DOT may move to double-digits soon thanks to this Polkadot staking protocol

Bifrost finance, a leading parachain on Polkadot [DOT], posted a tweet on 18 September. The tweet stated that Polkadot’s new staking protocol witnessed considerable growth with 121,551 vDOT successfully minted (tokens). And all this just within 30 hours of the launch of vDOT.

However, the question remains: Will the success of this protocol impact DOT’s prices?

The vDot protocol is a Staking Liquidity Protocol (SLP) protocol launched by Bifrost Finance. The intent for the launch was users enjoying benefits. These include staking rewards as investment revenue from the liquid vDOT. Furthermore, accumulate raindrops during the campaign period, thus bringing rewards, such as airdrop dividends and inclusions in the NFT whitelist.

Polkadot “DeFi’s” the odds

The growth of Polkadot in the DeFi space can be considered as an interesting one. And Bifrost has been paving the way for Polkadot’s growth. Bifrost’s overall Total Value Locked (TVL) saw a massive spike from 26 August and the TVL’s momentum has stayed put since then.

Although the TVL saw a depreciation of 12.32%, it appears that Bifrost’s DeFI momentum will continue to be positive.

However, despite Bifrost’s performance in the green, other Polkadot protocols, such as Acala and Stafi haven’t been witnessing the same kind of growth.

Polkadot’s protocol, Stafi, witnessed a depreciation in its total TVL since 11 August. Stafi’s TVL went on a downward trajectory and was down by 10.07% as of 19 September.

Furthermore, Acala too didn’t witness much growth and went from its high of $1.62 billion to $46.06 million aas of 19 September.

