ETH’s options OI surges by >$4B – Here’s what it could mean for you

Ethereum [ETH], the largest altcoin saw a major decline below the $1,600 support similar to Bitcoin [BTC]. ETH even dived below $1,550 before the bulls tried to take a stand but failed. Despite the lack of real fireworks in ETH, open interest in futures markets continues to see unprecedented levels.

Could this be a sign of volatility around the time of the upgrade?

We have to lift off

Ethereum speculative action continues, with over $6.12 billion in outstanding Open Interest for Call Options. Put options accounted for a much smaller share as highlighted by Glassnode’s latest insight.

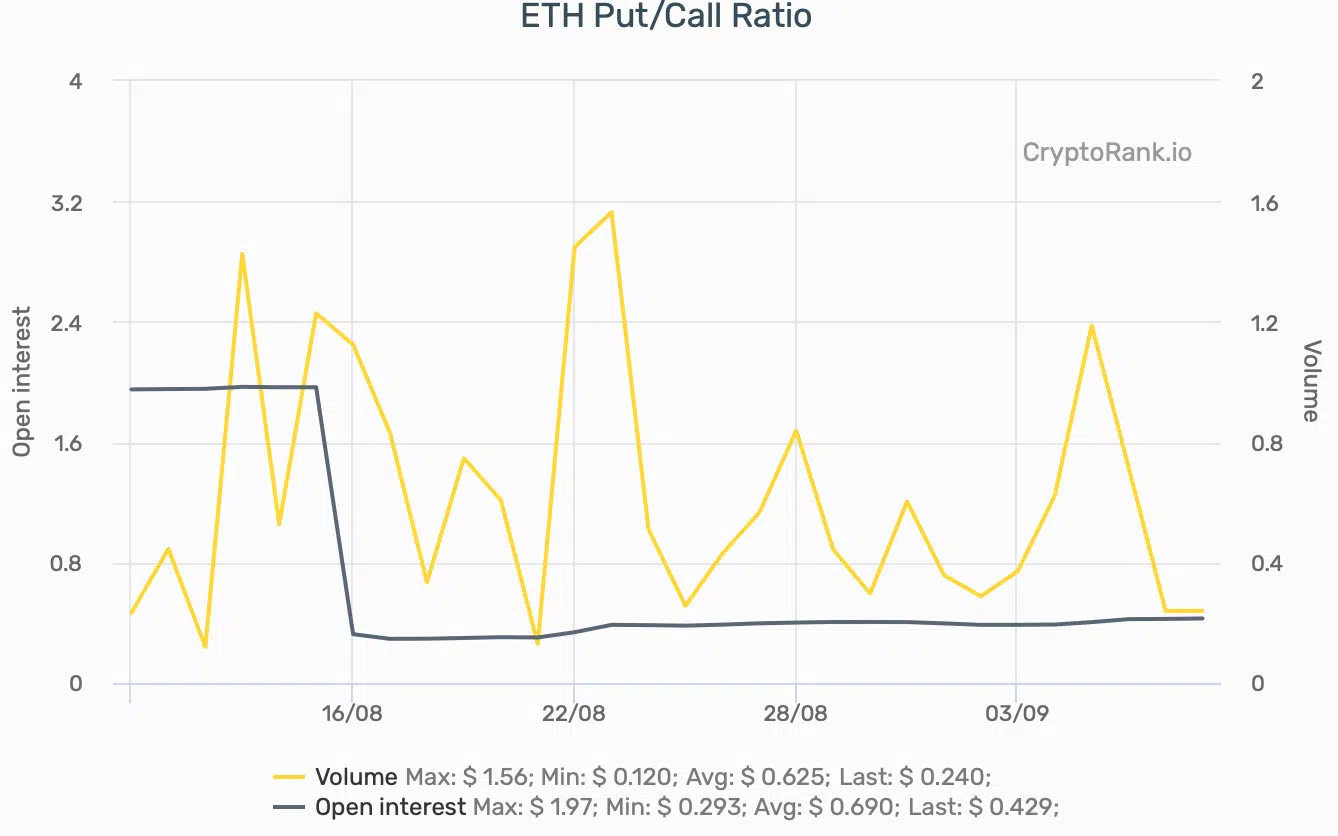

As per the graph above, Put Options registered a much smaller number of $1.5 billion. Thus, making for a Put/Call Ratio of 0.25.

ETH has been dominated by bullish call options traders as the Put/Call ratio (PCR) stood at 0.25. In fact, at press time, the rate stood at 0.24, which is again a bullish sign.

A PCR ratio below one suggests that traders are buying more Call options than Put options. It signals that most market participants are betting on a likely bullish trend going forward.

Interestingly, most of Ethereum’s option bets were placed for 30 September and 30 December. This, indeed, shed light on traders’ bullish bets on a potential ETH rise after the Merge.

The much-anticipated Merge would lead to a reduction in ETH issuance and bring a store of value appeal to the asset.

Furthermore, the said incline wasn’t just a one-night wonder that happened overnight. ETH’s open interest, for the first time, overtook industry leader BTC on 1 August as covered in a previous report.

The open interest of Deribit Ethereum options registered a notional value of $5.6 billion exceeding the open interest of Bitcoin’s $4.3 billion. This was 32% less compared to the value locked in open ETH options trades.

Nothing to worry about?

That being said, over $100 million ETH leveraged positions were liquidated in the past 24 hours as per CoinGlass. ETH suffered and there’s no doubt about it.

But recovery could be in play as ETH soared above the $1.62 mark after registering a fresh 7% surge on CoinMarketCap.