Could Ethereum Classic [ETC] in your portfolio enhance returns in 2022

If you are wondering whether to buy Ethereum Classic after the cryptocurrency market crash, you have in the right place. We will evaluate its latest price action and look at factors that determine whether it is worth holding as we approach Q2 2022.

Ethereum Classic has been heavily overshadowed by Ethereum ever since its fork, especially as founders focused heavily on the latter. Ethereum is currently in the lengthy process of switching from a proof-of-work consensus mechanism to Proof-of-staked in pursuit of more efficiency. Meanwhile, Ethereum Classic will retain its PoW consensus mechanism. This might make it attractive to users, developers and NFT makers who prefer PoW and this faction of individuals will maintain ETC demand.

The fact that ETC is one of the pioneers in the crypto market also maintains its appeal. The recent crash, especially the LUNA and UST crashes highlight a shakedown of questionable crypto projects. ETC is still operational after all these years, which means it has already been tested and proven.

Let’s analyze its price action for clarity

ETC traded at $21.25 at the time of writing, down by about 1.23% over the last 24-hours. Even so, this seemed like a slight recovery from the recent dip, in which it bottomed out at $16.02. The last time that its price tag was that low was in April 2021. The latest low represents a 69% drop from its 29 April peak and more than 80% from its historic high.

ETC’s heavily discounted price tag means it is already at an attractive price level in case of another rally. It has recovered slightly after dropping into the oversold but remains within a healthy accumulation zone. Ethereum Classic’s heavy discount might attract investors looking to buy tried and tested cryptocurrencies and ETH happens to be among the pioneers.

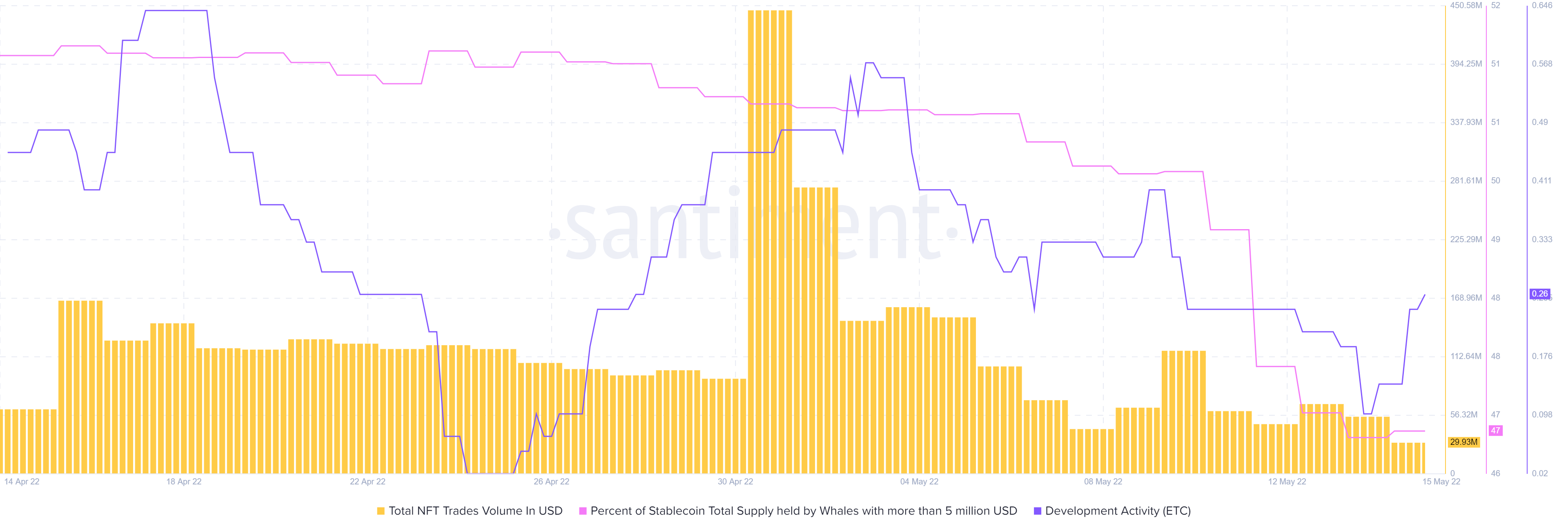

As far as on-chain metrics are concerned, Ethereum Classic’s total NFT trades volumes have so far dropped to the lowest level in the last four weeks. The NFT trades volumes for the last four weeks peaked at the end of April.

Ethereum Classic’s supply held by whale registered a slight uptick in the last two days, thus justifying the increase in price. Nevertheless, it is still within its lowest monthly levels. There is, however, healthy development activity according to the development activity metric. The network is still enjoying strong support and this is reassuring for investors wondering whether ETC is still a good pick.