Chainlink whales drive more utility- Is a bounce back on the card for LINK?

- Chainlink joins the list of most traded smart contracts among the top ETH whales.

- LINK bears face resistance threatening to cut short their recent dominance.

The Chainlink blockchain is gradually extending its tentacles across the decentralized landscape. Its long-term expectations are particularly high but its native token LINK remains undervalued at best. But, there is some hope even in the short term.

Read LINK’s price prediction 2023-2024

The latest WhaleStats alert puts LINK in the crosshairs of addresses with large balances. This is because Chainlink made its way into the list of most used smart contracts among the top 1,000 ETH whales in the last 24 hours. This observation confirms that ChainLink is still experiencing healthy levels of utility.

JUST IN: $LINK @chainlink one of the MOST USED smart contracts among top 1000 #ETH whales in the last 24hrs?

Peep the top 100 whales here: https://t.co/jFn1zIOq03

(and hodl $BBW to see data for the top 1000!)#LINK #whalestats #babywhale #BBW pic.twitter.com/pSPFvjivwD

— WhaleStats (tracking crypto whales) (@WhaleStats) January 19, 2023

The timing of this observation is ideal, especially considering LINK’s price level. The token pulled back by as much as 10% from its current monthly high. This puts it within the 50-day moving average, as well as the 50% RSI level where it is likely to bounce off.

The price had already started demonstrating signs of a potential bounce back. There are some interesting observations that demonstrate why the downside may have been cut short.

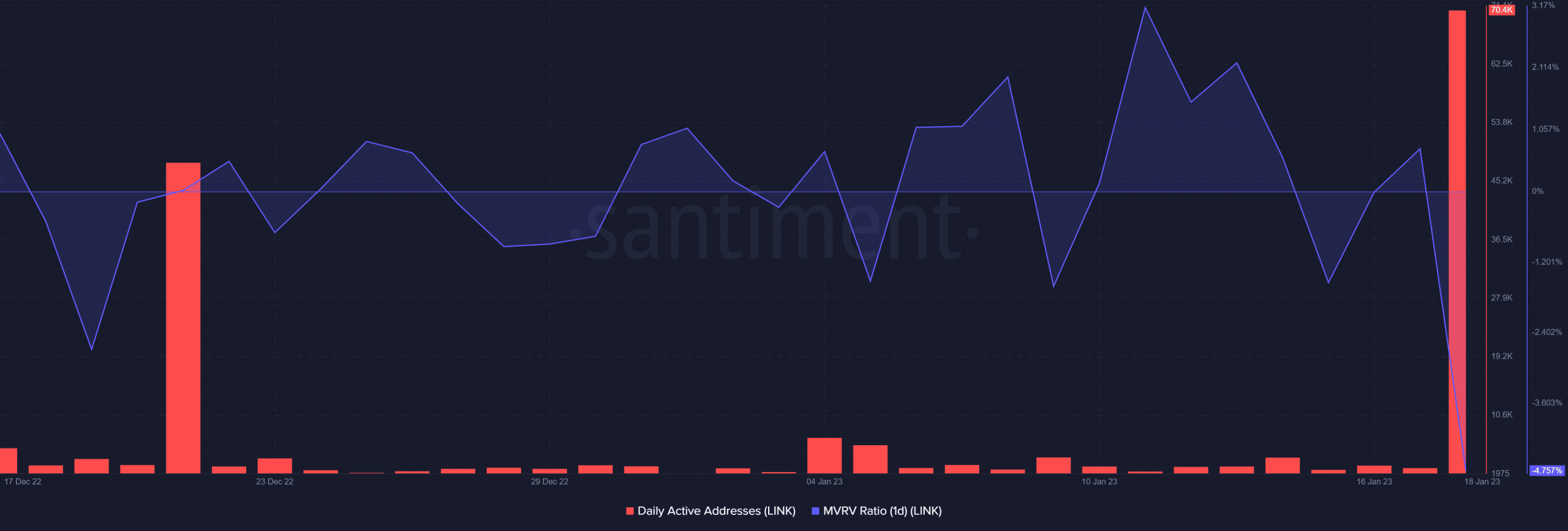

We did witness a massive drop in the MVRV ratio since 11 January which confirms a sizable drop in profitability. The same metric is currently at a new monthly low.

