Crypto market’s weekly winners and losers – TON, NEO, W, UNI

- Toncoin, Neo, and LEO registered gains over most assets in the market.

- Core, Wormhole, and Uniswap topped the biggest losers chart.

The week ended on a tough note for the broader crypto market, as Bitcoin [BTC] almost slipped below $60,000 on the 13th of April. Despite the turmoil, some cryptocurrency prices were able to gain.

However, more projects saw their values shrink than those that gained. Here’s AMBCrypto’s list of crypto’s biggest winners and losers this week.

Biggest winners

Toncoin [TON]

Despite the turbulence that hit the market, Toncoin [TON] defied all odds and jumped by 19.47%. This helped the token to rise to the 9th position on the market cap standings.

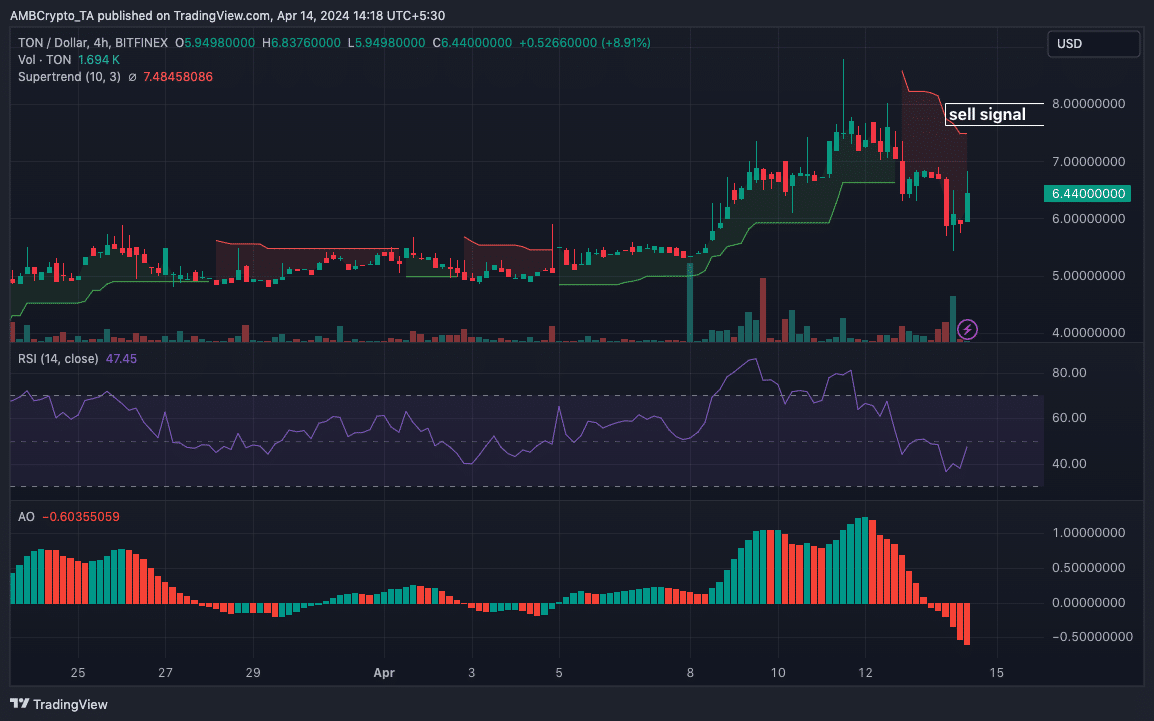

Though TON rallied toward $9 earlier, indicators revealed that it could be time for the token to step back.

For example, the Awesome Oscillator (AO) on the 4-hour chart was negative, suggesting increasing downward momentum.

The Relative Strength Index (RSI) was below 50.00, indicating that the momentum was bearish. Likewise, the Supertrend flashed a sell signal at $7.49.

Therefore, if TON rises toward that level, it could face some resistance and the price might decline.

Neo [NEO]

The price of Neo [NEO] increased by 10.21% in the just-concluded week. Though the value had decreased in the last 24 hours, the price rallied above $20 earlier.

At press time, NEO’s price was $17.11. There has also been a decline in its trading volume. However, if the volume decreases alongside the price, the downtrend could become weak, and sellers might be exhausted.

Should this be the case, NEO might experience a rebound in the short term.

UNUS SED LEO [LEO]

The massive downturn in the market meant a token like UNUS SED LEO [LEO] was one of the biggest gainers. At press time, LEO changed hands at $5.82, representing a 1.12% increase in the last seven days.