Some more developments

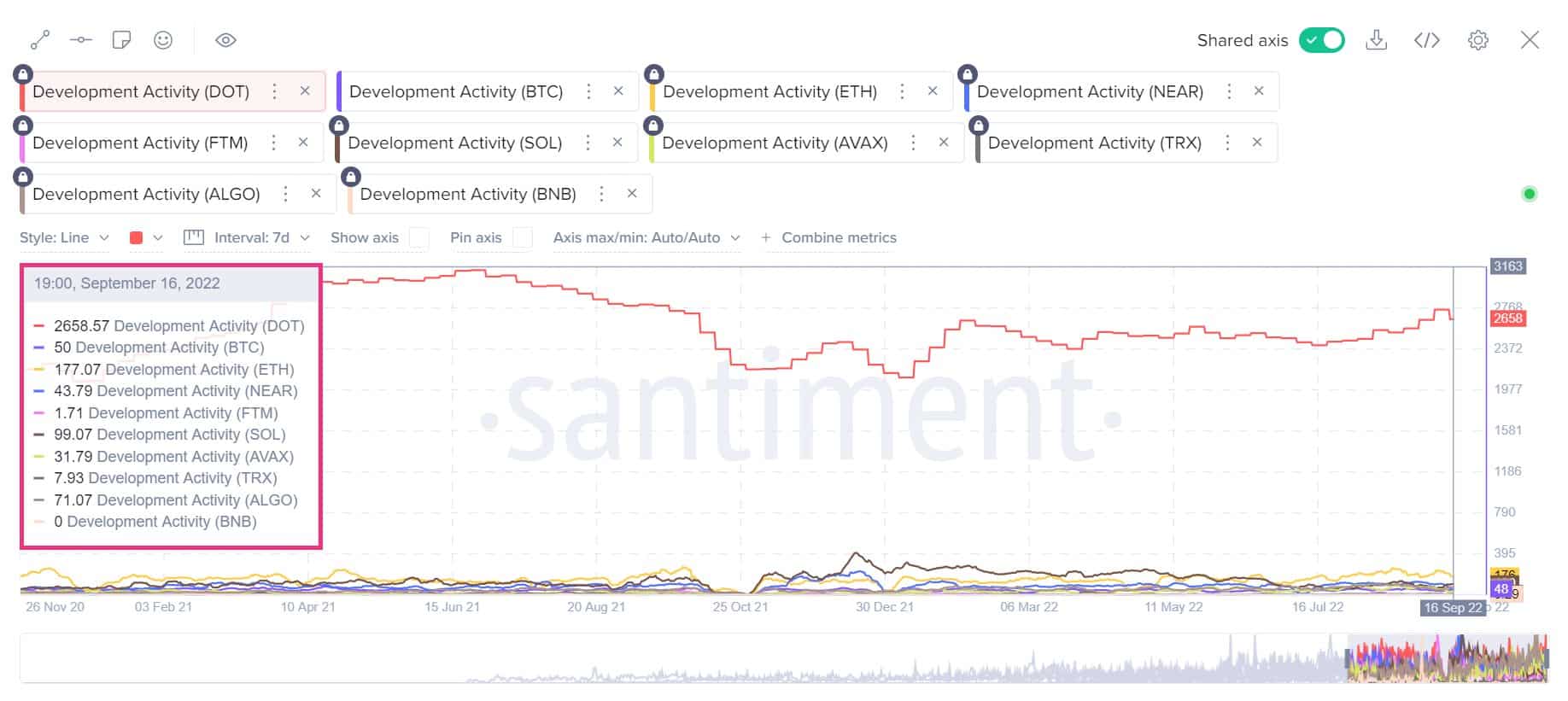

Polkadot’s developers have been seen to have topped last week’s charts with regards to development activity. Furthermore, DOT’s developers outranked major competitors. such as Ethereum, Tron, and Solana in this category.

This could be considered as a positive indicator for investors as this update implied that the Polkadot team has been consistently trying to upgrade and update their current technology.

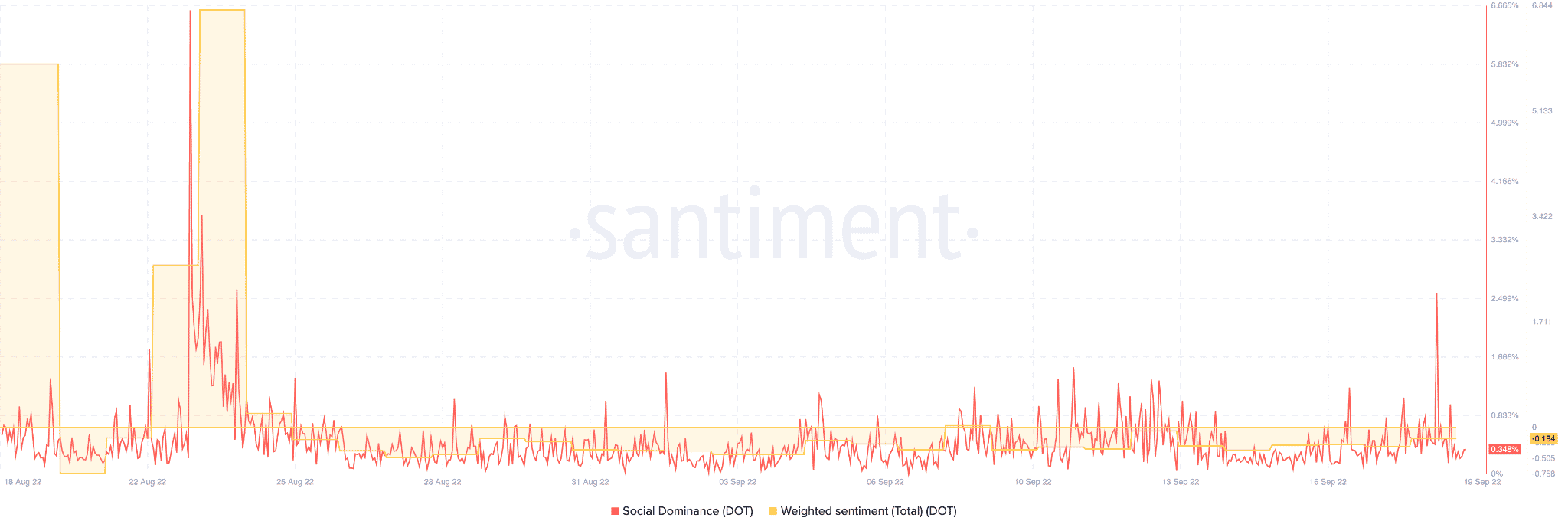

However, Polkadot hasn’t managed to make a positive impact around the social media landscape and witnessed a drastic drop in social dominance since August. It’s weighted sentiment stood at -0.184 at the time of writing. This suggested that the public outlook on the coin has been slightly negative.