TRON ranked second with its TVL, but will it help the TRX bulls?

- Tron was only behind Ethereum in terms of TVL.

- Metrics and market indicators looked somewhat bullish.

According to a tweet by TRON Community on 20 December, TRON [TRX] grabbed the second spot on the list of blockchains with the highest total value locked. It was second only to the king of altcoins, Ethereum [ETH].

#TRON ranks second as the largest #TVL after #Ethereum and outperforming #Binance, #Arbitrum and #Polygon ⚡️ pic.twitter.com/sf08Gqe4P9

— TRON Community ? (@TronixTrx) December 19, 2022

Read TRON’s [TRX] Price Prediction for 2023-24

However, DeFillama’s data revealed a different story. As per the chart, TRON witnessed a decline in its TVL over the last few days, and at press time, it sat at $4.7 billion.

Interestingly, TRON‘s price action was also quite promising. In the current bearish market, where most crypto charts were painted red, TRX registered nearly 2% positive weekly gains.

At press time, TRX’s price had increased by nearly 1% in the last 24 hours. It was trading at $0.05423 at press time, with a market capitalization of more than $4.9 billion.

Is a bull run around the corner for TRON?

Similar to these updates, which looked optimistic for TRON, a few metrics suggested the possibility of a continued price hike.

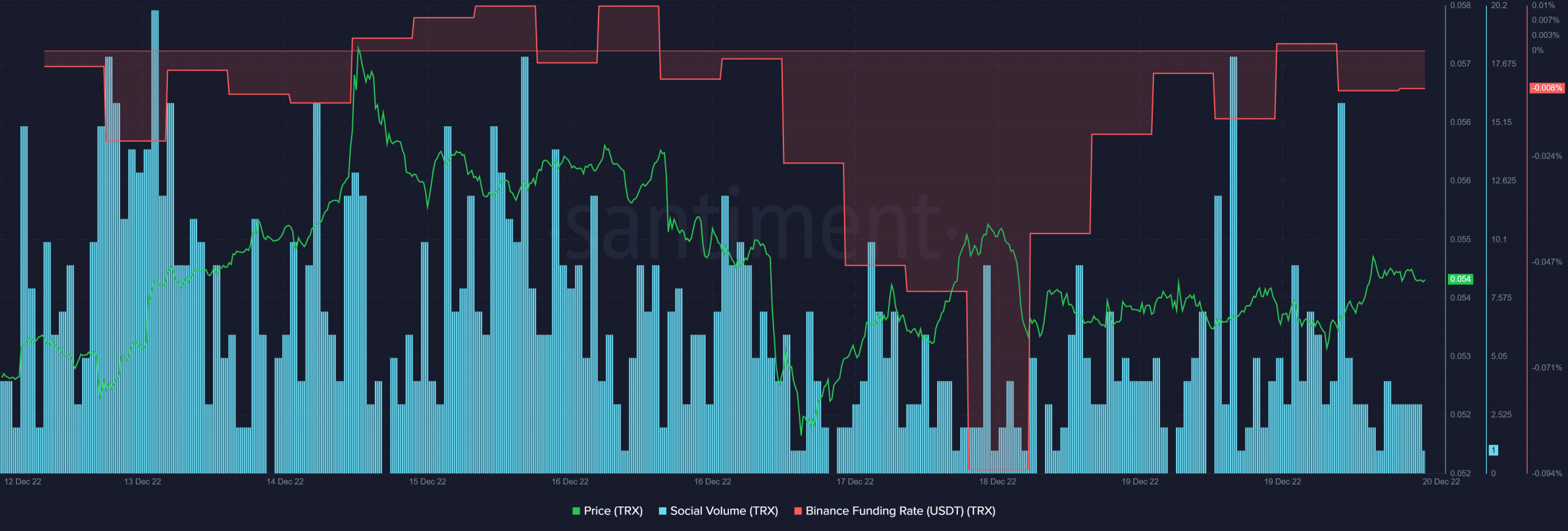

For instance, TRX’s Binance funding rate registered an uptick, which was good news as it indicated higher interest from the derivatives market. TRX’s social volume was also consistently high throughout the week.

TRON’s burn rate also looked promising, as it reflected the deflationary characteristics of the token. As of 18 December 2022, over 7,841,309 coins had been burned, with a net production ratio of less than zero, at -2,781,133.

