DeFi tokens brace for Ethereum ETF decision: What’s at stake?

- The DeFi sector’s price chart performance was muted ahead of the ETH ETF deadline.

- Ethereum’s sentiment will affect the next price direction for most DeFi tokens.

The DeFi narrative has been trailing the meme coin sector for a while. At the time of writing, most DeFi tokens were under price consolidation before the Ethereum [ETH] ETF deadline this week.

As the home and pioneer of DeFi (Decentralized Finance), Ethereum sentiment can directly affect most DeFi tokens, such as Aave [AAVE], Maker [MKR], or Uniswap [UNI].

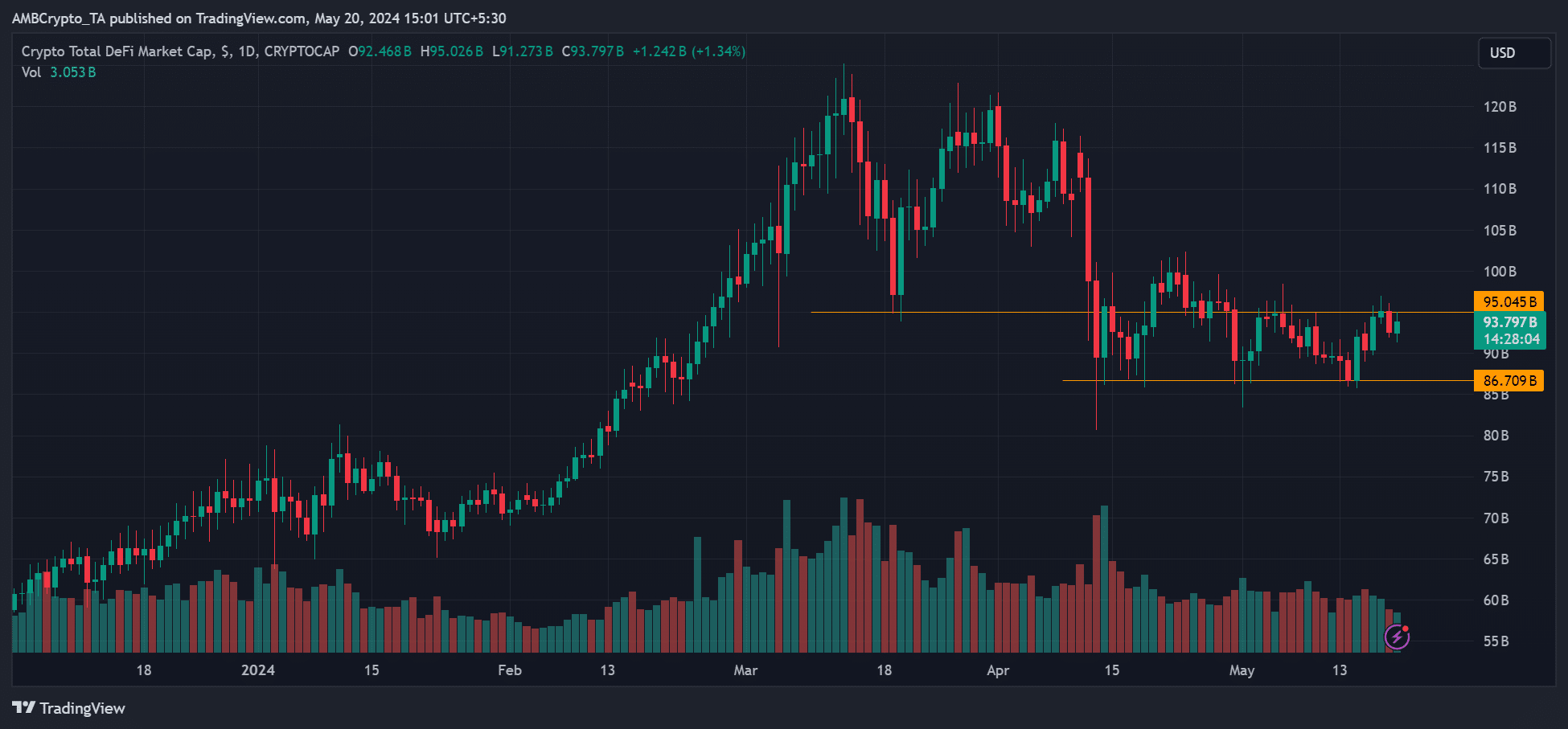

The DeFi market capitalization has dipped below $100 billion. Additionally, trading volume flattened over the past few weeks as approval chances remained below 25%, per Polymarket, a prediction platform.

