Compound [COMP] whales intensify accumulation, even as price fails to grow

![Compound [COMP] whales intensify accumulation, even as price fails to grow](https://ambcrypto.com/wp-content/uploads/2022/12/seiji-seiji-ur4pyEnPdA0-unsplash-1.jpg)

- The count of COMP whales has grown significantly in the last three months.

- Price, however, continues to fall.

Ranked as the 9th DeFi protocol with the largest total value locked (TVL), Compound Finance’s native token COMP has seen increased whale accumulation in the last three months, new data from Santiment revealed.

Read Compound’s [COMP] Price Prediction 2022-2023

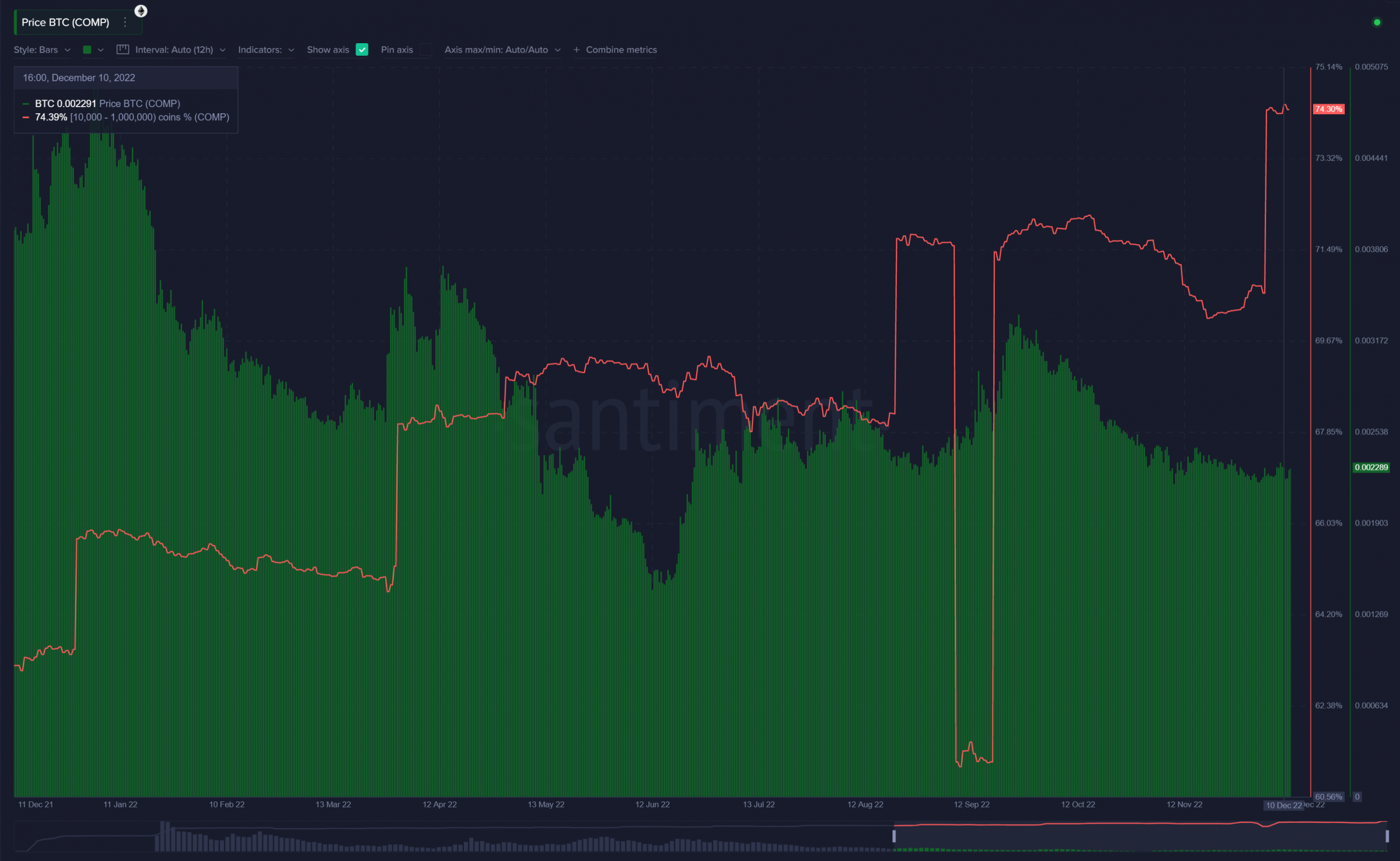

According to data from the on-chain analytics platform, holders of 10,000 to 1,000,000 COMP tokens have increasingly grown their holdings from 61% of the token’s available supply to over 74% in the last 90 days.

In addition, the number of sharks holding between one to 10,000 COMP tokens has grown by 14% in the last three months.

