Could MATIC be next in line for a new ATH

Despite Bitcoin breaching the $50,000-level recently, its market dominance has been falling on the charts. This seemed to be fueling the perfect opportunity for alts to climb towards their ATHs. Taking advantage of the same, altcoins like Cardano, Solana, and Terra (LUNA) rallied all the way to hit new highs.

In doing so, however, these alts also spurred the expectations associated with other altcoins in the market. Polygon’s MATIC is a case in point, with the crypto on a steady uptrend backed by cruisers on its network.

However, with MATIC facing strong resistance at $1.65, it will be crucial for the alt to rally above the level and maintain it in the days to come. $1.65 acted as strong support during the May-June price rally and a flippening would mean that MATIC could see major gains. At the time of writing, the cryptocurrency ranked 17th was close to this level following daily gains of 0.5%.

Even so, the altcoin is still around 37% away from its ATH. How likely is it that MATIC might be next to hit its ATH?

Network growth to the rescue

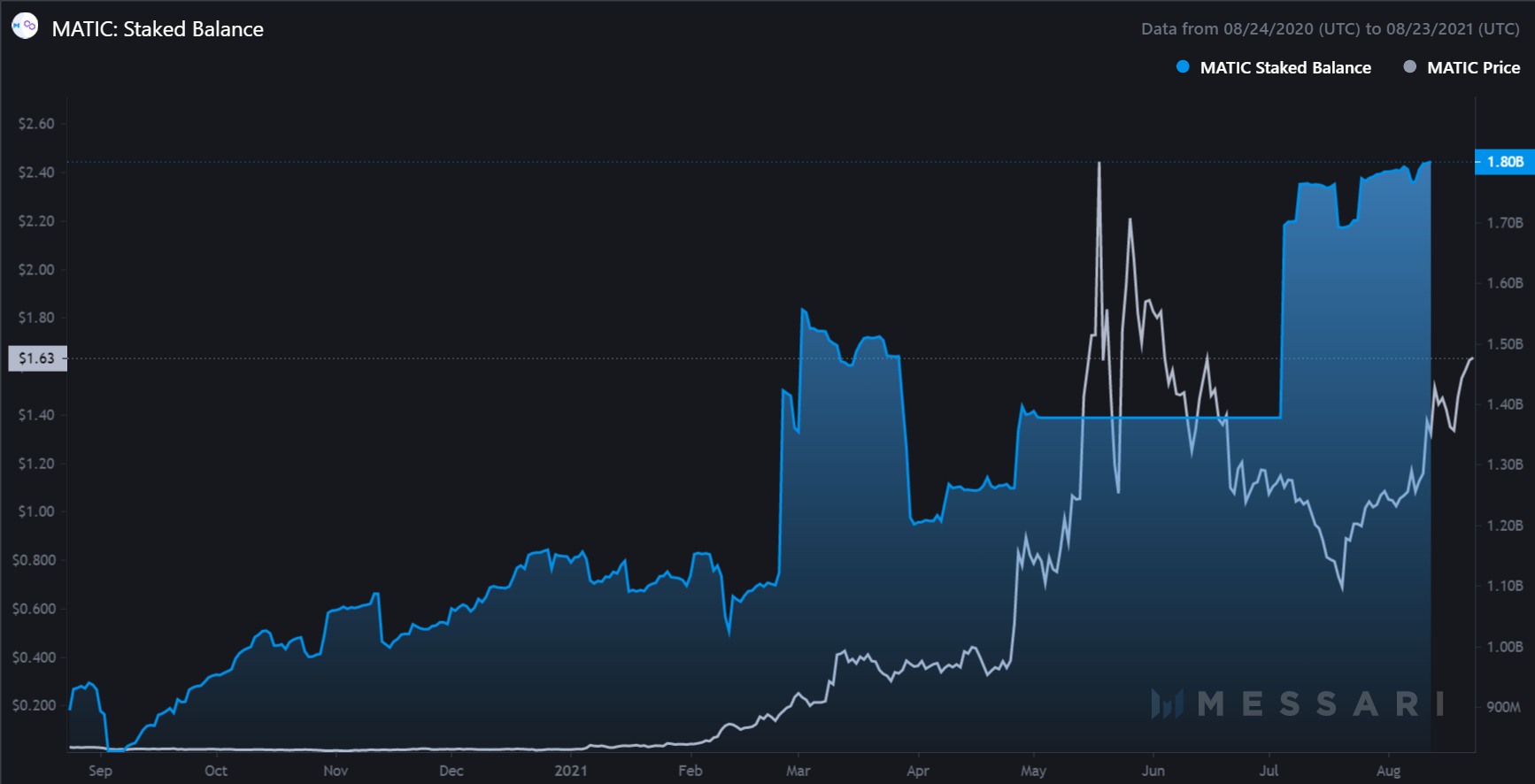

MATIC’s staking engaged balance, a metric that refers to the funds that have participated in staking activities within the network, is at an all-time high. This reflected the strength of the network.

Additionally, the altcoin’s active addresses have been on a downtrend over the last couple of months. Alongside recent price gains, MATIC has seen an impressive breakaway from this downtrend.