After the drop in mid-April, DeFi has been constricted between $85 billion and $100 billion. This means most blue-chip DeFi tokens could have been in sideways movements.

DeFi tokens follows ETH’s price trend

ETH chalked the same price action and oscillated between $3300 and $2900 over this period, meaning that the DeFi tokens followed the king of altcoins.

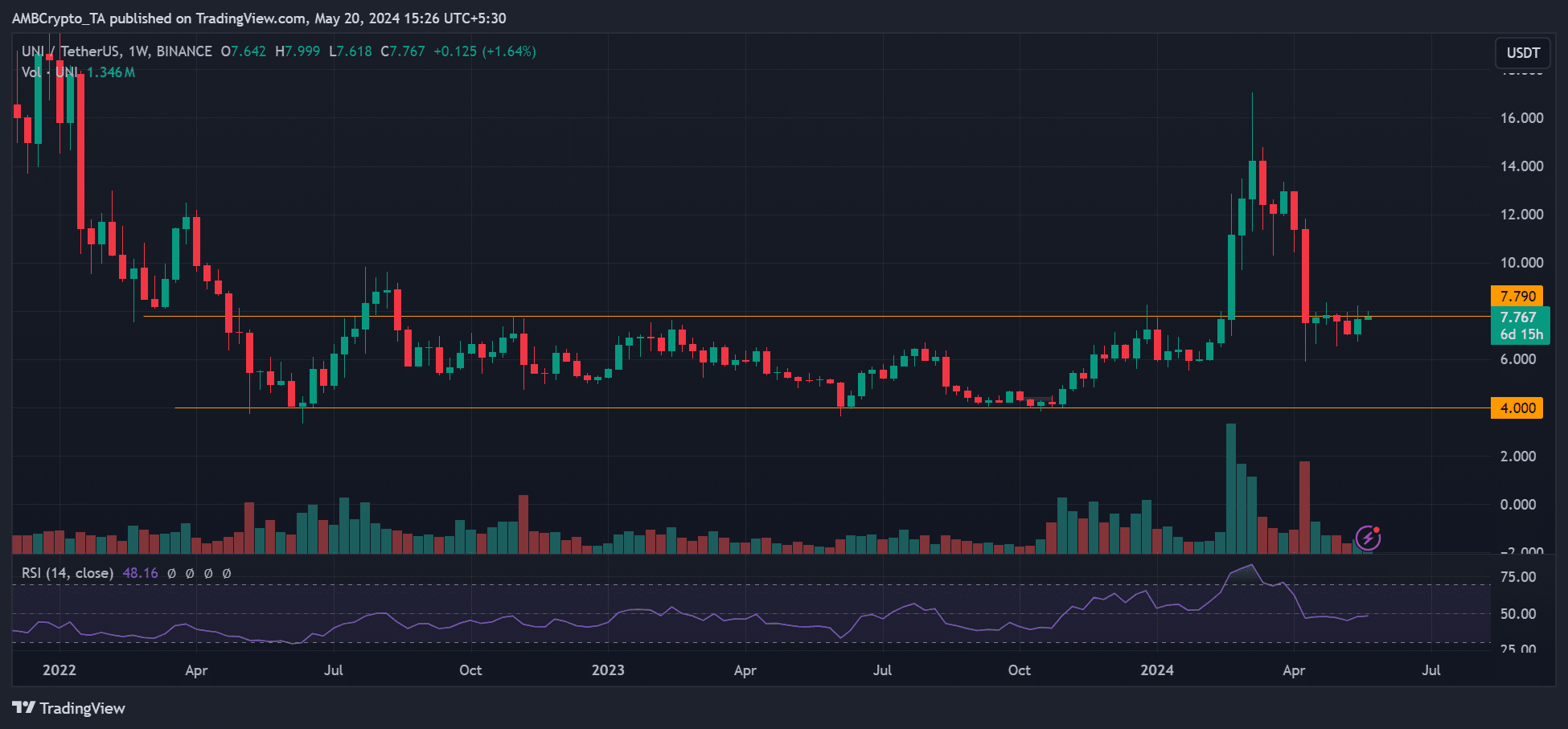

Uniswap, coupled with SEC’s Wells Notice, also retraced near January lows, effectively erasing most of 2024 gains. The DEX token was back in its 2022–2023 long-term range.