Interestingly, increased accumulation by these key addresses has intensified amid a consistent decline in the token’s value. According to CoinMarketCap, COMP exchanged hands at $39.75 at press time. Unfortunately, its price has dropped by over 30% in the last three months.

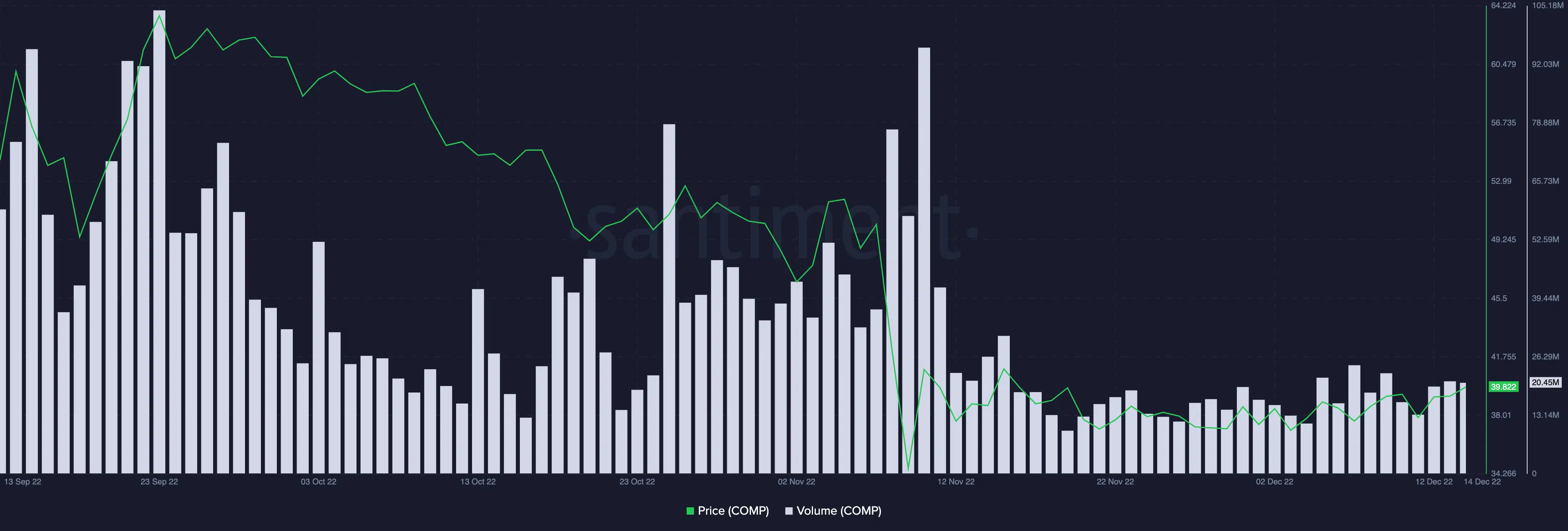

The decline in COMP’s value is partly attributable to the impact of FTX’s collapse. The token fell from a high of $50.3 at the beginning of November to close the trading month at an index price of $37.94. This was a 25% decline in COMP’s value within the 30-day period.

On-chain performance

As COMP’s price fell, the daily volume traded declined as well. Per Santiment, COMP tokens worth $20.4 million were traded in the last 24 hours, a 79% decline in daily trading volume in the last month.