18th December: #TRON burns more than 7,841,309 coins ? with a net production ratio less than zero -2,781,133 ? pic.twitter.com/mxcNVVwsxB

— TRON Community ? (@TronixTrx) December 19, 2022

Are your TRX holdings flashing green? Check the Profit Calculator

What do the indicators suggest?

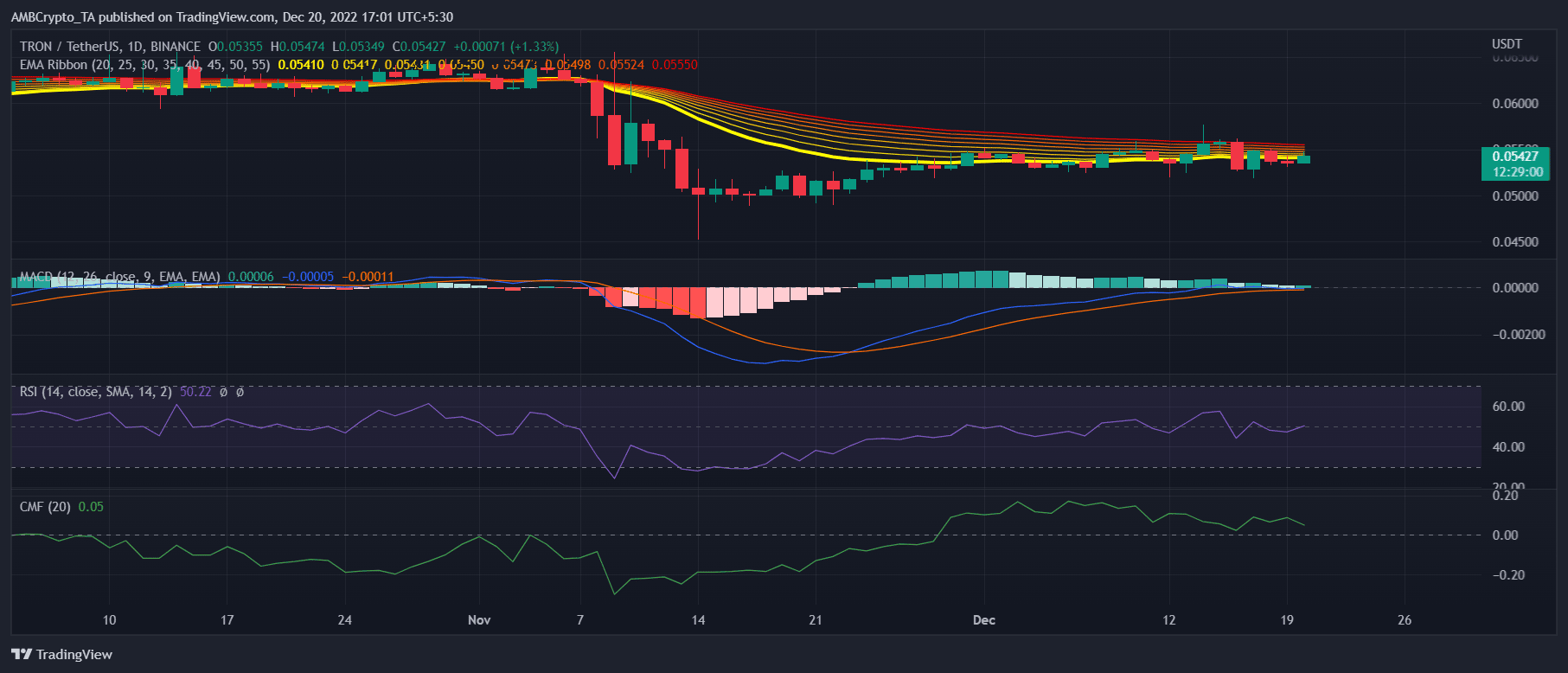

Interestingly, the market indicators were somewhat bullish. For instance, as per the Exponential Moving Average (EMA) Ribbon, the gap between the 20-day EMA and the 55-day EMA was reducing. The MACD also revealed an ongoing tussle between the bulls and the bears.

Though the Relative Strength Index (RSI) was near the neutral mark, it registered a slight uptick, which was promising. Nonetheless, TRX’s Chaikin Money Flow (CMF) was headed downwards towards the neutral position, which might bring trouble in the coming days.