A similar weakened market structure was also present on MKR’s higher-timeframe price charts. The DeFi token dropped from $4K and hovered around $2.8K at press time.

Most of the top blue-chip DeFi tokens showed players were sidelined as they waited for the ETH ETF announcement, as shown by indecision or a sideways movement.

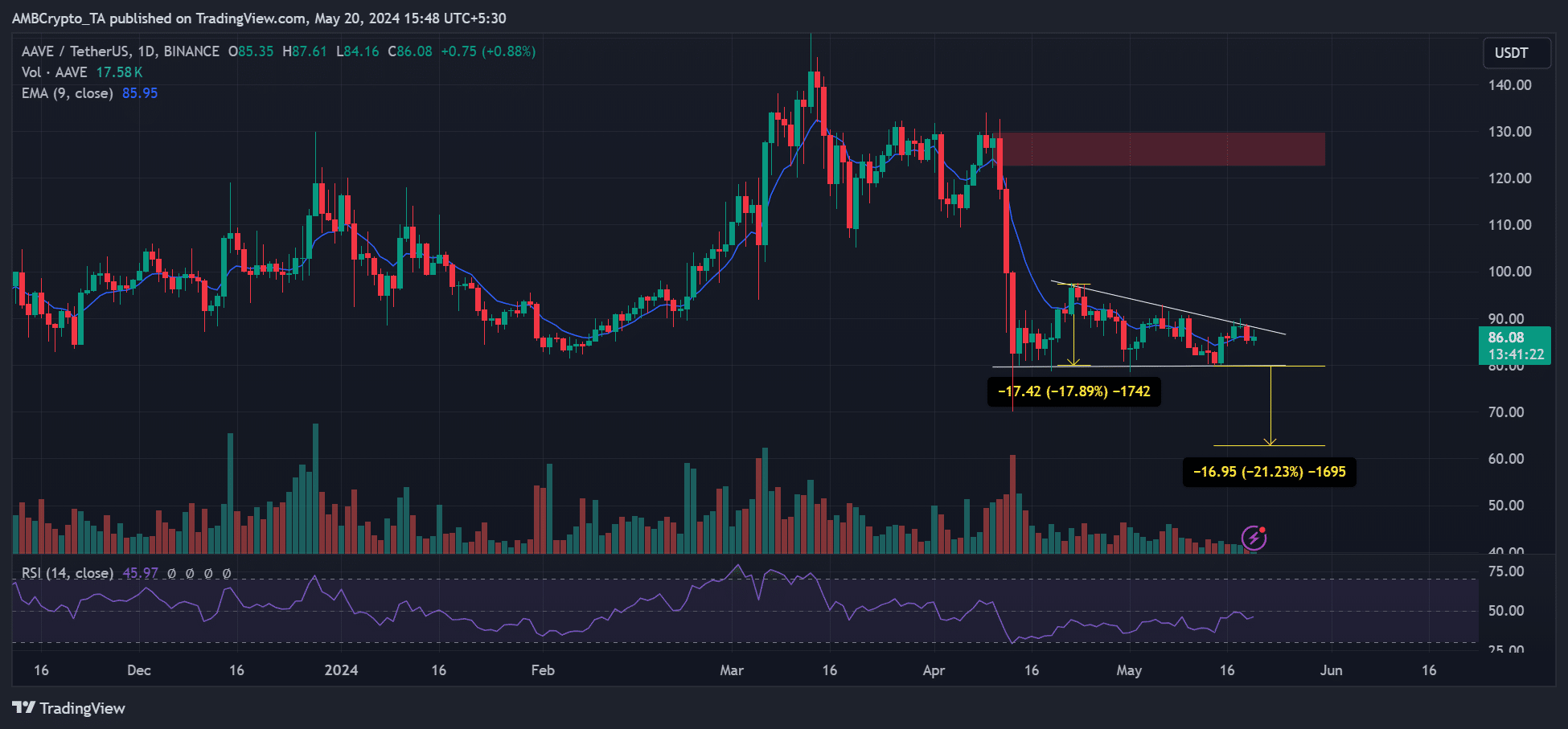

However, other DeFi tokens, like AAVE chalked up a bearish flag pattern, which could expose it to about a 20% drop if ETH ETFs are rejected.

Will ETH’s sentiment dent DeFi tokens?

The bearish pressure on some DeFi tokens could be made worse by the dip in trading volume recorded at press time. CoinMarketCap data revealed that DeFi trading volume sank by over 10% in the past 24 hours.

