Could Bitcoin’s security be at risk as a result of this update? Decoding details

Bitcoin [BTC] managed to surpass the $19,000 level towards the end of October. The king coin was constrained to this level for the longest time and made several attempts to move past it. Both holders and watchers rejoiced because they believed that this time, the end of the long-term resistance may signal the beginning of a new rise.

Furthermore, those who had taken short positions against BTC were also liquidated during this small price increase. Despite this encouraging trend, things didn’t appear to be going well for miners in the ecosystem.

________________________________________________________________________________________

Here’s AMBCrypto’s Price Prediction for Bitcoin [BTC] for 2022-2023

________________________________________________________________________________________

Hashrate and difficulty on the rise

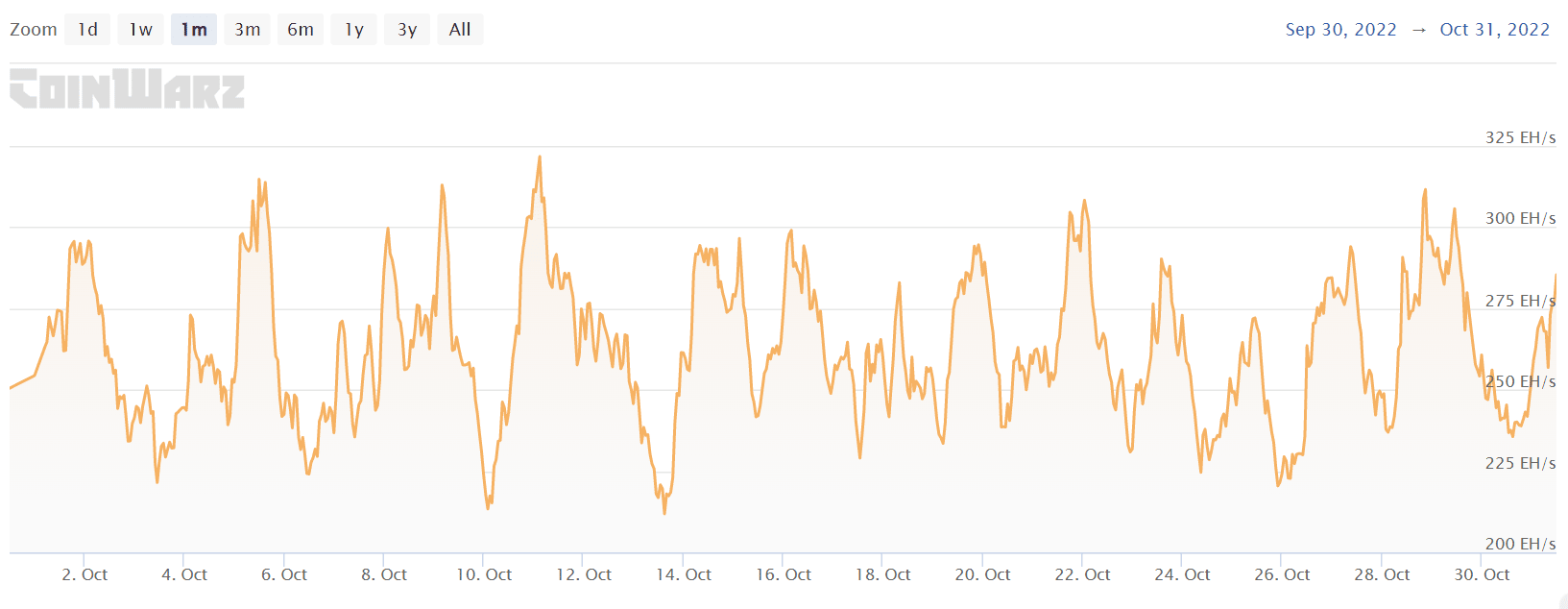

A review of numerous metrics revealed that Bitcoin mining had become less profitable and more challenging. The hashrate metric revealed that the BTC hashrate had been relatively high, particularly in October. Recent information collected from coinwarz indicated that the hashrate has increased.

Furthermore, as of 31 October, this figure stood above 285 Exahash (EH/s). This rate had been rising, which indicated that it took more energy for miners to add a new block.

