Depegging debacle: Is DEI, hybrid algorithmic stablecoin, following UST’s footsteps

Following the decimation of Terra’s UST and a temporal depegging of Tether’s USDT, Deus Finance (DEI) is the latest to suffer the same fate.

The meltdown of the stablecoins

Currently valued at over $50 million by market capitalization, DEI is a hybrid algorithmic stablecoin from DEUS Finance, a DeFi Protocol.

DEUS Finance uses two tokens called DEUS and DEI. The former is the project’s native governance token, and the latter is its dollar-pegged stablecoin.

The depegging of the DEUS’ DEI can be attributed to the Protocol’s loss of over $30 million as a result of two flash loan attacks experienced in the last two months.

This, coupled with a decline in the price of the DEUS token led to a depreciation of the collateral value of the DEI stablecoin which pushed down the collateral ratio to 43%.

Last 48 hours

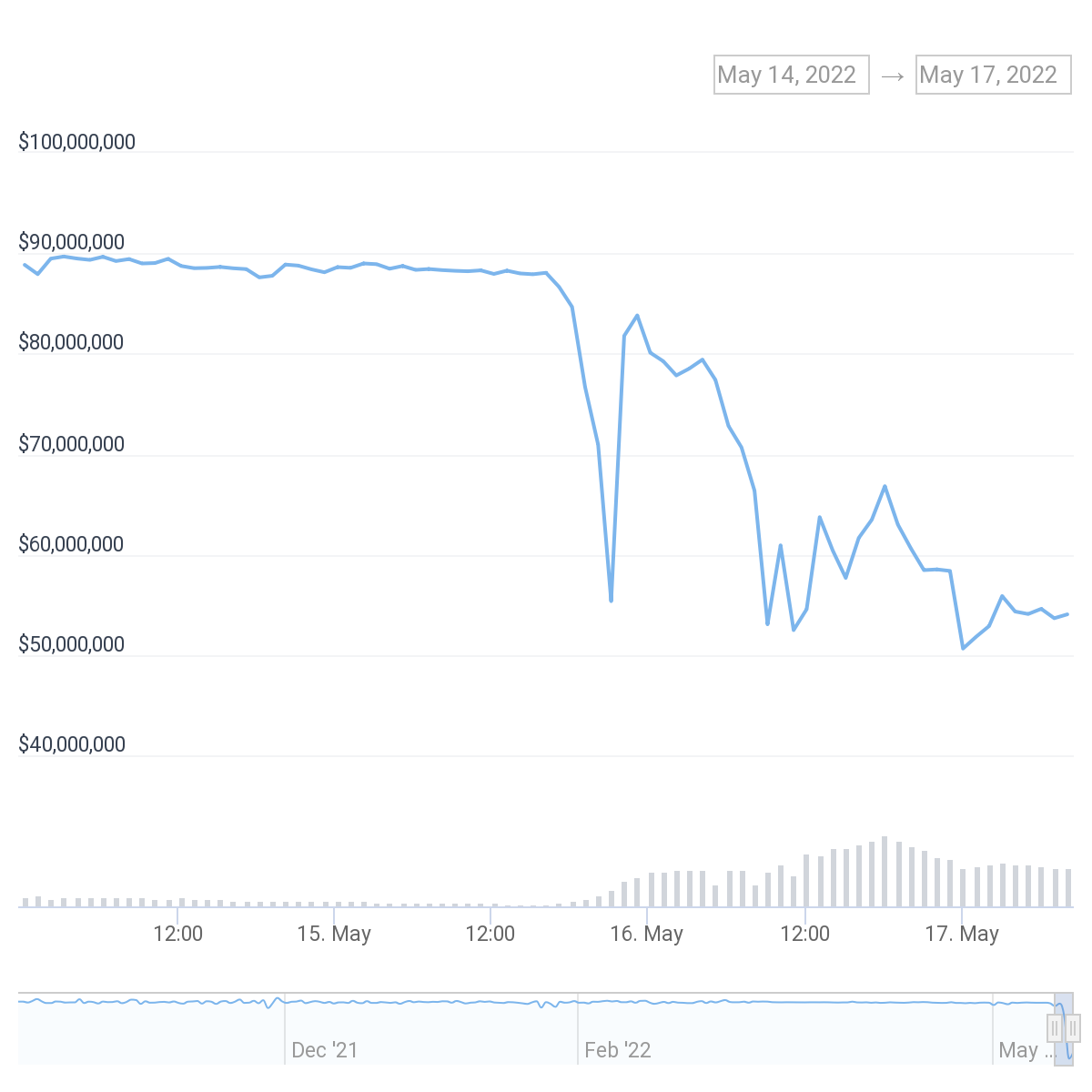

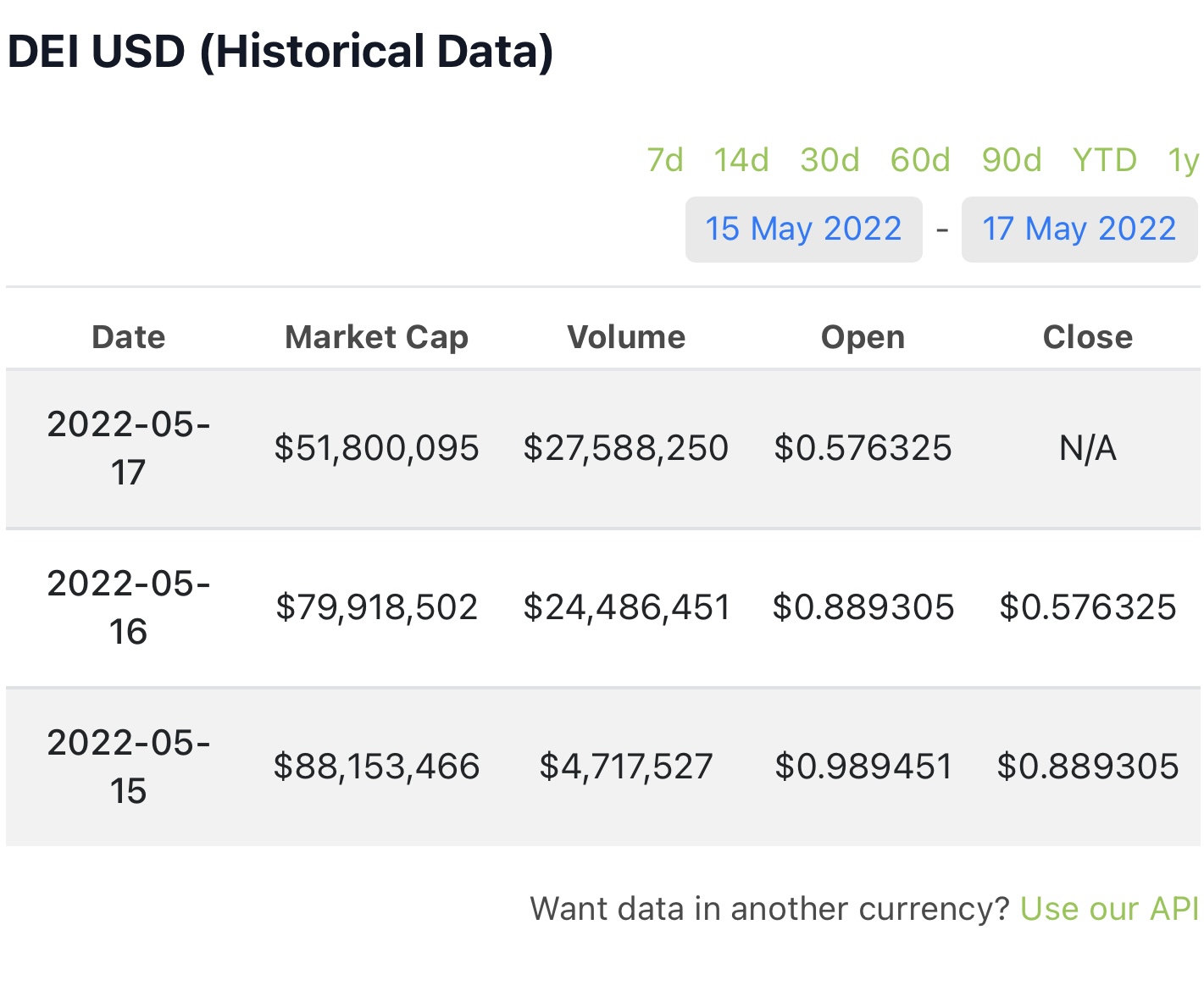

DEI’s depegging was first noticed on 15 May as the token traded three cents short of its $1 peg. By night, the token declined by an additional 17 cents as lack of liquidity on decentralized exchanges pushed traders to switch their DEI tokens for USDS. Increased FUD led several traders to distribute their DEI to hedge against risk and this further pushed down the price of the token.

At $0.6336, the token declined by 6% in the last 24 hours. At $0.6336 per DEI token, the token so far recorded a 36% decline from its $1 peg.

Similarly, before the depegging commenced on 15 May, the market capitalization for the DEI token was $88,844,548. Immediately, the depegging occurred and it declined sharply to $55,353,250, which was a 38% decline. With plans underway to ensure that DEI regains its peg, the market cap of the token stood at $56,093,053 at the time of writing.

Further to this, the last two days have been marked with significant distribution of DEI Token. Currently standing at $27,588,250, the trading volume for the token saw an 83% increase in just two days. Without a corresponding spike in price, this was only evidence of the increased selling pressure that had taken place.

With news of increased regulatory murmurs following UST’s and USDT’s depegging, regulators have once again been proven right as to why increased regulation is needed for the crypto space to thrive optimally.