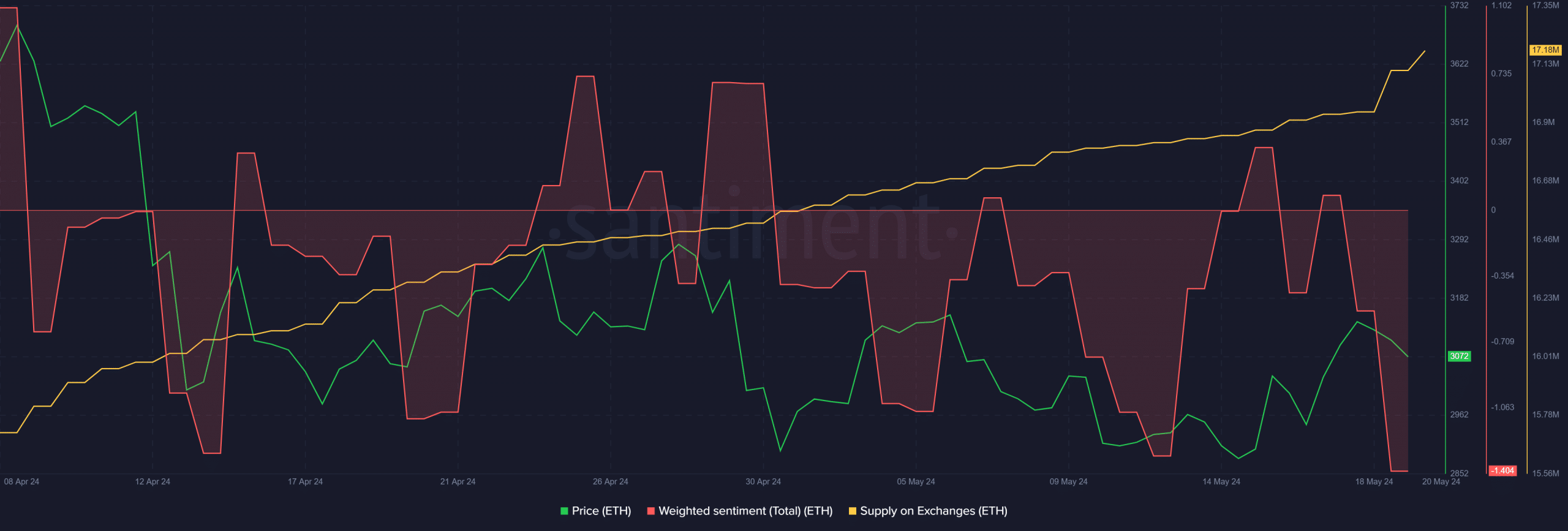

The negative Weighted Sentiment on ETH at press time could further constrain DeFi tokens’ upside.

With the ETH sell pressure-picking momentum, as shown by the spike in Supply on Exchanges, a rejection could lead to massive discounts across several DeFi tokens.

That said, the negative sentiment on ETH could derail the DeFi narrative and its tokens, especially if the SEC rejects Ark/21Shares’ application on the 24th of May.

However, in an unlikely ETF approval scenario, DeFi tokens could front a bullish breakout.