Chiliz [CHZ]: A change in market structure, cautiously bullish traders, and…

![Chiliz [CHZ]: A change in market structure, cautiously bullish traders, and...](https://ambcrypto.com/wp-content/uploads/2022/10/PP-3-CHZ-cover-e1666866721559.jpg)

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- Can World Cup high spur Chiliz on towards new heights?

- Stiff resistance levels are ahead for CHZ, but a bullish Bitcoin can help Chiliz break above these

The launch of Scoville Testnet Phase 4 has been announced by Chiliz. This came around the time when the token broke above its local resistance level at $0.19. With Bitcoin also having a lower timeframe bullish bias, it looks like CHZ can register more gains.

Here’s AMBCrypto’s Price Prediction for Chiliz [CHZ] in 2022-23

Over the past week, CHZ saw a break in market structure to the bullish side. However, at press time, it faced significant resistance near the $0.2-mark.

Demand was present at $0.16 and CHZ was quick to rally

In cyan, a bullish order block from mid-September was highlighted. In recent weeks, the price threatened to break under this zone. However, there seemed to be ready buyers at the $0.16-mark. The bounce from that level saw the RSI slowly pull itself back above the neutral 50-line. This showed bullish momentum in recent days.

The bullish momentum was also reflected in CHZ’s break of market structure from bearish to bullish, highlighted on the chart. The DMI also denoted a strong upward trend in progress as both the ADX (yellow) and the +DI (green) were above the 20-mark.

One concern for the bulls is the slightly diminished trading volume over the past couple of days when the move upward occurred. Is this a sign that buyers have already run out of steam?

Traders might not want to buy CHZ, at the time of writing, as it did not offer a good risk-to-reward buying or selling opportunity. Sellers can look to short the asset with a stop loss above the $0.21-mark. On its way down earlier this month, CHZ did not test the liquidity around the $0.21-area. Hence, a revisit to this zone could face rejection and a retest of $0.207 can offer a buying opportunity targeting $0.22 and $0.24.

On the other hand, the bulls will begin to lose conviction if the price dips back beneath the $0.19-level where it posted its most recent higher low.

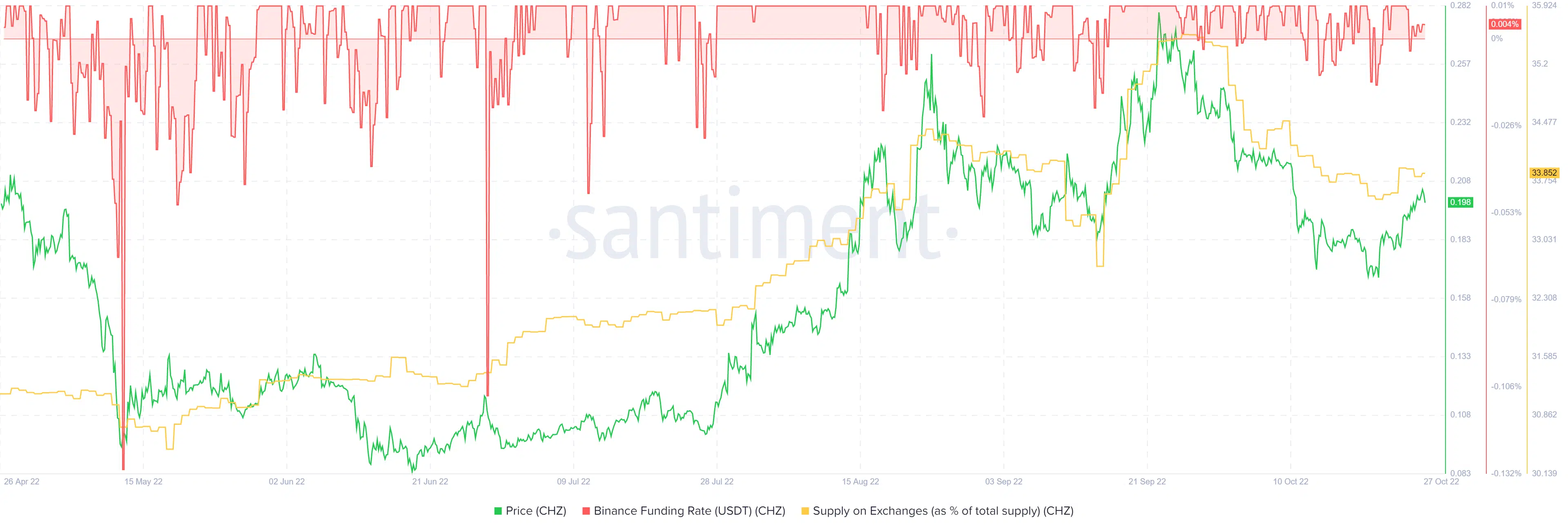

The funding rate is positive as speculators remain bullish on Chiliz

Source: Santiment

Its positive funding rate indicated that long positions paid funding periodically to short position holders. It implied that the majority of the market has been bullishly positioned. Combined with the bullish structure shift, speculator confidence is understandable. The Supply on Exchanges, on the other hand, has undergone a significant drop.

It formed a peak around late September with nearly 35% of the supply on known exchange wallets. This was followed by a sell-off and a drop to $0.16 on the price charts.