Equalizer: Changing the financial system with flash loans

The DeFi (Decentralised Finance) marketplace is becoming more and more popular as it is expanding significantly. A flash loan is a relatively newer type of lending that is popular on DeFi platforms and lets the borrowers take a loan for a very short period of time without any collateral to carry out specific tasks.

Pain points of the current lending system

A loan system has been around for a very long time but the basic concept remains the same, a creditor/lender lends an item or asset to a borrower in exchange for the redemption of the principal sum.

All institutional loan systems have three main characteristics namely the term, lending default risk, and the rate of interest. Although the system has evolved with time one of the main issues faced in the system is that of the structural weakness due to the centralized nature of the creditor. The need for pledges and high risks are still a problem that needs to be solved for the traditional loan system.

Decentralized lending has prospered with the advent of blockchain especially with the introduction of smart contracts. DeFi has further evolved the idea and provides users conventional banking services such as loans, asset trading, savings, and checking account in a decentralized manner.

Flash loans offer a solution to the problems faced by the current loan system with its no collateral and instantaneous process. They allow a user to borrow funds and repay them with the interest without any collateral within the same blockchain transaction.

Characteristics of flash lending

Flash loans enable a user to borrow an amount instantly without any collateral with the sole condition that the liquidity would be returned back to the pool within one transaction block. If the borrower fails to return the amount, the entire transaction is reversed to undo the actions that were executed until that point, this is done by utilizing smart contracts.

There are a few key differences between traditional loans and flash loans-

- Lenders are at no risk in the case of flash loans. The two major risks faced in the case of traditional loans are the possibility of a default from the borrowers’ end and an illiquidity risk, both of these are eliminated in the case of flash loans.

- The size of the loan is limited by the funds that are available rather than the user’s solvability. Since the lenders have zero risks and no opportunity costs, flash lending can have a lot of use cases.

- As mentioned earlier, the lenders do not face any risks and therefore the need for any collateral is eliminated.

How can flash loans be used?

Flash loans can have multiple use cases that could prove beneficial for the lenders, borrowers, and the DeFi ecosystem.

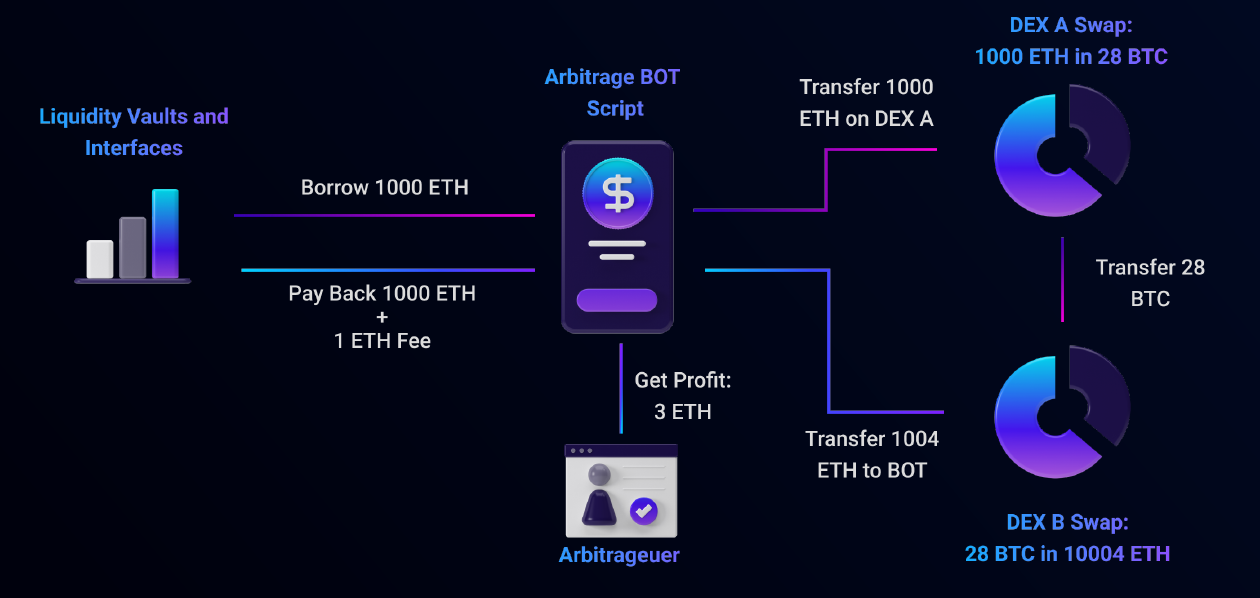

- Arbitrage– One of the most common use cases of flash loans is arbitrage. Even after considering the market slippage, liquidity, transaction fees, and any interest fees, flash loans’ innate characteristics prove to be beneficial in this case.

Source: Equalizer Whitepaper

-

- Flash minting– The idea behind flash minting is to allow instant minting of an arbitrary amount of any asset which would exist only during one transaction and is burned at the end of that transaction cycle. Flash minting takes into account the fact that cryptocurrencies are either inflationary or deflationary in nature. This use case is still under development and can be explored more in the future.

- Self-liquidations and liquidations– Liquidators do not need to hold any volatile stocks in fact they can flash borrow from a major platform, payback on behalf of the borrower, release the deposit, swap it for the token in which the flash loan has been taken, pay back the loan and gain bonus. The process sounds very elaborate however all these steps are performed automatically with the flash loan contract.

- Loans refinancing– Users could use flash loans to follow a better rate of interest and unlock the Vault without any external capital.