More notably, LINK’s daily active addresses surged to a new monthly high in the last 24 hours, at the time of writing. These observations likely represent a resurgence of bullish demand considering that the bears failed to maintain dominance.

Hunting on thin ice?

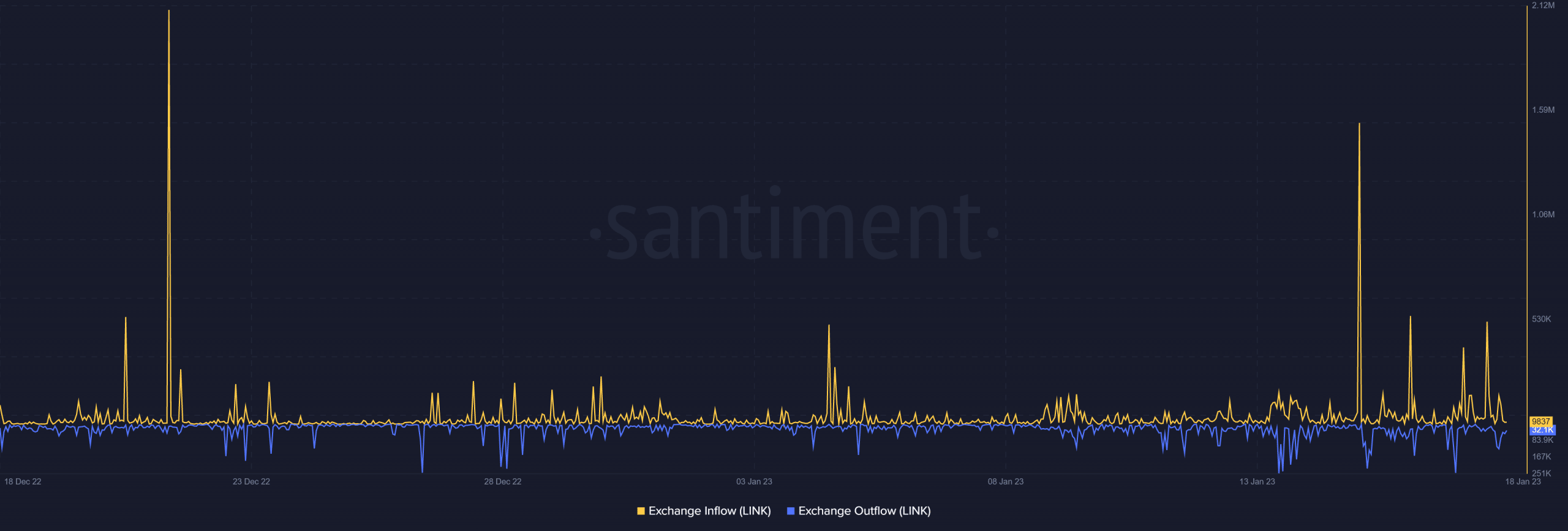

An analysis of LINK’s exchange flows confirms that bears were previously in control. However, a surge in exchange outflows was also evident in the last 24 hours, although not enough to sustain a strong rally.

These observations point towards a potential short-term upside. Despite this, LINK is still underperforming in some segments regardless of the utility it promises to offer through cross-chain integration.

How many are 1,10,100 LINKs worth today?

