Despite ATH, Bitcoin Futures market ‘less exuberant’ than early 2021

Half a year after May’s crypto crash and the ensuing market carnage, an investor might assume that the king coin is stronger than ever. Furthermore, with the debut of the ProShares Bitcoin ETF which shot past $1 billion in Assets under Management (AUM) in less than three days, the BTC Futures market also appears to be flourishing.

However, fresh research offered another perspective and traders must take note of what’s different this time.

It’s just not the same

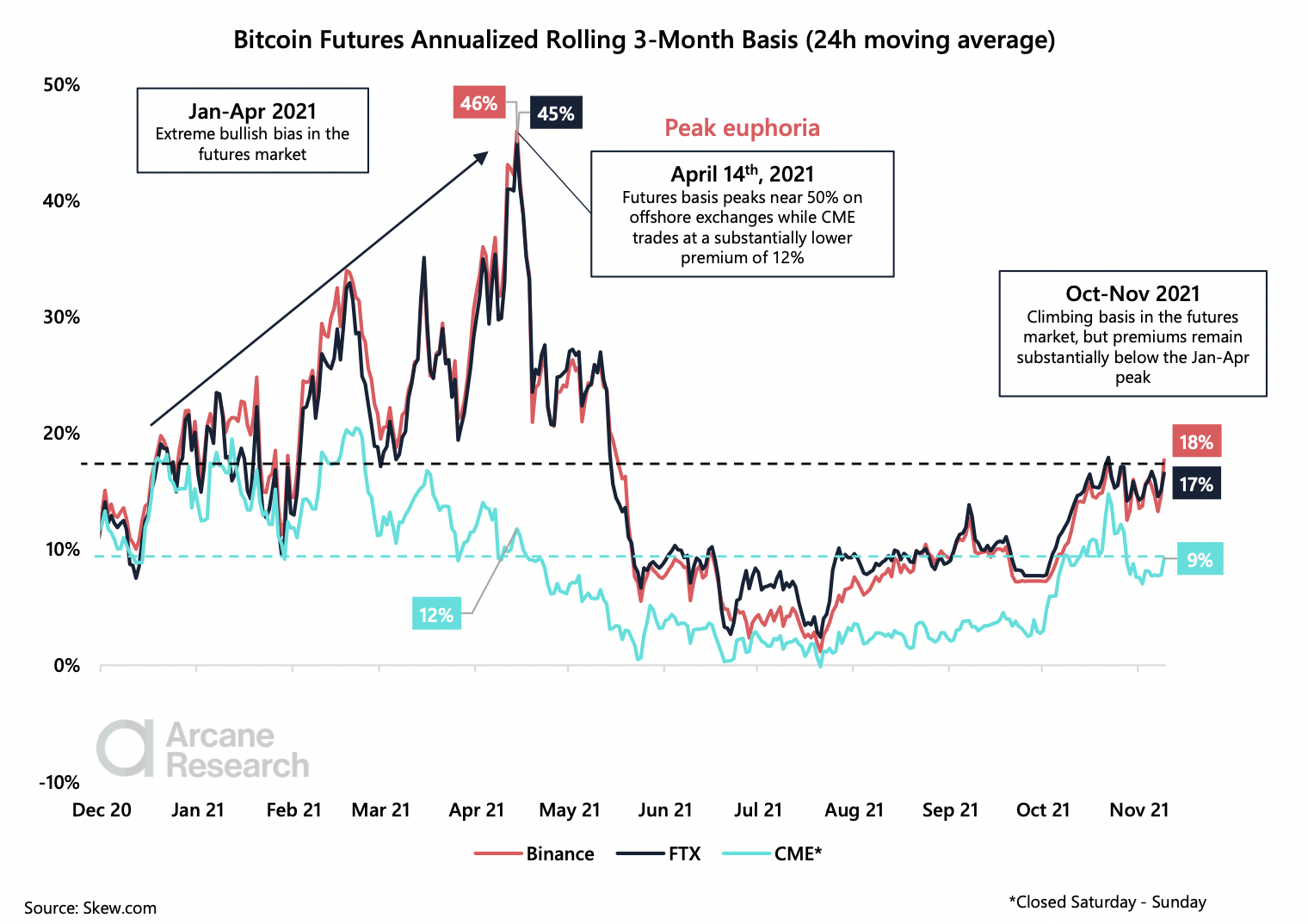

A report by Arcane Research showed that there was indeed quite a bit of optimism in the Bitcoin futures market. Even so, the report made it painfully clear, that the market is still far below the levels of euphoria recorded before the May crash.

The report claimed,

“However, as evident by the chart, the market is in a far less exuberant state today than what we saw throughout the first four months of 2021. The basis premiums are substantially lower.”

The report also noted that bullish bias of late wasn’t as strong as it was during the first two quarters of 2021.

Source: Arcane Research

What doesn’t kill you…

Why were traders so euphoric in April? It wasn’t just the spring flowers, was it? Well, as Bitcoin explored a new all-time-high and a certain dog-loving billionaire added to the hype, sentiments grew increasingly positive.

This was in spite of severe fluctuations in the assets’ basis which led to intense rises and dips. The peak was around 14 April, when the 24 hour moving average basis premium came close to 50% on offshore exchanges.

One thing to note here, was how following the China and Tesla FUD struck the bullish investors. The worst affected included traders who depended on huge portions of borrowings from brokers – or leverage – thinking that the king coin was safe on its throne.

After the liquidations, futures basis ran low during the summer, but with the SEC seemingly approving a BTC ETF, they are on the rise once more.

What’s the takeaway? The report stated,

“While the gap between CME’s basis and the offshore exchanges is growing, the market is definitely in a far healthier state today than when bitcoin traded above $60,000 earlier this year.”

Mark your calendars

14 November should reveal whether the SEC will say yay or nay to VanEck’s spot-based Bitcoin ETF.

Though the SEC reportedly rejected Valkyrie’s leveraged Bitcoin Futures ETF, there are nine or so more applications waiting for a verdict. No doubt, the coming months will be emotional for traders either way.