Despite Arbitrum’s subdued performance, there are takers for ARB and here’s why

- The number of ARB holders has tremendously grown.

- The short to mid-term outlook remained bearish.

Arbitrum [ARB], having shown various attempts to recover from its massive plunge at launch, lost 16.58% of its value in the last seven days. Although the token is not alone in this line, the decrease indicated that it has been one of the worst performers of the top 50 in market capitalization.

Read Arbtirum’s [ARB] Price Prediction 2023-2024

Trust in the system

Despite its underwhelming show, the number of ARB holders continued to surge since 25 March. According to Token Terminal, the increase was exponential, helping the holder count surpass 640,000.

ARB tokenholders & DAUs pic.twitter.com/JPvGc6gjxE

— Token Terminal (@tokenterminal) May 11, 2023

This means that the total number of entities that have added ARB to their portfolio increased.

Additionally, a spike in this metric most times suggests that a token has massive potential to be profitable in the long term considering that the impact of increased accumulation might not be instant.

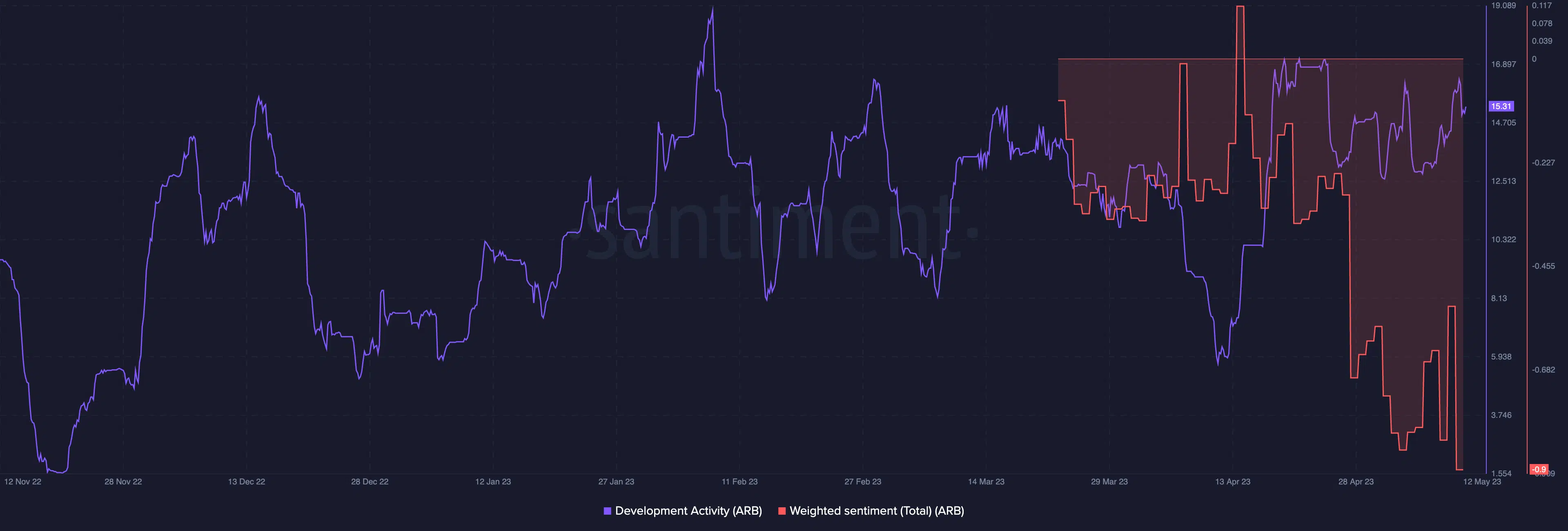

While the ARB hype might have shrunk, the same cannot be said of its development activity. The metric gauges the input of developers towards upgrades on a network. At the time of writing, Santiment revealed that the development activity was 15.31.

Although subdued, the current value remained close to the peak of February 2023. Hence, this shows that Arbitrum developer community was dedicated to the project’s objectives. In consequence, it could also make a case for a bullish run if sustained.

However, it was not an all-glittering state for ARB, based on the indications from the weighted sentiment. At press time, the metric was in its most unfavorable state since the token’s introduction into the market.

Since the weighted sentiment considers social volume perception, the decline implied that the fanfare around ARB was close to extinction. But if Arbitrum was to excel in the long term, the condition of this metric might need to turn positive.

ARB: Flushing down the charts

In terms of price action, ARB has not been able to dislodge the red, recording a 4% shrink in the last 24 hours. As per the four-hour ARB/USD chart, the 20-day Exponential Moving Average (EMA), in blue was below the 50 EMA (yellow).

Realistic or not, here’s ARB’s market cap in BTC terms

When there is a countertrend movement like this, it means that there might be no case for a short-term bullish trend. However, holders’ expectation of a rally could take longer than might be projected based on the technical outlook.

As of this writing, the 50 EMA crossed below the 200-day EMA (orange). Thus, there could be a struggle to establish a new uptrend within the time frame.

![Arbitrum [ARB] price action](https://ambcrypto.com/wp-content/uploads/2023/05/ARBUSD_2023-05-12_11-03-22.png.webp)