DeFi winter freezes TVL growth, but the road ahead could be better

- DeFi TVL marked a 70% downfall from the peak witnessed during December 2021.

- The technology began to evolve in accordance with the realities of contemporary market dynamics.

There is little doubt in admitting that decentralized finance (DeFi) has proved to be a vanguard of financial revolution in the new decade. The emergence of blockchain technologies, the disruptive narrative around decentralization, and the historic crypto bull market of 2020-21, played a big part in turbocharging the DeFi economy.

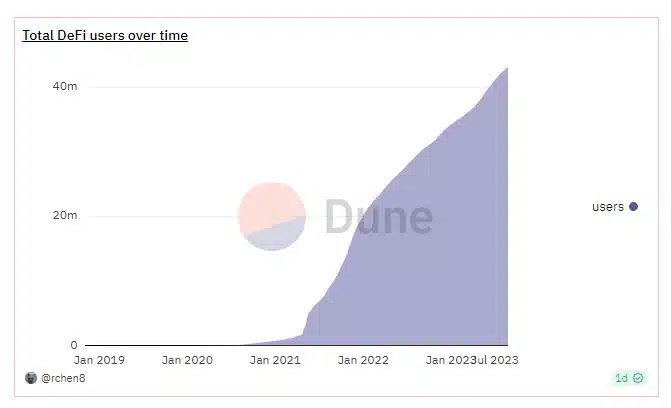

From a little over 80,000 aggregate users in 2020, the ecosystem has ballooned to accommodate more than 43 million at the time of publication, data from Dune revealed.

However, over the past year or so, this breakneck growth ran across a speed bump. The onset of the crypto bear market in 2022 scarred this burgeoning sector, from which it was yet to recover as of this writing.

DeFi winter freezes TVL growth

According to on-chain analytics firm IntoTheBlock, the total value locked (TVL) in DeFi protocols reached 2.5-year lows. Fresh data from DeFiLlama corroborated this assertion. The TVL at the time of publication was $62.75 billion, last seen during the first quarter of 2021.

Moreover, the TVL marked a 70% downfall from the peak witnessed during December 2021. Needless to say, the bear market of 2022-23 played a big part in unnerving DeFi investors, resulting in outflows of roughly $170 billion from the ecosystem.

TVL, or the total worth of all crypto assets deposited on smart contracts, remains the most popular indicator among investors. The locked-up capital is used for operations such as staking, lending, and liquidity provisioning on a DEX.

A higher TVL means more liquidity and therefore, higher chances of the project’s adoption and vice versa.

Even though the broader crypto market saw a spirited rebound in 2023, the value locked in DeFi witnessed a sluggish recovery. On a year-to-date (YTD) basis, the TVL grew by 19% compared to the global crypto market cap growth of 32%.

A tale of implosions and hacks

The sensational collapse of stablecoin Terra USD [UST] and its support coin Terra [LUNA] precipitated the crisis, leading to a sharp decline in token prices. This cascade effect led to markedly lower yields on deposits, in a stark contrast to the situation prevalent during 2021.

As depositors swayed away, the influx of tokens declined, leading to less perceived value for the protocol

Furthermore, the security vulnerabilities of the landscape eroded investors’ confidence. As per DeFiLlama, 2022 was the most notorious year in terms of DeFi exploits. Nearly 3.27 billion worth of crypto assets were stolen out of DeFi protocols in the year.

DeFi 2.0

DeFi may be going through a difficult period, but it began to evolve in accordance with the realities of contemporary market dynamics.

When yields on risk-free government debt were low, DeFi attracted depositors in hordes because of higher rewards. However, with yields touching record highs recently, DeFi has started to orient its game from depositors to borrowers.

According to IntoTheBlock, lending protol Aave [AAVE] offered enticing borrowing rates of 1-1.5% on its stablecoin GHO. As a result, the decentralized stablecoin breached $20 million in market cap and $60 million in collateral within a month of its launch.

Furthermore, popular stablecoin lending protocol MakerDAO [MKR], began diverting a part of its revenue earned through U.S. Treasury bonds to offer high yield to users of stablecoin DAI. This resulted in sharp demand for DAI in the following weeks as evident by the growth in circulating supply, per data from Glassnode.

Maker’s decision also indicated its strategy to incorporate more real-world assets (RWAs) into its DeFi operations. There have been several proposals among the MakerDao community to increase holdings of U.S. treasury bonds, aimed at diversifying DAI’s collateral reserves.

Recall that DAI was conceived as a crypto-collateralized stablecoin. However, the recent steps were intended to avoid the hazards linked with crypto-reserves that surfaced during the USD Coin [USDC] crisis of March.

In a nutshell, DeFi protocols embarked on a new wave of experimentation to attract investors. The bear market may be a difficult time for investment and value, but the reduced noise may ensure that developers build products and plans that are aligned with long-term growth plans.