Source: Messari

While this diversion from the downtrend in active addresses is a good sign of a sustained rally, there seemed to be another sign which came to the same conclusion.

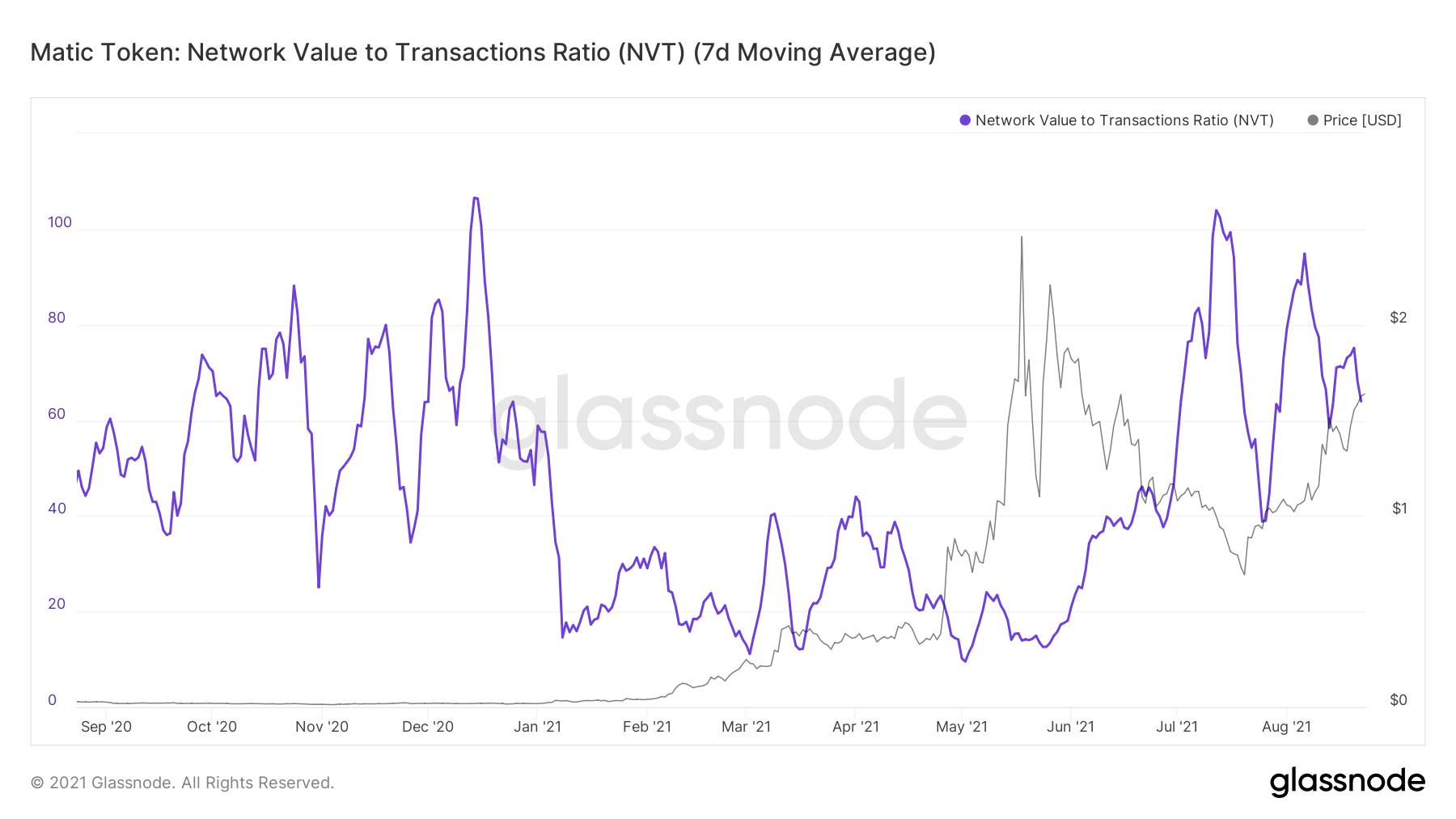

An inverse relationship can be spotted between MATIC’s NVT ratio and price. It is notable that the NVT ratio has been making lower peaks over the last month. While in general, this would mean that network value isn’t keeping up with greater usage of the network, in the case of MATIC, it’s a good sign.

Source: Glassnode

When NVT made lower peaks in April-May this year, the alt’s price soared and made an ATH. The same pattern was visible this time and if it pans out well, MATIC could see another ATH soon.

Furthermore, the Sharpe Ratio recently registered an ATH – last seen when MATIC’s price was at an ATH. Ergo, not only is the crypto generating positive ROIs, but it is also more “risk-free” now than any time in the last three months.

Traders beware

Even though most metrics flashed bullish signals for the alt, a minor pullback might be observed in the short term. This could be a result of a bearish momentum divergence in MATIC’s RSI on the four-hour chart at significant resistance.

Further, MATIC’s trade volumes on the daily chart were pretty low, and for MATIC to reach its ATH, a push from buyers would be required.