Ethereum: A fall in sell pressure might depend on these key factors

Most major altcoins are in a state of disarray at the moment as recovery is yet to take place for these assets. Now, there was hope that Q3 2021 may leave the bearish woes of Q2 behind, but Ethereum’s price structure has continued to proceed on a declining path. After rejecting a breach of $2400 during the first week, Ether was positioned well under $2000 at press time, closer to its lower range prices.

However, few things continue to facilitate an argument for sell pressure reduction and indicate a possible bullish turnaround.

Ethereum miner balances are improving

Ethereum miner balances had dropped down to all-time low levels of 94.2k ETH back on 6 June, a development that highlighted the very strength of the correction a few weeks back. Keeping that in mind, the miner balance had certainly improved at press time, rising to 115k ETH.

This is a fundamental improvement in light of the fact that miners have begun to hold more again, but the price didn’t note any correction based on that. Now, there are few things that need to be put into context.

Miner balance is still at a very low average when compared to its previous historical levels. On 26 March 2021, for instance, it was 163.4k ETH and on 18 November, it was as high as $193k ETH.

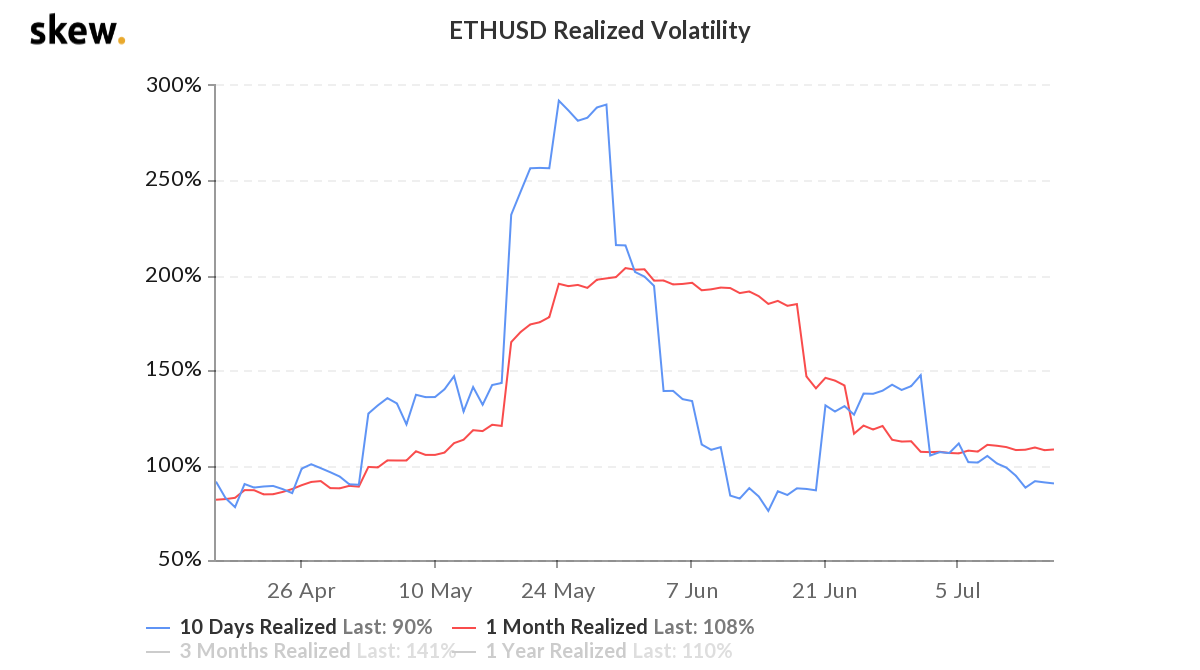

The realized volatility for Ethereum is currently leveling down as well, with the 10-day and 1-month indexes constantly going down. While this doesn’t really dictate price action, it does restrain the value from breaking out.

What’s more, the ongoing derivatives market isn’t proactively bullish either, but there are other factors that may cultivate such market sentiments.

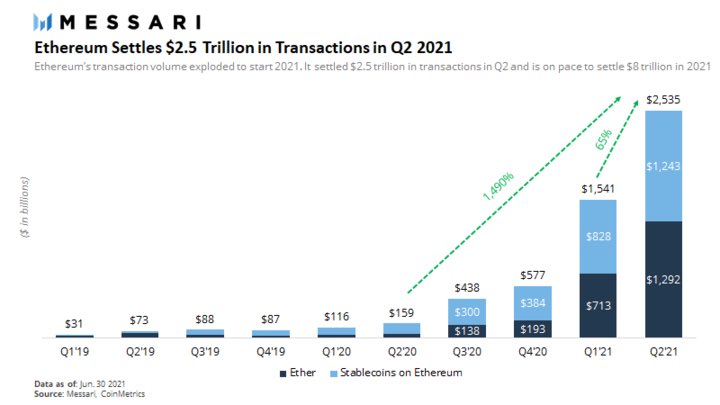

ETH settles $2.5 trillion in Q2 2021

The number of transactions settled by Ethereum was quite impressive over the past year as its quarter-on-quarter hike was 65%, a whopping 1490% increase since last year. According to analysis, Ethereum is currently on pace to settle $8 trillion in 2021.

Another key announcement was that an Ethereum ETF will soon be listed on the Brazilian Stock exchange. Blockchain investment firm QR Capital listed the ETH ETF after attaining approval from the Brazilian Securities Commission (CVM).

So, when will the price show recovery?

Retaining a strong bullish position in the market remains crucial for the asset to gain cohesive growth. However, if Ethereum registers another low, market sentiment might take another hit, and investor patience could again be put to the test.