However, this was one of the lowest the token hit, as its price almost crossed $6 on the 11th of April. The last hours have also seen the value tried to bounce.

If it keeps up the momentum, LEO might surpass the $6 milestone within a few days.

Biggest losers

Core

Core’s [CORE] price dropped by a whopping 45.66% in the last seven days. This made it the worst-performing asset out of the top 100.

At press time, CORE changed hands at $1.41. But during the week, the value of the token went lower than that.

For instance, on the 13th of April, the price fell to $1.25 as selling pressure hit the broader market. Interest in the token has also declined, with the volume decreasing and the market cap shrinking.

Going into the new week, CORE might erase some of its losses, but a return above $2 might be unlikely.

Wormhole

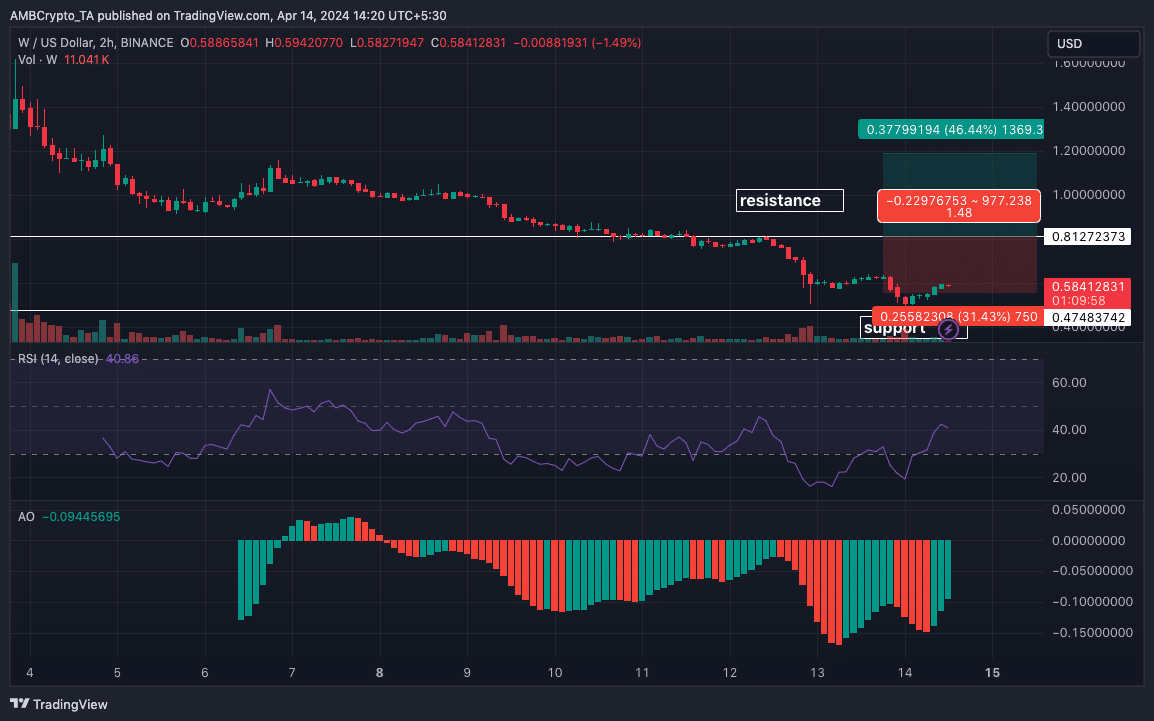

For the second week in a row, Wormhole [W] was one of the biggest losers. As of this writing, the price of the token was $0.59, meaning it had lost 44.57% of its value in the last seven days.

However, the technical perspective offered a glimmer of hope for Wormhole. At press time, AMBCrypto noticed that bulls had formed support at $0.47. This was what made the price increase to $0.58.

But an overhead resistance stood at $0.81. If bulls clear this path, W might rally toward $1.20. On the other hand, a breakdown could cause the price to drop below $0.50.

However, the RSI reading was rising, indicating that the bullish thesis might be valid as long as sellers do not neutralize it.

Uniswap

Uniswap [UNI] could not avoid being one of the biggest losers after the FUD it experienced during the week.

Previously, AMBCrypto had reported how the SEC warning caused panic in the market and triggered a wave of sell-offs.

Realistic or not, here’s W’s market cap in TON’s terms

As a result, UNI’s price fell by 35.19% within the last week. At one point, the value of the token plunged to $5.85. But it has been able to bounce off the lows, trading at $7.32 at press time.

Over the next few days, UNI might experience a bit of stability, but a harder push northward might not happen in the short term.