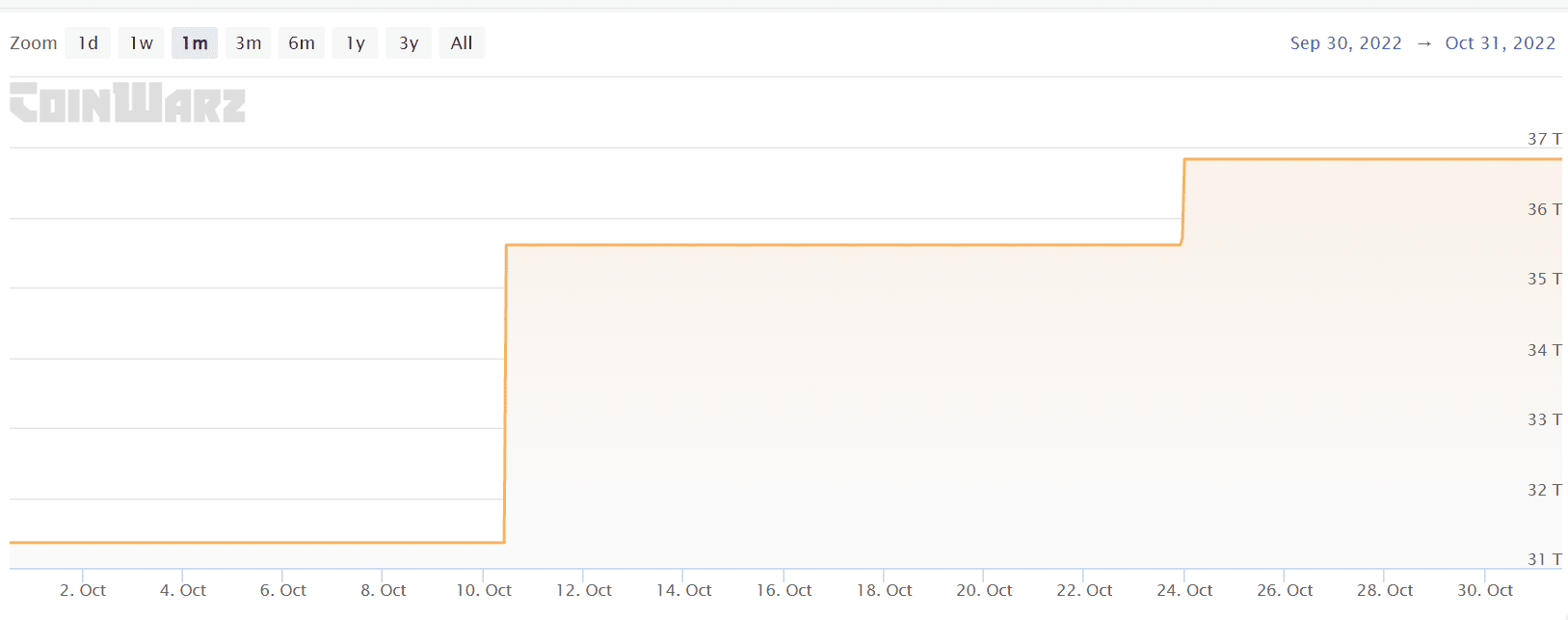

The mining difficulty had also been rising, with the most recent increase being noticed around 23 October. With a rise of 17.46% over the previous 30 days, the current BTC difficulty was seen to be 36.8T. The difficulty had also grown by more than 33% during the previous 90 days.

Revenue dip and capitulation risks

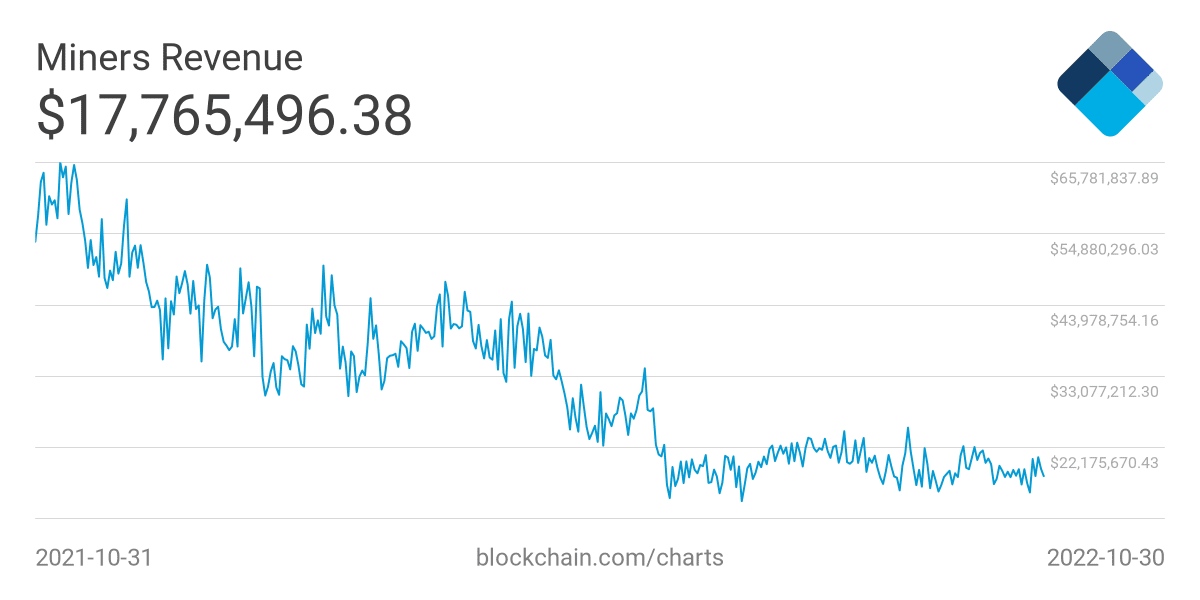

However, a comparison of the miners’ earnings revealed a difference. In contrast to what was found with hashrate and mining difficulty, a decline was seen on the miners’ revenue chart. The disparity basically indicated that, given the current bear market, miners were losing money.

A persistent downward trend could force miners to capitulate, in which case they would have to sell off their assets and quit mining.

A reduction in network security may occur as a result of too many miners giving up. The mining could become more centralized when more miners leave the network and are replaced by others who have greater financial resources. Block manipulation could result from this, which could result in theft or other illegal activity on the network.

Although Bitcoin has never been in this situation before, as the difficulty and hashrate decrease with a reduction in the number of miners. This effectively meant that as fewer resources were used, mining could become somewhat economical again and more miners come on board. Around 7 November, the next difficulty adjustment is anticipated to occur, and it is estimated to decrease by 1.32% to 36.35T.

As of the time of this writing, the BTC price was around $20,700. An increase in the value of BTC would ultimately result in an increase in revenue for miners. This might give them a respite and make BTC mining profitable again.