Cosmos heading to crucial $10.58 – shorting opportunity limited?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- ATOM was bearish on the 12-hour chart.

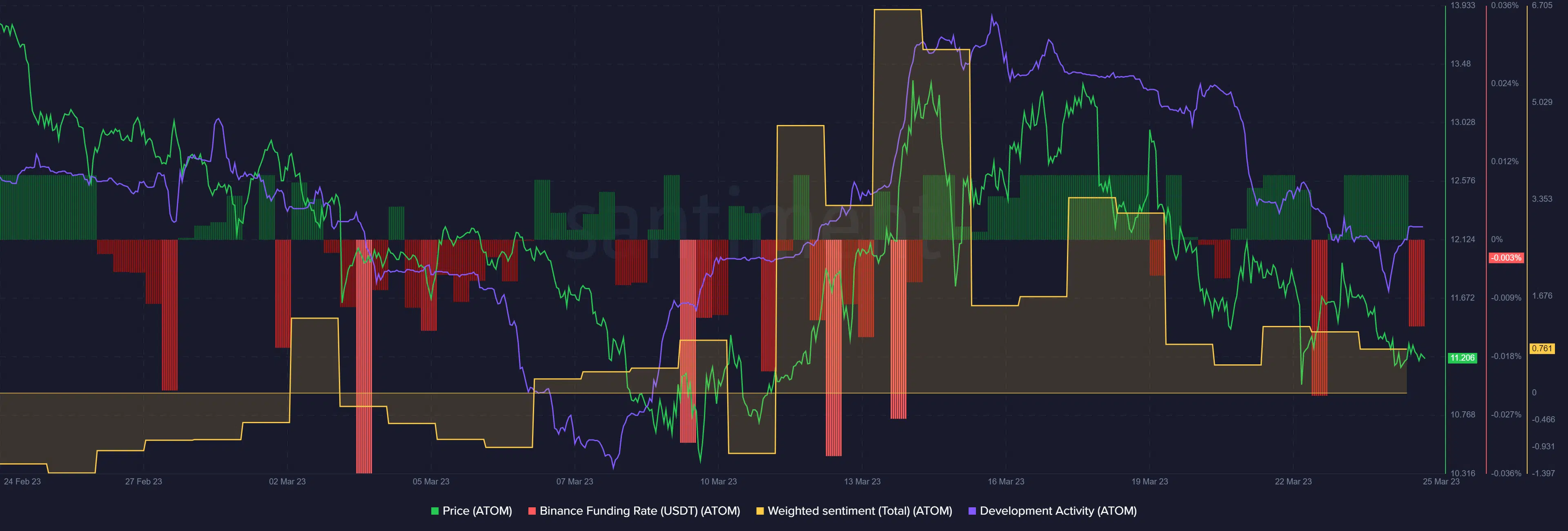

- Funding rates declined, but development activity improved slightly.

Cosmos [ATOM] has depreciated by over 15%, clearing gains from the recovery in mid-March. ATOM dropped from $13.5 and was operating at the $11 price level at the time of writing. A retest of a crucial support level could offer new buying opportunities at discounted prices.

Read Cosmos [ATOM] Price Prediction 2023-24

At press time, Bitcoin’s [BTC] value was below $28K and could further exert selling pressure on ATOM to retest this key support level.

The $10.58 support – Can ATOM bulls prevail?

After facing price rejection at $15.5 in January, ATOM has weathered selling pressure that has seen it drop to $10.58. Bulls successfully recovered from the $10.58, but the second leg of the rally was interrupted by the obstacle at $13.5.

ATOM’s retracement could set it to retest the $10.58 support, and a rebound could be likely if the bulls defend it. A pullback retest on the support could offer long positions targeting 50 EMA, 200 EMA, or $13.5.

A close above $13.5 could usher ATOM into the second leg of the rally with a target of $15.5 if the bulls clear the $14.77 hurdle.

On the other hand, ATOM could depreciate further to $9.57 if bulls fail to defend the $10.58 support. As such, the downswing could offer short-sellers extra shorting opportunities at $9.57 if ATOM closes below $10.58.

The Relative Strength Index (RSI) retreated from the upper ranges and fluctuated below the 50 mark, showing buying pressure declined. Similarly, the Average Directional Index (ADX) dropped, suggesting a likely further retracement or consolidation.

Funding rate was negative: development activity improved

According to Santiment, funding rates flashed red at press time – an indication of bearish sentiment in the derivatives market. Moreover, the weighted sentiment had dropped significantly but remained positive, which could give bulls little hope.

How much are 1,10,100 ATOMs worth today?

Development activity has declined since mid-March but showed signs of improvement at press time. The trend could bolster investors’ confidence and prop up ATOM’s value in the long run. Investors should track BTC’s performance to make better moves.