Creating the future of flash loans

Although there are platforms that offer flash lending as a service it is usually seen as an additional service. Since these platforms are not focused on the aspect of flash loans especially, they have very little in terms of the scope of flash loans that they offer. Creating a platform that is focused on it as a central principle was the main idea behind Equalizer.

Equalizer is a one-of-its-kind flash lending platform that was designed specifically for countering the barriers faced by its predecessors and perform the key function of flash lending.

The platform is built on a scalable infrastructure which helps it handle the rising trading volumes of the decentralised network.

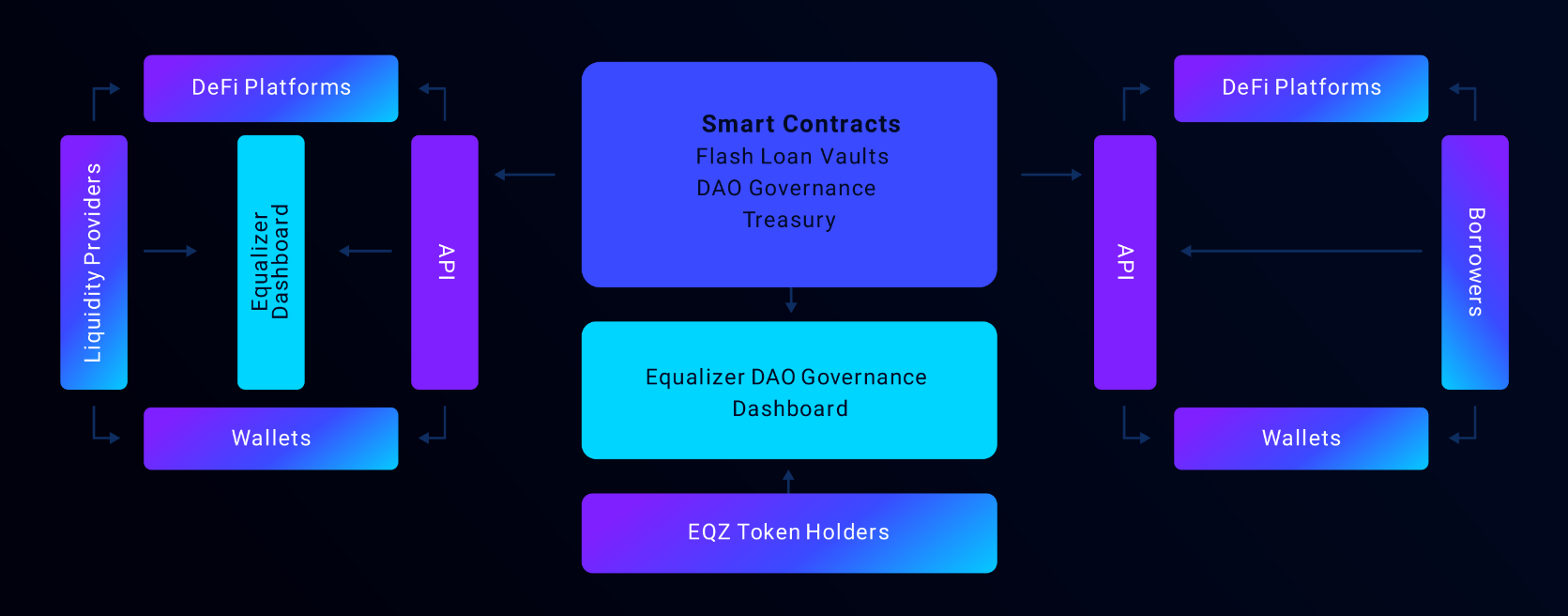

Source: Equalizer Whitepaper

Equalizer brings liquidity providers and borrowers together in their flash lending marketplace. The liquidity providers are provided incentives in the form of passive income of the same token they provide as liquidity and are also given Equalizer governance tokens proportionate to their lending duration and funds. Whereas the borrowers get access to a number of highly liquid tokens that can be used to trade, execute market-making activities, and make profits off liquidation opportunities.

Equalizer considers flash loans as not just a tool but also as a valuable component that could facilitate growth and stability in the DeFi ecosystem. Their goal is to become pioneers in bringing reliable and inexpensive flash lending services to DeFi.

The platform has been designed incorporating a multi-chained and cross-chained infrastructure which helps it multiply the number of tokens listed as each chain has its own tokens. Thus, Equalizer has no limitations on the number of tokens listed on it with regard to a particular chain.

Equalizer’s business model

Equalizer is focused on providing its users with one core service of flash loans. Due to this, they get the flexibility to adapt to market conditions in the future and scale horizontally across multiple chains and bigger volumes vertically.

Since Equalizer is dedicated to the cause of flash loans entirely their focus is also on creating a community-driven platform that is based on instant governance.

Source: Equalizer WhitepaperLiquidity providers on the platform get access to a safe vault without any risk of losing their funds in addition to profits depending on how much the vault is used. They also get a chance to be a part of the platform’s governance protocol. As for borrowers, the Equalizer platform provides for a reliable and easy-to-use platform that is specialized in flash loans.

Conclusion

While flash loans are gaining popularity as a relatively new and lucrative concept that is being provided by DeFi platforms to their users, a platform dedicated entirely to the idea aims to make the process simpler and more profitable for both the liquidity providers and the borrowers.

Equalizer recognizes the potential of flash loans and its main aim is to develop itself and become a pioneer in the DeFi ecosystem with regard to it. Since it is built over a scalable infrastructure, Equalizer can handle the increasing demands of lending and borrowing in a decentralized manner. With the growing use cases of flash loans, Equalizer will look into tapping into the potential of flash loans and become a pioneer in DeFi.

For more information check out their website.

Disclaimer: This is a paid post and should not be treated as news/advice