ETH vs. BTC: A change of scenario in the futures market has left BTC at #2

Bitcoin [BTC]‘s ever-dominating rise in the spot market (market cap) has left all rivals behind by a margin. Ethereum [ETH], the closest rival still has miles and miles to go before it could catch up with the king coin.

However, what would happen if we change the battleground to the futures (market) instead? Here’s how the tables have turned this year when comparing BTC and ETH.

All in the name of Merge

The upcoming Ethereum Merge has created a positive hype around the network and the future it holds. The much-anticipated Merge would lead to a reduction in ETH issuance and bring a store of value appeal to the asset.

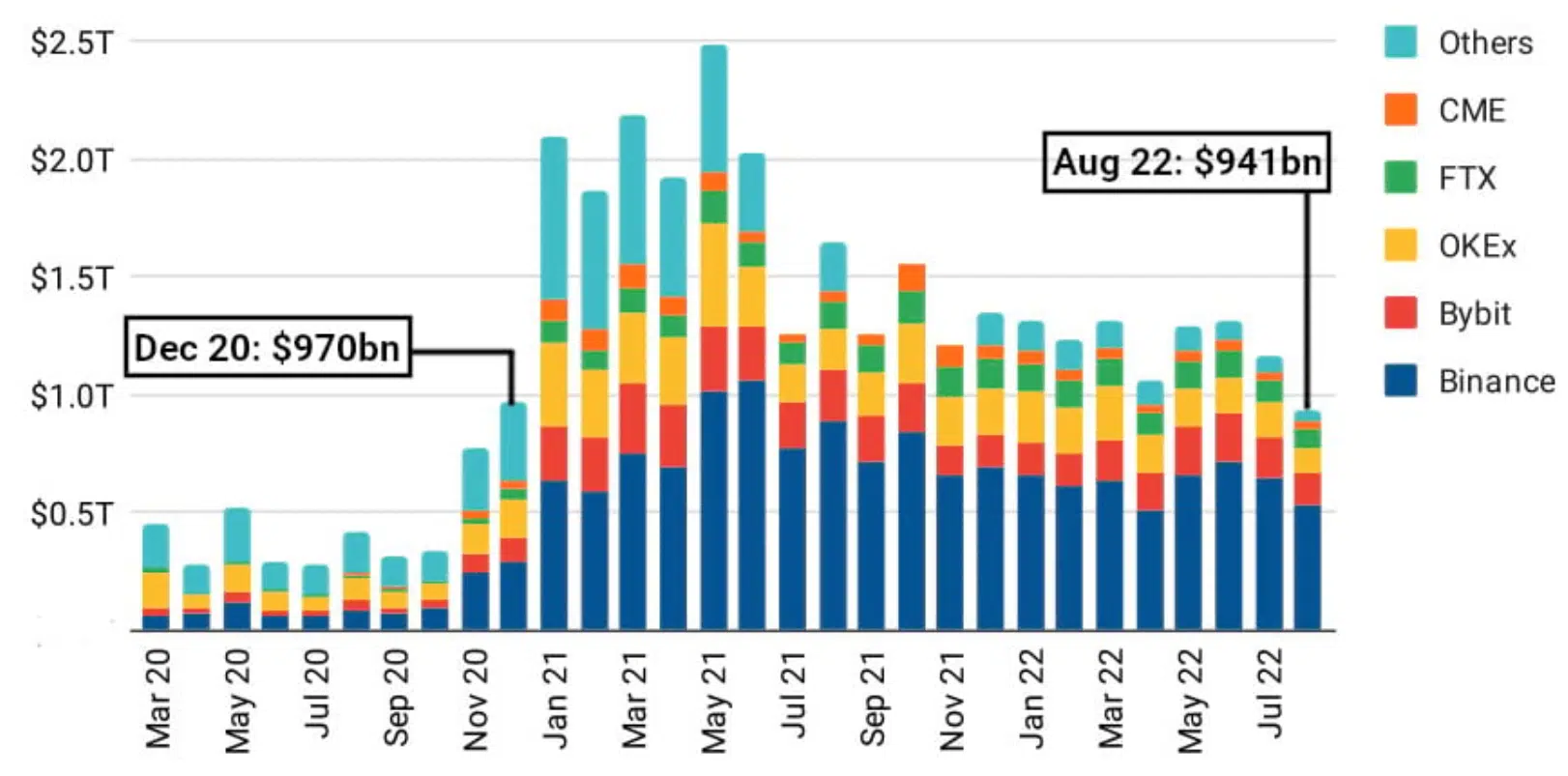

The futures markets have hit a $1 trillion market capitalization following the hype as per new a report from Tom Rogers, head of research at ETC Group. While doing so, Ethereum Futures surpassed Bitcoin in terms of the trading volume.

In fact, last month (August) was the “first time since records began that Ethereum futures trading volume surpassed Bitcoin, at $1.07 T across the month,” the report added.

Furthermore, Glassnode’s latest insight shed light on the same development. Herein, the analysis depicted the sheer difference in annualized 3-month rolling basis between the two rivals.

(The three-month futures annualized rolling basis is the annualized yield (percentage return) obtained by buying a spot asset and simultaneously selling a futures contract on it that expires in three months. Due to supply and demand factors, futures contracts often trade at a higher price than their spot counter-part.

This is used by traders to lock in the profits that is the difference between spot and futures prices, which currently played out perfectly for the largest altcoin.

ETH surpassed BTC’s traded volume in the futures market and the attractiveness of spot hedge via short futures drove ETH into backwardation. This means that it showcased a potential to rise as traders put bullish bets on the same. (Backwardation is when futures prices are below the expected spot price, and therefore rise to meet that higher spot price.)

Open interest – or the number of unsettled futures contracts – surged to over $9 billion this week from under $4 billion in July, data shows. Also, ETH has been dominated by bullish call options traders as the Put/Call ratio (PCR) stood at 0.25.

In fact, at press time, the rate stood at 0.24, which is again a bullish sign.

Losing grounds

Looking at BTC, the token remained in ‘contango’ and fundamentals suggested the “bottom is in” as per Glassnode’s insight. While the Ethereum crowd’s celebration began, Bitcoin supporters are getting wary about BTC.

Bitcoin futures volume has retraced to $941 billion in August 2022, behind its closest competitor, Ethereum Futures.

Indeed a sharp contrast as compared to the past two to three years since Bitcoin has always been the one that’s leagues ahead of Ethereum.