Crypto venture investments to worsen in 2023? Galaxy Research says…

- As per a Galaxy Research report, the downward market conditions prevalent in the cryptocurrency industry will likely continue into 2023.

- The number of deals and amount invested by venture firms into Web3 and crypto start-ups was a little over $30 billion in 2022.

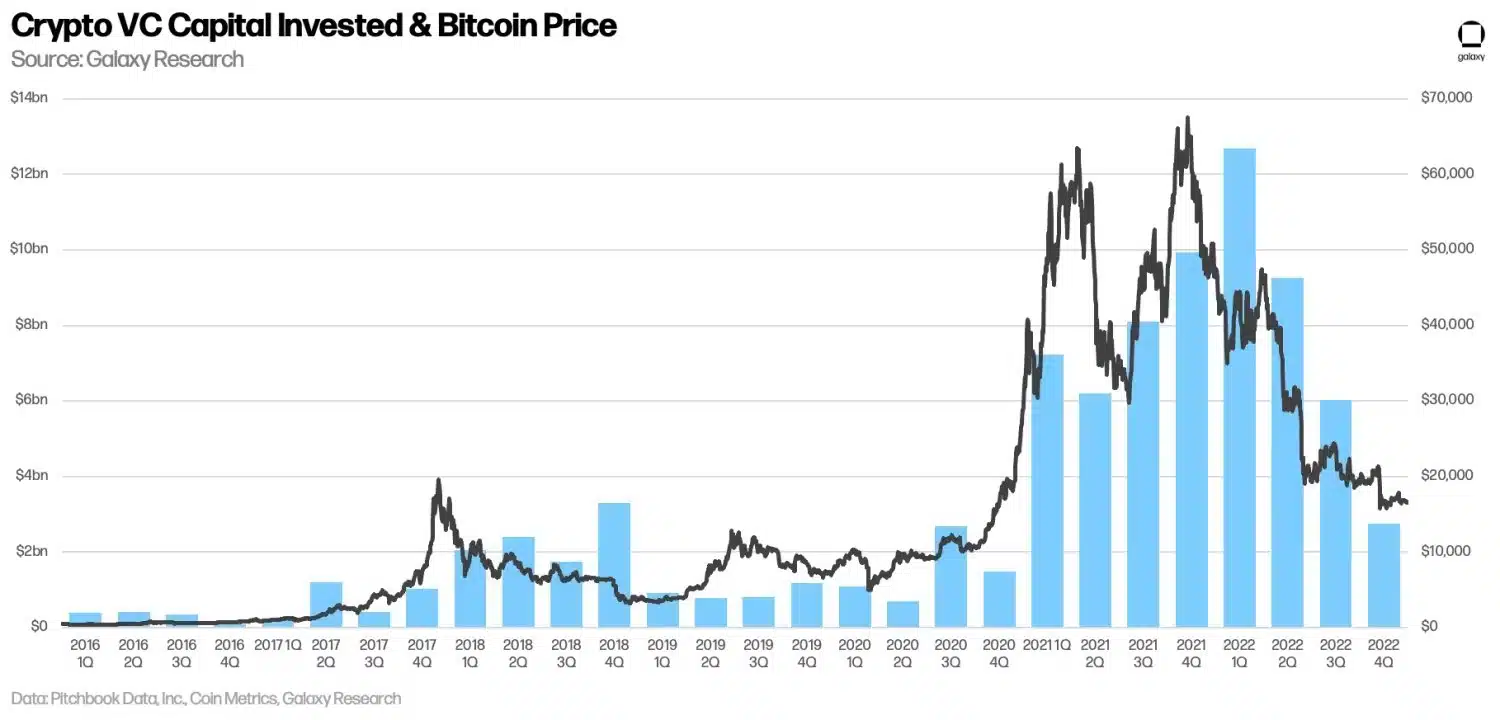

As per a report by Galaxy Research on 5 January, the crypto industry’s downward market conditions will likely continue into 2023. These market conditions have already led to significant investment pullbacks in the second and third quarters of the previous year.

Despite multiple high-profile meltdowns, there were significant venture capital investments in the crypto industry in early 2022, but it withered in the second half. According to Alex Thorn, the Head of Firmwide Research, funds may not flow as freely this year.

more than $30bn was invested in crypto startups by venture investors in 2022 across 2900 deals, an absolutely monster year that was only beaten by 2021. but that isn't remotely the whole story… pic.twitter.com/khduDKDZhd

— Alex Thorn (@intangiblecoins) January 5, 2023

The number of deals and amount invested by venture firms into Web3 and crypto start-ups was a little over $30 billion in 2022. There were 2,900 venture deals in 2022, though the fourth quarter saw the fewest deals and the lowest capital invested in two years.

Crypto and Web3 companies may have difficulty raising funds in 2023 if this trend continues.

How will the American regulatory policy impact the Crypto industry?

Declining company valuations and stricter investor demands will make fundraising more difficult for entrepreneurs. In 2023, startups will need to be laser-focused on fundamentals, lowering operational costs, and driving revenue.

The regulatory environment in the United States will also have an impact as the country continues to dominate the crypto-startup ecosystem. Last year, a US-based startup received over 40% of all crypto venture capital deals. The continued importance and its dominant position of the US in the crypto industry provide ample reason for American policymakers to clarify and codify rules and regulations for the emerging space.

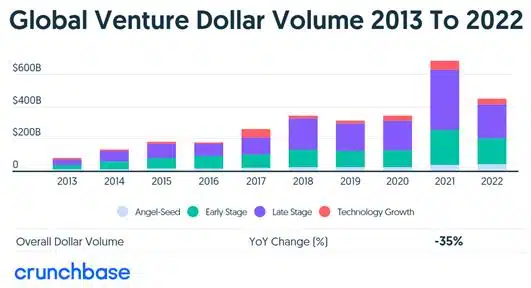

Crunchbase’s report on 5 January further predicted a slower 2023 for venture funding across all sectors. Global venture capital funding has dropped by 35% since 2021, down to $445 billion.