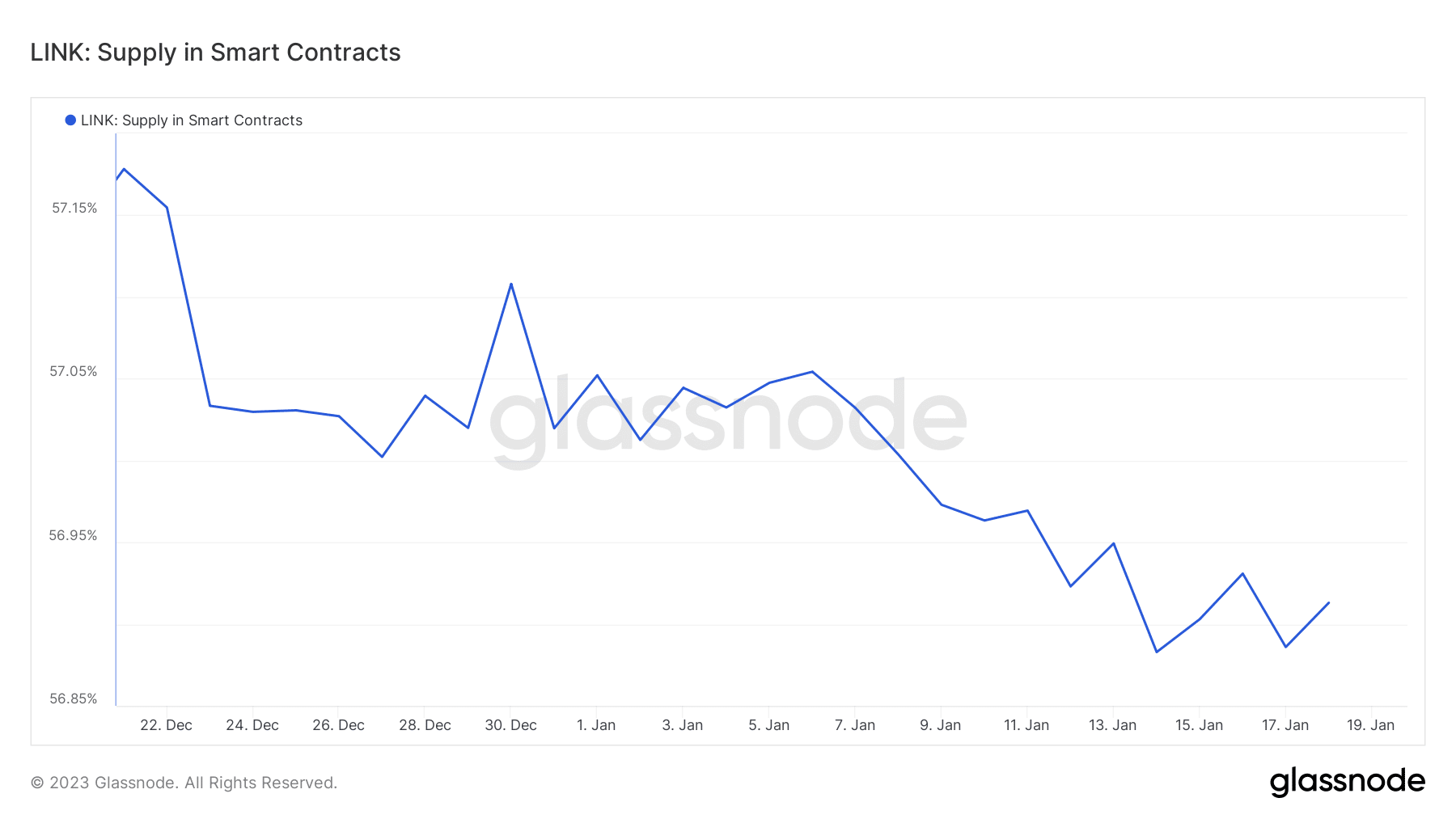

One area that shows relative underperformance is the amount of LINK supply locked in the smart contracts. This amount has been declining for the last four weeks, especially during the first weeks of January when prices were rallying.

A potential reason for this outcome is that investors have opted to focus on taking short-term gains. This reflects the uncertainty of the latest crypto rally in the current month. More so the uncertainty behind whether the rally represents the start of the next bull run.

![Solana [SOL] gains on Ethereum [ETH] but faces sell-off risks](https://ambcrypto.com/wp-content/uploads/2025/04/5B92B32E-5F8B-49F6-94A3-D0086EF6CCA2-400x240.webp)