EOS, BAT, Ethereum Classic Price Analysis: 25 September

The last 24 hours saw buying pressure dip across the board. This contributed to major altcoins dipping on their respective charts.

While EOS was close to trading at its multi-month low, at press time, BAT also fell by 6.8% and saw chances of low price volatility. Finally, Ethereum Classic flashed bearishness and the chance of a price reversal.

EOS

EOS declined by 7.2% over the last 24 hours and was trading at $3.99. The support line for the altcoin rested at $3.73, which also marked the multi-month low for EOS. On the four-hour chart, the price of EOS was below the 20-SMA line.

The Relative Strength Index was below the 50-mark. This meant that selling strength preceded buying pressure in the market. Parabolic SAR’s dotted lines were above the candlesticks, with the same noting the beginning of a downtrend. Finally, the Chaikin Money Flow was above the midline and pointed to positive capital inflows.

On the other hand, if the price rises, EOS can meet resistance at $4.37. Other additional price ceilings lay at $4.96 and at $5.68.

Basic Attention Token [BAT]

BAT saw devaluation over the last 24 hours, with the crypto falling by 6.8%. BAT’s technical indicators too pointed to negative price action.

The Relative Strength Index was below the half-line as the crypto has been struggling to revive its buying pressure. MACD underwent a bearish crossover and flashed red histograms. Bollinger Bands showed slight convergence, with the price volatility likely to decline soon.

If BAT moves up north, the price of the altcoin can hover around the resistance level of $0.661. Additional price ceilings lay at $0.734 and at its one-week high of $0.846.

Ethereum Classic [ETC]

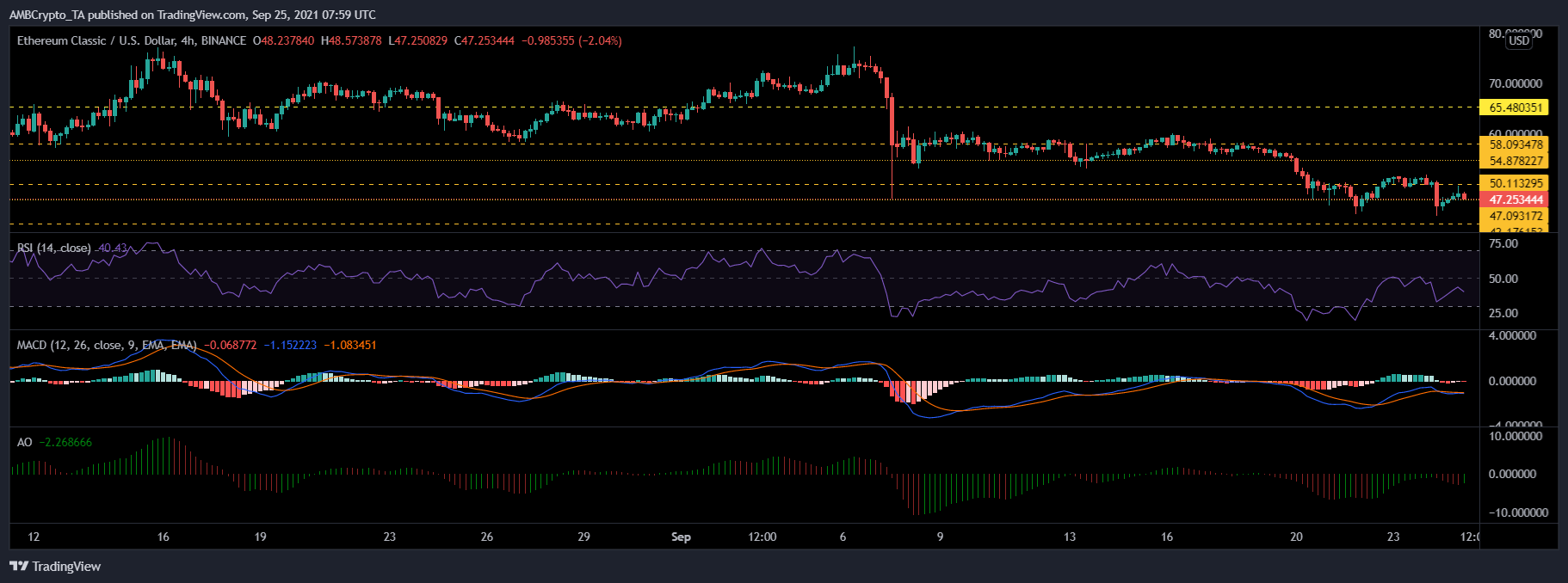

Ethereum Classic met with a sell-off and depreciated by 4.5% over the last 24 hours. It was priced at $47.25. It could encounter support from the $47.09-level. Ethereum Classic’s price action remained bearish as per the indicators.

The Relative Strength Index was below the 50-mark and indicated declining buying pressure. MACD flashed red histograms. Awesome Oscillator displayed red histograms, although the last green bar suggested that the price could reverse itself.

The price reversal could push ETC to test $50.11 and then revisit $54.87. The other additional price ceilings were at $58.09 and at $65.48, respectively.