Cosmos buyers can enter at these levels as ATOM forms a bullish divergence

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- A bullish divergence was spotted but it could take a while to play out

- Investors would have a keen eye on the 78.6% retracement level

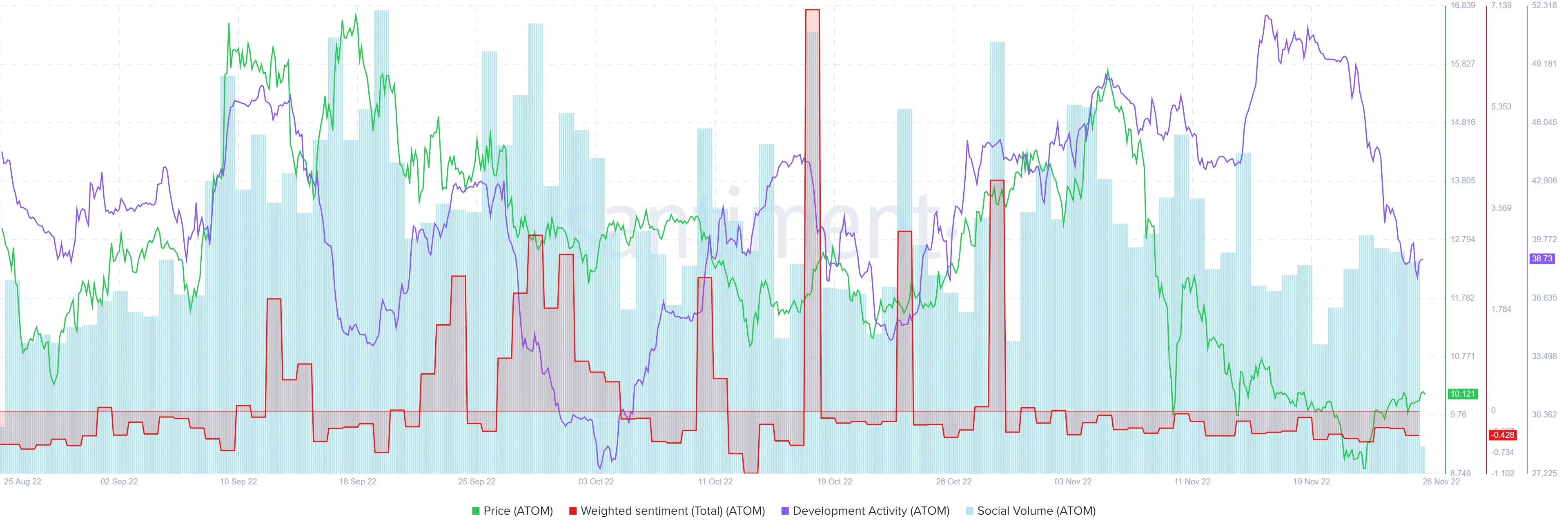

The Cosmos network saw a spike in development activity earlier this month, and this has been a trend for Cosmos in the past nine months. Despite the bear market, the developers were going strong, and projects such as Osmosis could be important for the chain in the long term.

Read Cosmos [ATOM]’s Price Prediction 2023-24

Despite the positive activity on the dev front, the price action was not particularly inspiring. It had a bearish outlook to it but indicators showed steady buying pressure despite the downtrend. This implied that the recovery of ATOM could be strong, should the market sentiment take a bullish shift.

Buying volume is on the rise even though ATOM declined in price

Based on the move upward from mid-June to September, a set of Fibonacci retracement levels (yellow) was plotted. It showed the 61.8% and 78.6% retracement levels to lie at $10 and $8.04 respectively.

Earlier this month, the $10 level acted as support, but the bearish momentum saw this level broken. ATOM was able to register a bounce from $8.73, another horizontal level of significance. Yet, the market structure remained bearish. The Relative Strength Index (RSI) was also beneath neutral 50 to highlight bearish momentum was present.

If ATOM has been in a pullback since September, then the 61.8% and 78.6% are logical places where longer-term buyers would enter the market. A continuation of the previous uptrend can occur if Cosmos buyers can defend the $8 region. To support this idea, the On-Balance Volume (OBV) formed a series of higher lows since October. In the same period the price made a series of lower lows. This was a bullish divergence.

However, a divergence need not imply an immediate reversal. A test of the $8 level, if it materialized, could take weeks, but would offer a good buying opportunity, with a low risk and high reward for buyers.

Social volume declines while sentiment remains negative

Source: Santiment

Santiment data showed social volume to be on decline throughout November, as the metric formed a series of lower highs. Meanwhile, the weighted sentiment was in negative territory throughout the time ATOM descended from $14 to $8.73.

Development activity soared earlier this month but at press time was in a downtrend. If we looked further back in time, the development activity has steadily risen since February 2022. This would give long-term investors some hope.

Source: Coinglass

For lower timeframe traders, the funding rate went into negative territory on multiple exchanges in the past couple of days. Shorter-term price charts showed $10-$10.25 to be an important zone of resistance as well.

For higher timeframe investors, a revisit to the $8-$8.5 region could present a long-term buying opportunity. A session close beneath $8-$7.8 could indicate further losses to follow.