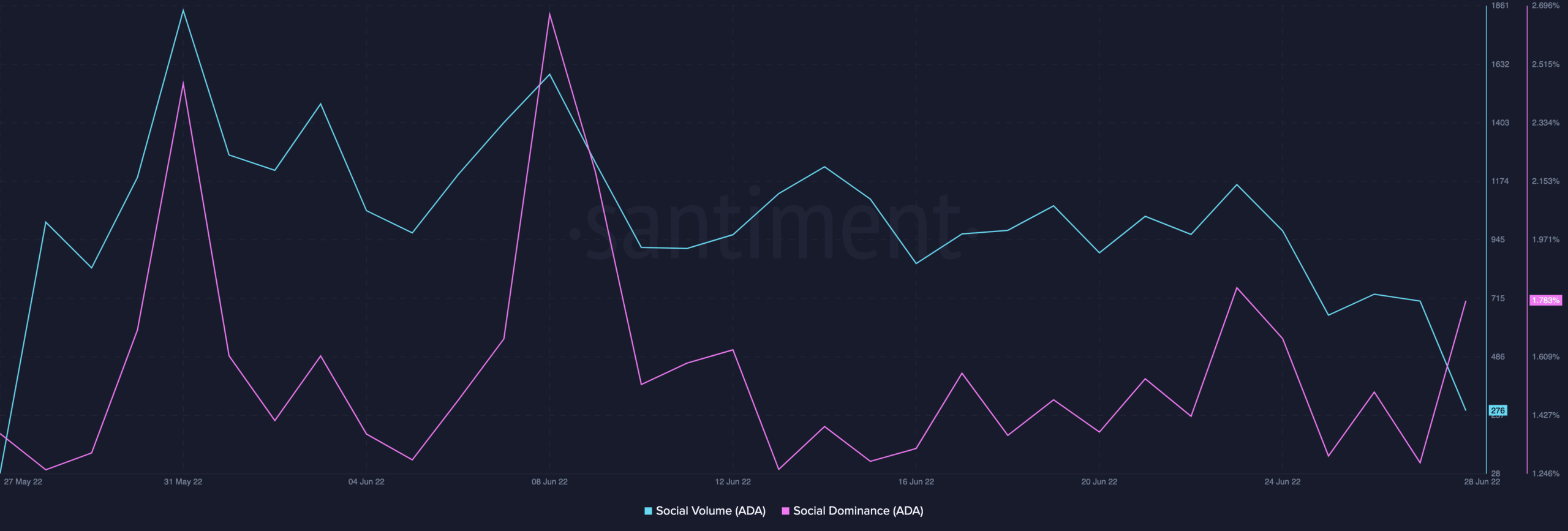

On a social front, the token did not see much traction in the last 30 days. The social dominance of the coin saw a high of 2.67% on 8 June and slowed down since then.

At press time, the social dominance was 1.783%, a 33% drop from 8 June. Similarly, the social volume ticked a high of 1843 on 31 May and has been dropping since. At press time, this was spotted at 278.

Anything from the whales?

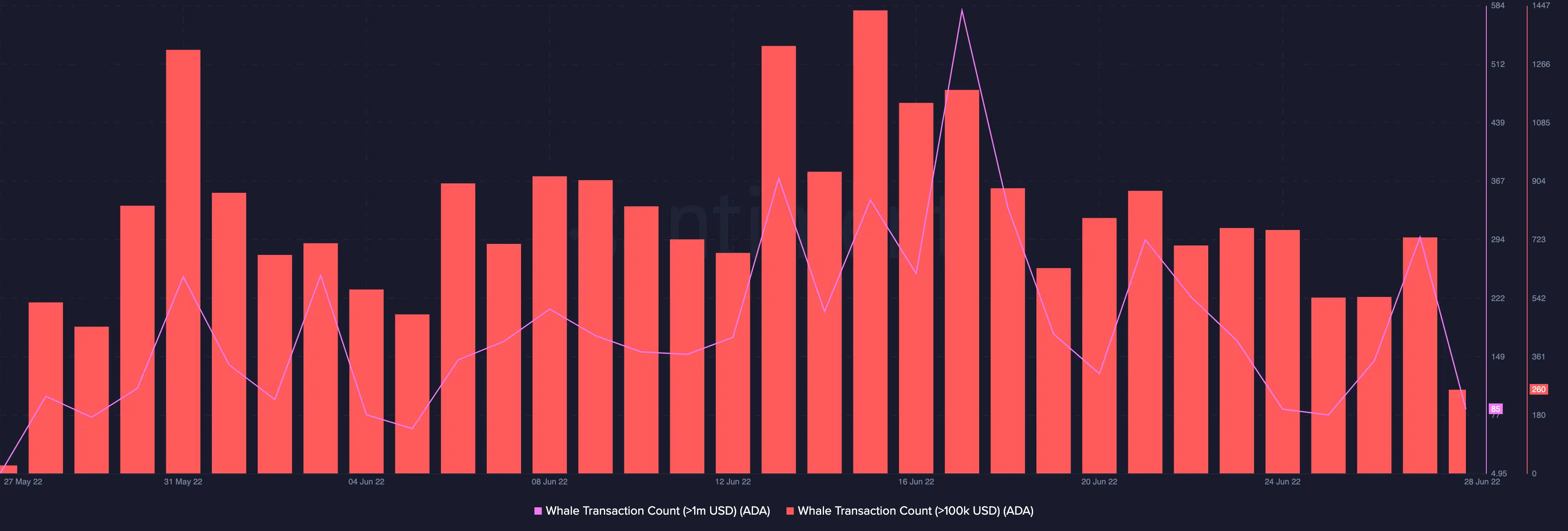

Within the period under review, the count for whale transactions above $100k saw a fall between 31 May and 12 June- a drop of 47% was noted.

By 15 June, the transaction count went as high as 1,433. However, this was immediately followed by a steady decline that forced it to be pegged at 260 by press time. For whale transactions above $1 million, this rose by over 400% between 28 May and 17 June. Since then, it has followed a downward slope.