Chainlink: This is where LINK could be headed despite its 2022 achievements

- Chainlink revealed its achievements of 2022

- However, the metrics and indicators were bearish

Chainlink [LINK] posted a new update that highlighted its achievements through 2022, which reflected how far the network has evolved in a year.

One of which was Chainlink Oracle Services that supported more developers and projects than ever before. Furthermore, the update enabled more than $6.9 trillion in transaction value in 2022.

Additionally, Chainlink Data Feeds expanded across new blockchains and layer-2s, including support for a non-EVM chain such as Solana.

In 2022, #Chainlink reached several major milestones from value enabled to #LINK staked, helping the #Web3 economy scale securely.

Here's a look at key network highlights & how Chainlink is growing to meet global demand for #ProofNotPromises ?? pic.twitter.com/fO6pCmvlEo

— Chainlink (@chainlink) December 31, 2022

Read Chainlink’s [LINK] Price Prediction 2023-24

How can this benefit LINK in 2023?

As of January 1, 2023, Chainlink was down by more than 6% in the last seven days and was trading at $5.57 with a market capitalization of over $2.8 billion. Though LINK’s stock price showed signs of recovery during the first days, concerns still remain on its metrics front.

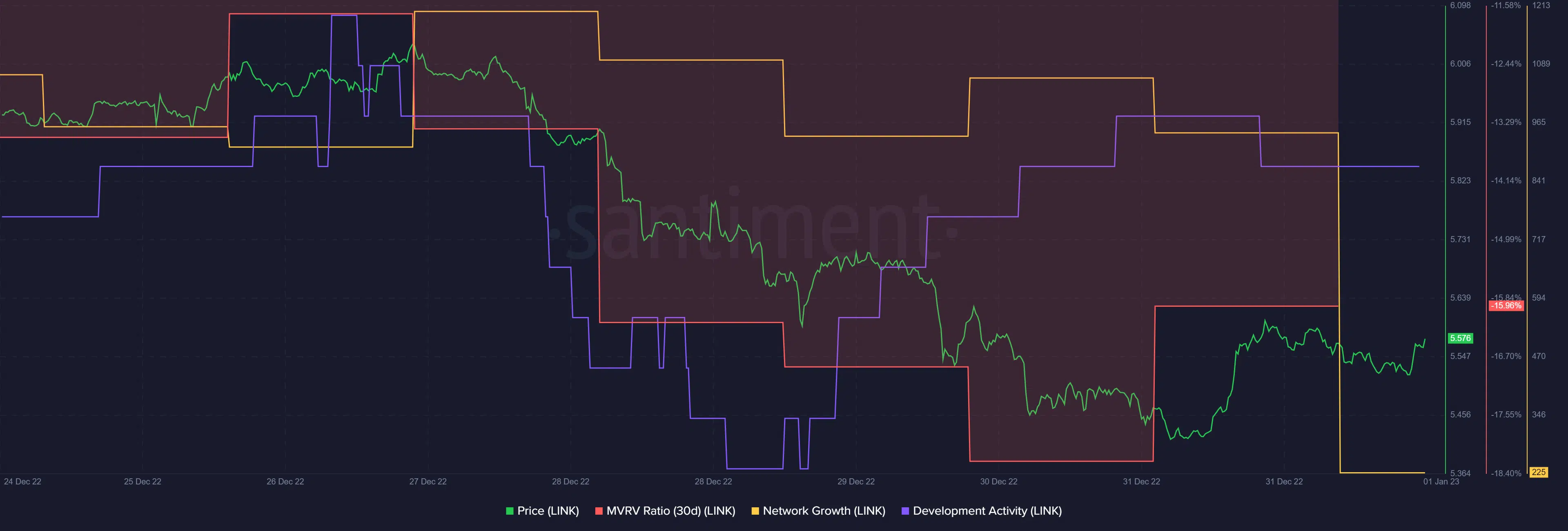

As per Santiment’s data, LINK’s Market Value to Realized Value (MVRV) Ratio witnessed a substantial low over the past week. This could be troublesome for the future of LINK.

Furthermore, LINK’s network growth also followed a similar path and registered a sharp decline. CryptoQuant’s data revealed that LINK’s exchange reserve was increasing, signifying high selling pressure.

The good news was also that LINK’s development activity increased, which reflected the developers’ efforts to improve the blockchain.

Interestingly, Chainlink also partnered with several other companies over the last year. This could help the network increase its offerings for its users. A few of them include the partnership with the Blueberry Protocol, Magpie XYZ, and Galilio Protocol.

Are your LINK holdings flashing green? Check the Profit Calculator

Patience is recommended, but why?

A look at LINK’s market indicators portrayed a bearish picture. Most indicators didn’t favor a price hike. For instance, LINK’s Chaikin Money Flow (CMF) registered a downtick.

Not only that, but the Relative Strength Index (RSI) was also quite low. This looked negative for the network. LINK’s Exponential Moving Average (EMA) Ribbon also looked pretty bearish, which might bring in more trouble.

![Magic Eden crypto [ME] surges post-listing, but concerns rise](https://ambcrypto.com/wp-content/uploads/2024/12/Magic_Eden-1-400x240.webp)