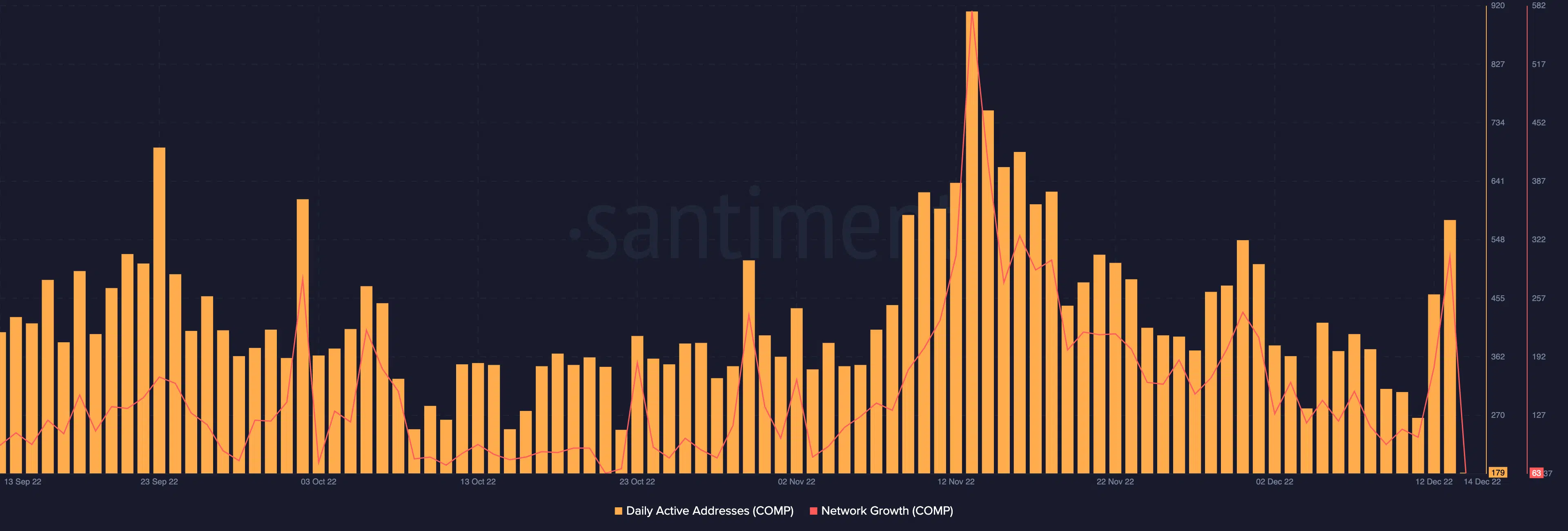

FTX’s unexpected fallout aggravated COMP’s decline in value as fewer unique addresses traded the COMP token following the exchange’s collapse. Since 13 November, the count of unique addresses that traded COMP daily has fallen by over 80%.

In addition, COMP logged a decline in new demand. Data from Santiment revealed a significant drop in network growth following FTX’s collapse. New addresses on COMP’s network have dropped by 89% in the last month.

The strong correlation that exists between an asset’s price and its network activity makes it such that a decline in an asset’s network activity often leads to a corresponding decline in its price.

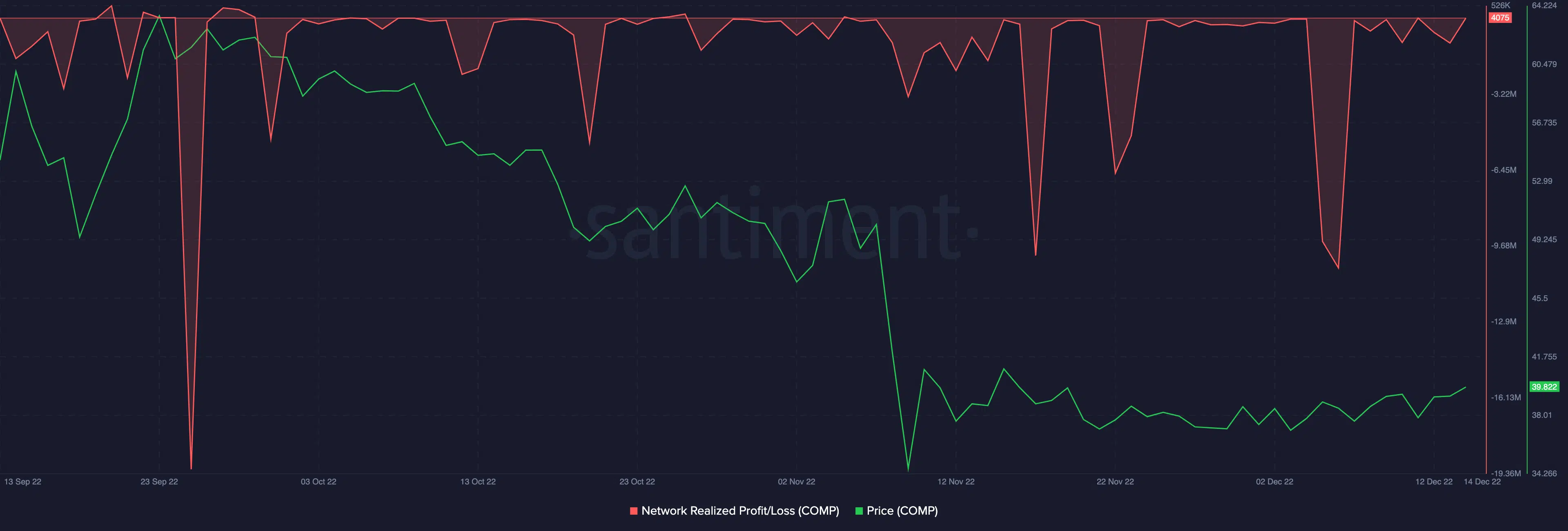

Lastly, an assessment of COMP’s Network Profit/Loss ratio (NPL) showed that the last month had been marked by a series of short-term capitulations of “weak hands,” many of who sold their holdings at a loss.

While the re-entry of “smart money” usually follows these NPL dips, COMP has seen no such interest in the last month.