Curve Finance CEO sells off more holdings as deadline for hackers lapse

- Egorov has sold off CRV worth $57 million to repay debts.

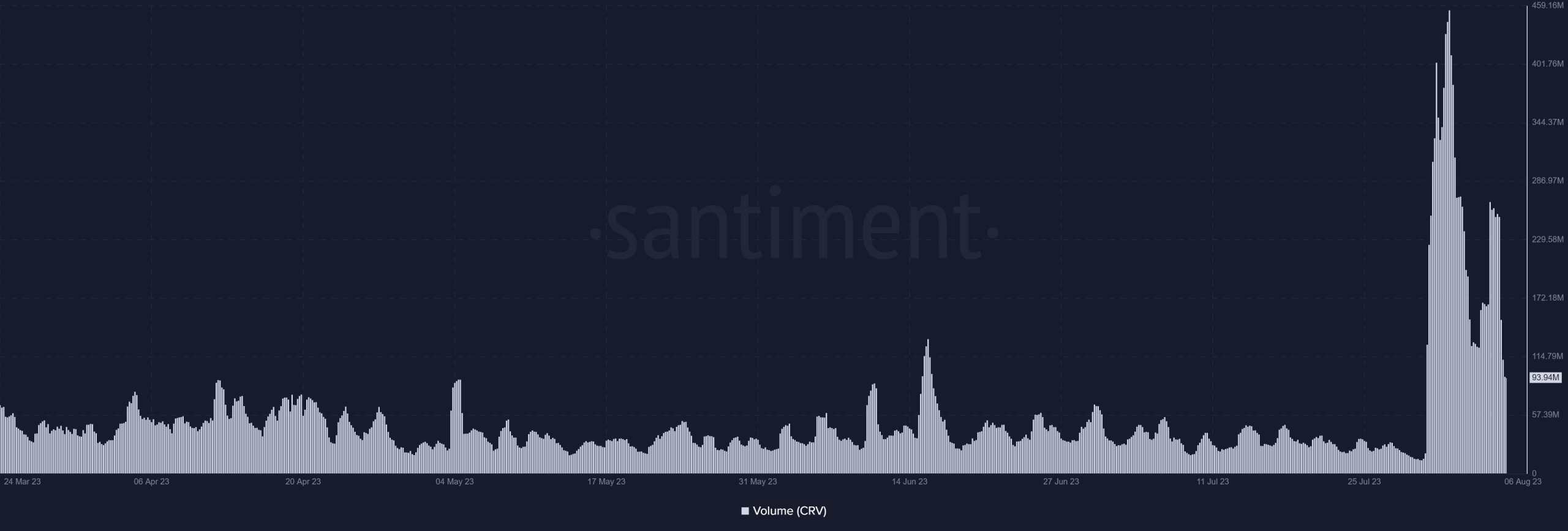

- CRV’s funding rate has climbed back to positive as volume remains high.

The fierce struggle to salvage Curve Finance after a recent hack rages on. As the spotlight intensified on the CEO’s debt involvement in the breach’s aftermath, he orchestrated moves to settle the debts. This was to prevent the platform from sinking deeper into trouble.

Read Curve Finance (CRV) Price Prediction 2023-24

Egorov moves to lessen Curve Finance’s exposure

The hacking incident on Curve Finance thrust the CEO, Michale Egorov, into the spotlight, exposing his current debt situation. Reportedly, he had millions of CRV tokens as collateral. Faced with the pressing need to safeguard his positions from liquidation, Egorov started selling his CRV holdings.

According to a recent post by Look On Chain, Egorov engaged in a strategic maneuver, selling a staggering $142.6 million worth of CRV to 30 institutions and investors through over-the-counter (OTC) channels, securing a favorable price of $0.4 per token. As a result of these transactions, he successfully obtained $57 million, which he promptly utilized to repay his debts.

Update:

The #Curvefi founder(Michale Egorov) sold a total of 142.6M $CRV to 30 institutions/investors via OTC at a price of $0.4 and received $57M to repay the debts.

He currently has 269.8M $CRV($166M) in collateral and $48.7M in debt on 4 platforms.https://t.co/8ozY1y5KrO pic.twitter.com/ITA08Fuf4f

— Lookonchain (@lookonchain) August 6, 2023

As it currently stands, Egorov retains a considerable amount of CRV collateral, totaling 269.8 million tokens, valued at an impressive $166 million. However, he still carries a debt burden of $48.7 million, spread across four different platforms. Despite the challenges, Egorov’s resourcefulness and resilience shine through as he navigates the intricate waters of financial recovery.

Curve Finance gets over 70% of its funds back

In response to the attack on Curve Finance and other affected protocols, a unique approach was taken to recover the stolen assets. On 3 August, a 10% bug bounty, amounting to $6 million, was offered to the hacker responsible for the breach. Surprisingly, the hacker accepted the offer and returned the stolen assets to Alchemix and JPEGd.

However, not all affected pools received the same level of restitution, as refunds were not completed for some. In light of this, Curve Finance announced a generous reward of assets valued at $1.85 million for anyone who could successfully identify the culprit.

Over $52 million has been returned as of now. Nevertheless, approximately $20 million is still yet to be recovered at the time of this writing.

Analyzing the CRV sentiment

When news of the hack emerged, Curve experienced a predominantly negative funding rate per data from Coinglass. This signaled that traders were betting on CRV’s decline amidst mounting selling pressure.

How many are 1,10,100 CRVs worth today

However, there is a glimmer of hope in the current situation, as a positive funding rate now dominates, providing a slight reprieve.

Moreover, the trading volume remained robust, indicating increased activity despite the recent events. As of this writing, the volume was over 93 million, lower than the staggering 400 million it reached on 1 August but still higher than before the hack.